Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

It is the weekend!

List your pre-loved gems in Neighbourly Market.

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

Mark from Three Kings

Hi all, I am relocating my business and can no longer look after Sylvia who frequents my premise. Recently checked for a microchip but isn’t chipped.She is a mature girl, probably 7+ years old, still playful and enjoys cuddles. She might be suitable as an only cat. She has quite an appetite and … View moreHi all, I am relocating my business and can no longer look after Sylvia who frequents my premise. Recently checked for a microchip but isn’t chipped.She is a mature girl, probably 7+ years old, still playful and enjoys cuddles. She might be suitable as an only cat. She has quite an appetite and eats a fair bit. Would like to find her a stable and loving home. Am moving from Te Atatu this weekend. I have some photos to send through if you are interested. Thank you- Mark, 027 353 2674.

Brian from Mount Roskill

A joint report from the Retirement Commission and accounting firm Hnry called Improving the retirement savings of the self-employed, found self-employed workers contribute to KiwiSaver at less than half the rate of employees, with many missing out on Government contributions.

Only 44% of … View moreA joint report from the Retirement Commission and accounting firm Hnry called Improving the retirement savings of the self-employed, found self-employed workers contribute to KiwiSaver at less than half the rate of employees, with many missing out on Government contributions.

Only 44% of self-employed Kiwis actively contribute to KiwiSaver, compared to 78% of employees between April 2024 and March 2025, according to the report.

Meanwhile, 41% of self-employed KiwiSaver members receive no government contribution, often due to irregular income or low earnings.

“Self-employed New Zealanders make up a growing share of our workforce, yet they are being left behind when it comes to retirement savings,” Retirement Commissioner Jane Wrightson said.

“Without meaningful reform, we risk seeing hundreds of thousands of people reach retirement without sufficient financial security.”

This could leave more retirees relying heavily on Government transfers – such as NZ Super and other benefits – as well as other public support, Wrightson said.

“Today’s inaction could become tomorrow’s fiscal burden.”

According to the 2023 Census, New Zealand has more than 420,000 self-employed individuals.

However, recent changes to KiwiSaver announced in this year’s Budget could further diminish retirement savings for self-employed.

From July 1, the Government’s contribution was reduced from 50c for every $1 to 25 cents for every $1 contributed up to $260.72.

The report said the policy change will reduce the retirement savings of self-employed KiwiSaver members, as they face the reduction in the Government contribution with no increase in employer contributions to offset this.

Hnry’s Sole Trader Pulse survey, commissioned two weeks after the Budget, found 24% of sole traders said they would reduce their KiwiSaver contributions because of Budget 2025 policy changes.

A further 6% said they would stop contributing to KiwiSaver altogether.

James Fuller, Hnry chief executive, said retirement savings must work for all New Zealanders, regardless of how they earn their income.

“Right now, we have a two-tier system that favours employees.

“Sole traders face a very real risk of poverty in retirement unless there is a cross-party consensus and policies that help them save more.

“We hope these findings finally lead the Government and Parliament to take this issue seriously.”

The report outlined policy options to improve outcomes for the self-employed based on initiatives already in place in other OECD nations, including:

Flexible percentage-of-income contributions;

Enhanced incentives for low-income contributors;

Innovative savings products such as linked emergency and retirement accounts.

===================================================

Kia pai from Sharing the Good Stuff

We’ve hit a tipping point, where choosing clean energy is the smart choice, and not just because we want to reduce our carbon emissions 🌍⚡💸

Thanks to major tech improvements and mass production over the past decade, the cost of wind, solar, and other renewables has dropped fast. As a … View moreWe’ve hit a tipping point, where choosing clean energy is the smart choice, and not just because we want to reduce our carbon emissions 🌍⚡💸

Thanks to major tech improvements and mass production over the past decade, the cost of wind, solar, and other renewables has dropped fast. As a result, most new power capacity built around the world came from renewables, and every continent added more clean energy than fossil fuels.

Money — the ultimate decision-maker in politics and business — is finally lining up with climate action. A big win for the planet (and maybe our wallets?)

We hope this news brings a smile!

