Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

It is the weekend!

List your pre-loved gems in Neighbourly Market.

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

The Team from New Zealand College of Chinese Medicine

The New Zealand College of Chinese Medicine (NZCCM) offers industry-focused Massage and English programmes that prepare students for professional practice.

Students gain strong Anatomy and Physiology knowledge, hands-on experience in the student clinic, and pathways into health and wellbeing … View moreThe New Zealand College of Chinese Medicine (NZCCM) offers industry-focused Massage and English programmes that prepare students for professional practice.

Students gain strong Anatomy and Physiology knowledge, hands-on experience in the student clinic, and pathways into health and wellbeing careers. NZCCM actively incorporates tikanga Māori and Te Ao Māori, partnering with local marae for cultural learning and community treatments.

As Auckland’s only provider of Massage diplomas, NZCCM is enrolling now for February 2026 Programmes include the Level 5 Wellness and Relaxation Massage Diploma and the Level 6 Remedial Massage Diploma, both NZQA-approved with intensive block courses. NZCCM also offers NZCEL Level 4 for academic English preparation.

Open Days will be held on 12 December and 23 January.

Contact: 09 580 2376 or auck@chinesemedicine.ac.nz

.

Find out more

Jude from Hillsborough

Solid, metal wire drawers

White

X4 pull out drawers

3 of the drawers have a height of 16 cm

Top drawer has a height of 7cm

Total height - 75 cm… View moreSolid, metal wire drawers

White

X4 pull out drawers

3 of the drawers have a height of 16 cm

Top drawer has a height of 7cm

Total height - 75 cm

Width - 49 cm

Depth - 49 cm

Collection is from Herd Rd, Hillsborough

Price: $15

Saima from Mount Roskill

I am keen to sell single solid wood bed frame (150$) and mattress(50$). It's from pet free and smoke free zone. Please dm me if interested. Pick up Mount Roskill.Selling as of moving. Have two sets with one side table. Price is for each bed but if buying all three items can can negotiate.

Price: $150

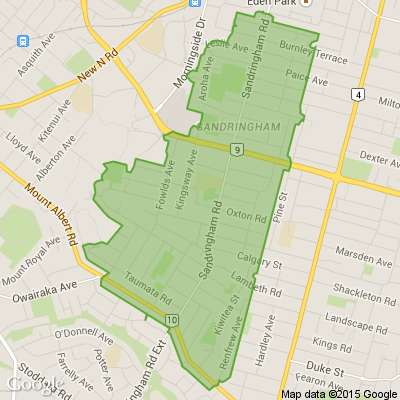

Cindy from Sandringham

Hi,

I no longer have use for this. Please message me on 021 154 0735 to pick up.

Thanks

Cindy

Free

The Team from New Zealand Police

As Christmas gift shopping moves increasingly online, scammers are ramping up their activity across the country.

Dunedin’s Investigation Support Unit is seeing more and more people fall victim to scams and other fraudulent activity, particularly on Facebook Marketplace.

There are a few ways… View moreAs Christmas gift shopping moves increasingly online, scammers are ramping up their activity across the country.

Dunedin’s Investigation Support Unit is seeing more and more people fall victim to scams and other fraudulent activity, particularly on Facebook Marketplace.

There are a few ways to avoid the scams and keep yourself safe doing online trades this holiday season, says Southern District Service Delivery Manager Senior Sergeant Dalton.

🔒 “A good first step when looking to purchase something on Marketplace is to check when the seller’s Facebook profile was created. If it’s very recent, there is a higher risk that they have just created this account for a one-off fake item.”

🔒 Another important step is to make sure the seller’s profile name and bank account name match up. “We’re seeing a lot of scammers claiming their bank account name is different because it belongs to their partner or family member - that’s a huge red flag."

🔒 “When you’re selling, never trust a screenshot anyone sends you showing that payment has been made. Check your own bank account to make sure a payment has gone through."

🔒 “Quite frankly, it’s best for all parties to agree to pay, or be paid, for items in cash and in-person. Ideally in a public place with CCTV coverage."

🔒 "If you’re buying a car, check Carjam.co.nz to see if it’s stolen or if there’s money owed on it.”

A reminder: Suspicious activity can be reported on 105

Brian from Mount Roskill

More than 4000 people have been affected by an Inland Revenue error that could have meant they paid the wrong amount of tax.