73 replies (Members only)

Hany from Mount Albert

REGO DEC 25, WOF MARCH 26,

PURCHASED DECEMBER 2014

DONE 72,520 K

ENGINE 1.5 L PETROL

AUTOMATIC GEAR

NEVER DRIVEN OFF ROAD

GOOD THRID TYRES

ALLOYS WHEELS

… View moreREGO DEC 25, WOF MARCH 26,

PURCHASED DECEMBER 2014

DONE 72,520 K

ENGINE 1.5 L PETROL

AUTOMATIC GEAR

NEVER DRIVEN OFF ROAD

GOOD THRID TYRES

ALLOYS WHEELS

BLUETOOTH

USB JACK

CRUISE CONTROL

MINT CONDITION

STUNNING COLOR

VIEWING IN EPSOM

Price: $9,999

The Team from Neighbourly.co.nz

It’s been a little full-on at the office lately, and the Neighbourly team found ourselves chatting about something we all experience: stress.

We got talking about the power of nature — green spaces like parks, bush walks, or even just sitting under a tree, and blue spaces like the ocean, … View moreIt’s been a little full-on at the office lately, and the Neighbourly team found ourselves chatting about something we all experience: stress.

We got talking about the power of nature — green spaces like parks, bush walks, or even just sitting under a tree, and blue spaces like the ocean, lakes, or rivers. Research agrees: being in nature really does help calm the mind. We’re lucky here in Aotearoa to have such beautiful spots right on our doorstep!

But sometimes, getting out for a walk or escaping to the beach isn’t an option. So we’re curious...

We want to know: What do you do to find a moment of calm when life gets a bit too much?

A hot cuppa? A good playlist? Staring out the window?

Let us know ... your go-to might help someone else breathe a little easier, too.

92 replies (Members only)

Weather permitting spot spraying will be carried out in the following areas during August 2025.

Albert-Eden, Puketāpapa & Whau Local Board

Auckland Domain

Manukau Memorial Gardens

North Shore Memorial Park

Waikumete Cemetery

Herbicide applications will be carried out in reserves, … View moreWeather permitting spot spraying will be carried out in the following areas during August 2025.

Albert-Eden, Puketāpapa & Whau Local Board

Auckland Domain

Manukau Memorial Gardens

North Shore Memorial Park

Waikumete Cemetery

Herbicide applications will be carried out in reserves, cycleways, street gardens, street kerb and channels and berms/boundary edges. No spraying will be undertaken in agreed no-spray zones, during this period.

Auckland Council operates from a Code of Practice that governs all spray operations. Spraying will be undertaken by Programmed Facility Management.

For more information, please contact Auckland Council on 09 301 0101.

Find out more

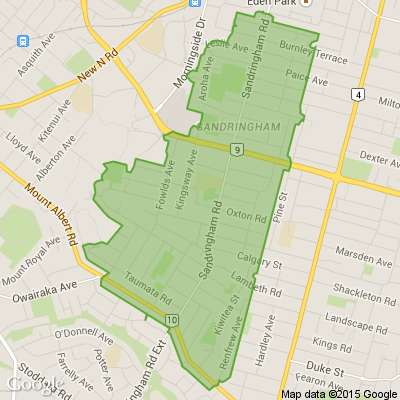

Jo from Sandringham

Hi All,

As a frequent buyer on Fb market place. I have noticed that scammers have quadrupled in all areas, but a particular new focus area seems to be sofa’s or lounge suites. So if you are using this platform please always check the sellers profile first!- if the profile was activated in 2025-… View moreHi All,

As a frequent buyer on Fb market place. I have noticed that scammers have quadrupled in all areas, but a particular new focus area seems to be sofa’s or lounge suites. So if you are using this platform please always check the sellers profile first!- if the profile was activated in 2025- then it’s 99 percent a scam!

It’s horrible that honest people are being targeted this way! So if you are buying from Facebook market place always check the profiles activation date and the sellers friends list. They will generally have zero friends and the profile would have been activated in 2024/ 2025 - You can then report the SCAMMER in action!

Hope this helps - Keep alert!

Brian from Mount Roskill

Maintenance tips

==============

Although tedious, a bit of TLC will keep your dryer in tip-top condition. Here are some simple maintenance tips:

The heat exchangers in condenser dryers get clogged with fluff circulating in the air. Clean the heat exchanger at least 4 or 5 times a year.

The … View moreMaintenance tips

==============

Although tedious, a bit of TLC will keep your dryer in tip-top condition. Here are some simple maintenance tips:

The heat exchangers in condenser dryers get clogged with fluff circulating in the air. Clean the heat exchanger at least 4 or 5 times a year.

The water reservoirs in condenser and heat-pump dryers need to be emptied after nearly every load. This is easier if the reservoir is at the top of your dryer rather than the bottom – and you can avoid the hassle completely by plumbing your machine to a drain.

Lint filters should be cleaned after every load. This improves drying efficiency and reduces the risk of fire. Cleaning will be easier if the lint filter’s near the front of your machine or on the door. Some dryers have more filters than others.

Sensors won't work effectively unless you wipe the drum with white vinegar or stainless-steel cleaner every few months.

Troubleshooting your sensor dryer

============================

Is your sensor clothes dryer stopping short of drying your clothes? A sensor clothes dryer should detect when a load is dry and stop running. This prevents over-drying, which can damage your clothes. Because it’s not running any longer than it needs to, you’ll save money on your power bill too. But what if your clothes dryer stops and you open the door to a still-damp load?

Troubleshooting tips

=================

If you’re having trouble getting your sensor dryer to fully dry a load, try these tips:

Clean the moisture sensors: These are 2 metal strips that are usually inside the drum underneath the door. Over time, residue from washing powder and fabric softener can accumulate on the sensors, which reduces sensitivity. To clean them, switch the dryer off at the wall and wipe with a soft cloth and mild soap.

Sort your load: Mixed loads – for example, lightweight T-shirts and heavyweight jeans – can be challenging for a sensor dryer. For even results, dry similar-weight items together.

Use the right setting: Clothes dryers are becoming more sophisticated, with settings for different fabrics and items such as sheets and sportswear. It pays to read the user guide to check you’re using the most suitable setting for the type of items you throw in your dryer. For example, if your dryer has a “sheets” setting, use it as it will alternate the tumbling direction to prevent sheets tangling into a damp-centred ball.

Choosing the right clothes dryer pays off in the long run. We’ve tested heat-pump, condenser and vented clothes dryers to find the most efficient, easiest to use and fastest.

Dryer safety

==========

Before you throw laundry into the clothes dryer, make sure you've taken these basic safety steps.

*Lint build-up is a fire hazard. It can cause overheating and also reduces drying efficiency. Clean the lint filter after each use – and regularly move your dryer and vacuum up lint from the surrounding walls. If the dryer is ducted to the outside, clean any lint from the duct and the exhaust vent.

*Plastic items (such as shower caps and plastic-backed baby bibs) shouldn't go into the dryer: they'll melt.

*Items made of rubber can catch fire. Keep them out of the dryer, too.

*Watch out for clothes or towels that have been in contact with oils, waxes or products containing petroleum or alcohol (like hair-styling products) – they may be flammable. Make sure they've been washed in hot water before you put them in the clothes dryer.

*Always let the dryer complete its cool-down cycle then remove the load and spread it out.

*If you have to turn off the dryer before it’s finished, remove the load and spread it out to cool. Clothes left bundled up are more likely to catch fire by spontaneous combustion.

*Turn off the dryer whenever you're away from the house or are asleep.

*Kids are explorers, which means one could climb into a dryer. If you have small children, avoid models that start automatically when the door is closed.

*Allow plenty of ventilation around the dryer.

*If mounting or stacking your dryer, make sure you follow the manufacturer’s instructions and consider getting it professionally installed.

======================================================

Brian from Mount Roskill

Children are especially vulnerable to the influence of advertising, which is now more sophisticated and personalised than ever.

Children in Aotearoa are now targeted by advertisers in a wide variety of contexts, both physical and digital, and in a more systematic, integrated and personalised way … View moreChildren are especially vulnerable to the influence of advertising, which is now more sophisticated and personalised than ever.

Children in Aotearoa are now targeted by advertisers in a wide variety of contexts, both physical and digital, and in a more systematic, integrated and personalised way than ever before.

These days, ads aren't just something children see between TV programmes. They are woven into their physical environment and the digital platforms they use to learn, play and socialise.

Our new research showed just how pervasive this exposure is.

We used data from the earlier Kids’Cam observational study, which tracked 90 New Zealand children’s real-world experiences using wearable cameras that captured what they were looking at from waking up to going to sleep.

On average, we found children encountered marketing for “unhealthy” products – junk food, alcohol and gambling, 76 times per day. That’s almost two-and-a-half times more than their daily exposure to “healthy” marketing.

Coca-Cola topped the list of most frequently encountered brands, appearing 6.3 times a day on average. The findings also show stark inequalities. Children from more socioeconomically deprived areas were exposed to significantly more unhealthy marketing for junk food.

Why exposure matters

===================

Advertising directed at children extends far beyond simply promoting products. It profoundly shapes their cognitive, social and behavioural development.

Research has shown it can spark an immediate desire for products and contribute to conflict between children and parents.

It can also influence the formation of broader consumption values and desires. Advertising exposure has been linked to increased materialism, by associating possessions with happiness and success.

However, materialism is consistently associated with lower self-esteem, reduced well-being, and weaker social relationships because it shifts focus away from intrinsic sources of fulfilment such as personal growth and connection.

Moreover, marketing plays a pivotal role in shaping children’s beliefs, attitudes and social norms.

There is evidence connecting advertising to the internalisation of gender and racial stereotypes and distorted body image. It has also been linked to the early use of harmful products such as tobacco and alcohol.

Advertising has been found to affect dietary habits, with sustained exposure to food advertising significantly increasing the risk of childhood obesity.

Vulnerable to influence

===================

Children are uniquely vulnerable to the influence of advertising as they lack the critical reasoning skills to recognise and evaluate persuasive intent.

In the online environment where advertising is embedded in games, influencer content and social feeds, children are especially vulnerable.

Our study found a clear pattern. The less regulation there is, the higher the exposure.

Tobacco marketing, which is tightly regulated, was rarely encountered by the children in our study. Alcohol and gambling – regulated by a patchwork of laws and voluntary codes – appeared moderately often. But junk food marketing, almost entirely self-regulated by industry, dominated what they saw.

More than half of the unhealthy food and alcohol marketing children saw came from just 15 multinational companies. This highlights the systemic nature of the problem, as well as the resources behind it. These companies have the money to spend on marketing these harmful products to children.

Taking action

===========

International agencies such as the United Nations have warned that exploitative marketing is a major global threat to children’s health.

To respond to this growing harm, governments need to:

protect children through comprehensive regulation restricting junk food, alcohol and gambling marketing, similar to what already exists for tobacco

introduce restrictions on product packaging for unhealthy products, which the study found was a key medium for marketing

conduct further research to understand the digital marketing environment, in particular to identify disparities in targeting based on ethnicity, gender or socioeconomic status.

This is not just about protecting children’s innocence. It’s about protecting their health, autonomy and future opportunities. Left unchecked, the current commercial environment risks deepening health inequities and normalising harmful consumption patterns from an early age.

Aotearoa New Zealand has the chance to lead efforts to create a digital and physical environment where commercial interests do not undermine children’s rights and wellbeing.

That requires moving beyond voluntary codes towards enforceable protections – grounded in evidence, public health priorities and equity.

If we don’t act now, we risk commodifying childhood itself.

=====================================================

Brian from Mount Roskill

Nurses report that waiting rooms are packed around the clock, with some patients facing hours-long delays before being seen. A combination of flu cases, COVID-19 infections, and winter-related illnesses such as respiratory conditions has put enormous pressure on already stretched services. Staff … View moreNurses report that waiting rooms are packed around the clock, with some patients facing hours-long delays before being seen. A combination of flu cases, COVID-19 infections, and winter-related illnesses such as respiratory conditions has put enormous pressure on already stretched services. Staff shortages have further compounded the situation, leaving frontline workers exhausted.

One senior nurse described the conditions as “relentless,” noting that the patient flow has shown no sign of slowing down since the start of winter. Many patients arriving at EDs are elderly or have underlying health issues, requiring longer and more complex care. This has created a bottleneck, with patients often waiting for ward beds to become available.

Health experts say the demand highlights the need for more investment in both emergency and primary care. They stress that many people end up in emergency departments because they cannot access timely GP appointments, further increasing ED workloads.

Despite the pressure, nurses continue to provide critical care, but they warn the system is close to breaking point. Calls have been made for urgent action to support frontline staff, including additional resources, recruitment drives, and stronger community care initiatives to ease hospital demand.

As winter continues, Auckland’s ED nurses say they are bracing for even tougher weeks ahead.

=====================================================

Brian from Mount Roskill

Who doesn’t love a freebie - especially on their birthday?

=============================================

According to University of Canterbury marketing professor Ekant Veer, it makes us feel like we’re “winning” at life.

He told RNZ last week: “Treasure hunting is still within the … View moreWho doesn’t love a freebie - especially on their birthday?

=============================================

According to University of Canterbury marketing professor Ekant Veer, it makes us feel like we’re “winning” at life.

He told RNZ last week: “Treasure hunting is still within the psyche of every human to say, ‘I feel like I’ve accomplished something and I’ve done it for free’.”

The promise of free stuff is particularly tempting when the cost of living is high. A freebie at the supermarket might just ease the pain of forking out more than $10 for butter.

Restaurants and retailers know this, so many of them offer customers a free treat or gift on their birthday. You have to be signed up to rewards programmes or a membership to benefit from most of them - but it might just be worth the constant barrage of emails in your inbox.

So, here are just some of the perks, free food and vouchers you can nab on your birthday across New Zealand.

Food and drink

============

If you’re like me, your day truly starts when you take that first sip of coffee - so it makes sense to kick off our birthday freebie crawl with a hot beverage.

You can get a free hot drink from Columbus Coffee cafes throughout the country if you’re signed up to Columbus Rewards, and if one isn’t enough, you can get another beverage on Starbucks through their rewards programme.

If you’re after a sweet treat to go with your coffee - and you’re in Auckland - head into Krispy Kreme and get yourself a pack of 4 original glazed Krispy Kreme donuts for free, as long as you’ve signed up to their Inner Circle rewards programme at least 4 weeks before your birthday.

Subway also offers loyalty members a free cookie and drink with a meal purchase on their birthday. If you’re looking for something a bit more substantial, you can claim a free birthday burger from Burgerfuel if you’re a long-time VIB member. If you’re a new member or use your membership very rarely, it’s buy one popular burger, get one free.

Mexicali Fresh will sort you out with a free birthday taco with a $10 spend, and while we’re on that Mexican wave, sign up to Mexico’s Love Mexico app and get $10 to spend on your birthday.

Fancy a cheeky Nando’s? If you’re signed up to Nando’s PeriPerks, you’ll get a $15 voucher to spend during your birthday month.

And Mama Brown’s in Wellington will shout you a free meal and drink if you bring along a friend who orders and pays for their own, available five days either side of your actual birthday.

Shopping

========

It’s not just cafes and eateries that will shout you a birthday gift, so make sure you add a stop at the shops to your itinerary. If you haven’t signed up for a membership at your favourite clothing or tech stores because it’s too much hassle, think again; it could really pay off when your birthday rolls around.

I don’t know about you, but nothing calms me like browsing the Farmers homeware department, so best believe I was overjoyed to find that if you have a Farmers club card, you can opt in to get a free birthday gift.

If you sign up for a Country Road membership you can get rewards ranging from $10-$100 on your birthday.

Bendon also offers members a birthday gift of $10 off a purchase, while North Beach Locals can get $20 voucher on their birthday. If you’re the outdoorsy type, then Kathmandu’s Out There Rewards has you covered, while Palmers Rewards members can get a $10 birthday voucher from the garden centre chain.

For the beauty gurus, Mecca’s Beauty Loop programme will also earn you a free gift on your birthday.

If you’re the crafty type, you can get a birthday voucher from Spotlight through their VIP club.

Hoyts Cinemas offers a birthday reward of a free drink or small popcorn for members, while Silky Otter Club members can get a free movie ticket from the boutique cinema during their birthday week - as well as a birthday treat if they upgrade to a Platinum membership.

And for the techie, Noel Leeming will gift you a voucher to spend.

Activities

========

Eaten and shopped (for free) to your heart’s content? Turns out there’s plenty of free ways to pass the time on your birthday.

So, round up your mates for some good old-fashioned group activities and enjoy the birthday VIP treatment.

If you’re in Wellington and relish the idea of taking aim at your mates for free while they pay for the privilege, maybe you can talk 10 of them into heading along to Wellington Paintball Corp on your birthday with you - you’ll get free entry.

Gloputt Mini Golf in Takapuna, Auckland will let you play for free on your birthday - just bring your ID.

And the budding marine biologist in the family will get free entry to Kelly Tarlton’s in Auckland on their birthday.

If you’re after something more relaxing, you can get a free one-hour massage at Optihealth in Auckland with a refundable booking fee, if you’ve visited in the past six months.

=================================================================

The Team from Resene ColorShop Mt Eden

Brush up your painting skills and brighten your wash days. There’s no two ways about it, doing laundry is a chore so why not inject a sense of fun into it with a quick refresh? Paint a striped ceiling with Resene SpaceCote Flat, a blackboard with Resene FX Blackboard Paint, stencil words with … View moreBrush up your painting skills and brighten your wash days. There’s no two ways about it, doing laundry is a chore so why not inject a sense of fun into it with a quick refresh? Paint a striped ceiling with Resene SpaceCote Flat, a blackboard with Resene FX Blackboard Paint, stencil words with Resene SpaceCote Flat and Resene Enamacryl. Find out how to refresh your laundry with these easy step by step instructions.

Mabel from Hillsborough

We are a new support group for seniors. We meet once a month to share our experience and discuss our challenges & concerns.

With the growth of our ageing population, and more seniors living alone, this group would explore and advocate/address the social, emotional and physical needs of our … View moreWe are a new support group for seniors. We meet once a month to share our experience and discuss our challenges & concerns.

With the growth of our ageing population, and more seniors living alone, this group would explore and advocate/address the social, emotional and physical needs of our seniors, and promote positive and healthy ageing.

We meet on the first Saturday afternoon of the month in Mt. Roskill.

If you are interested in joining us and contribute your ideas, knowledge, experience, talents and resources, we would love to hear from you. Please contact us at agewellkiwi@gmail.com.

Trent Lash from Heartbeats Mt Roskill

Dr Seif El-Jack, one of Auckland's leading Cardiologists, and Team Lead Cardiologist at Waitemata Health District, will be giving a HeartTALK on heart disease and treatments after discharge from hospital, at Sunnynook Community Centre, North Shore, on Thursday 28th August.

This open forum … View moreDr Seif El-Jack, one of Auckland's leading Cardiologists, and Team Lead Cardiologist at Waitemata Health District, will be giving a HeartTALK on heart disease and treatments after discharge from hospital, at Sunnynook Community Centre, North Shore, on Thursday 28th August.

This open forum talk is sponsored by Heartbeats, New Zealand's largest community-led, peer-peer cardiac support group.

- if you have been diagnosed with a heart issue, had major heart surgery and lie awake, anxious at night, wondering what is my future now,

- if you have left hospital and are adrift out there with no idea how to 'get your head back in the game', or what to do to survive and not hav another frightening heart attack,

THEN THIS TALK IS FOR YOU!

Come along, bring a friend or family member, and hear what Dr Seif El-Jack has to say about treatment and management of your heart issue, and where to go to get help.

WHERE: Sunnynook Community Centre, 148 Sycamore Dr, Sunnynook

WHEN: Thursday 28th August

TIME: 7:00 - 8:00pm

EVERYONE IS WELCOME, its informal, friendly and open discussion following Dr El-Jacks talk. He will be answering ANY and ALL QUESTIONS from the group.

Alan Storage from Kiwi Self Storage - Mt Roskill

📦 Temporary Storage Solutions

When you only need storage for a short period, our temporary storage options are an ideal choice. They’re perfect for times when you’re relocating, waiting for a new home or office to be ready, or just need space for seasonal belongings. With modern, secure … View more📦 Temporary Storage Solutions

When you only need storage for a short period, our temporary storage options are an ideal choice. They’re perfect for times when you’re relocating, waiting for a new home or office to be ready, or just need space for seasonal belongings. With modern, secure facilities, your items will be kept safe, dry, and well-protected until you’re ready to collect them.

🛡️ Extended Storage Options

If you require storage for a longer duration, our extended storage services are designed to accommodate your needs. Whether you’re traveling overseas, reducing the size of your living space, or looking for a dependable place to keep valuables, we provide a safe and secure solution. With comprehensive security systems in place, you can rest assured your possessions are carefully protected for as long as you need.

Our flexible rental terms mean you can start out one way and simply change as required.

Contact Us Today

kiwiselfstorage.co.nz...

call: 09 625 6161

#aucklandnz #storagenz

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

© Neighbourly 2025