RNZ was contacted by a reader who said he had noticed the error when he went to finalise his tax return.

Inland Revenue now issues income tax assessments each year for most… View moreMore than 4000 people have been affected by an Inland Revenue error that could have meant they paid the wrong amount of tax.

RNZ was contacted by a reader who said he had noticed the error when he went to finalise his tax return.

Inland Revenue now issues income tax assessments each year for most New Zealanders, which tells them whether they have paid the right amount of tax.

The man said he and his wife would fill out an IR3 every year. “Nowadays the income, tax and imputation credits are automatically filled in, whether that be from investments in bonds, equities or bank accounts.

“Having always done this myself longhand, I still do this and thank goodness I did.”

He said, between them, they would have lost about $20,000 in credits if he had not noticed the problem.

“I found that my summary of income was correct; income, RWT, imputation credits. But when this was automatically input into the IR3 form, the imputation credits were only 50% of what they should have been.”

Inland Revenue said it had looked into the issue and identified a problem with how returns in the myIR system were pre-populating imputation tax credits for people who received dividends with imputation credits from jointly owned shareholdings.

“We have fixed this so any returns started in myIR from November 26 will not have this issue.

“Customers were able to amend the figure before filing the return; however, we have identified that approximately 4500 customers appear to have filed the return without changing the figure – so with the incorrect pre-populated imputation credits.

“We are currently working through the best way to amend these returns for the affected customers. Once we identify the easiest way to correct this error, [we] will be contacting those affected customers.”

Inland Revenue said it believed the amount involved was an average of about $300 per person, “all in the taxpayer’s favour. Late next week we should have a clearer picture of the exact number of customers and tax involved as we implement a fix.”

Deloitte tax partner Robyn Walker said anyone who had not noticed the problem could have paid more tax than they needed to, or received a larger refund than they should have.

“It’s interesting that the income and tax credits aren’t kept together when the amounts are halved for spouses – I would have expected that the income and credits would have both been wrong.”

She said it was a problem that a system that was meant to be able to be relied upon by taxpayers was not working correctly.

“In the scheme of the total number of people who might invest in shares receiving dividends, it’s possibly not a big error population; however, the existence of any error in pre-population is concerning. One of the risks associated with income and tax credit amounts being pre-populated is that there is a natural tendency to just accept what is there if it seems ‘about right’ rather than taking the next step of validating that the information is actually correct against source documents. It would seem that this is what those 4500 individuals have done.”

=======================================================

The Team from Resene ColorShop Mt Eden

These blossoms made from Resene wallpaper left over after decorating will mean your décor will be blooming gorgeous, no matter the season. Find out how to create your own wallpaper flowers with these easy step by step instructions.

At Waterford, life feels wonderfully effortless. Enjoy modern apartment living, peaceful harbour views and a warm, welcoming community. With cafés, boardwalks and the ferry close by, everything you love is within easy reach. Discover a lifestyle that brings calm, connection and a real sense of … View moreAt Waterford, life feels wonderfully effortless. Enjoy modern apartment living, peaceful harbour views and a warm, welcoming community. With cafés, boardwalks and the ferry close by, everything you love is within easy reach. Discover a lifestyle that brings calm, connection and a real sense of home. Learn More

Dale from Sandringham

(on behalf of my son) Hey, I’m Jack, a 19-year-old Business & Entrepreneurship student home for summer, and I’ve started a small water-blasting service.

If your deck, driveway, or outdoor areas are looking a bit tired, I can get them looking fresh again just in time for summer.

✔️… View more(on behalf of my son) Hey, I’m Jack, a 19-year-old Business & Entrepreneurship student home for summer, and I’ve started a small water-blasting service.

If your deck, driveway, or outdoor areas are looking a bit tired, I can get them looking fresh again just in time for summer.

✔️ Affordable rates

✔️ Fast, reliable work

✔️ Concrete, wood, brick, indoor/outdoor

✔️ Supporting a local broke student

Send me a message on 022 469 5621, with what you need done and I’m happy to pop by for a quick quote.

Brian from Mount Roskill

1. Buy food that is safe

Check the ‘use by’ date to make sure food is fresh when you buy it. Avoid food with damaged packaging and buy fruit and vegetables that are slightly unripe or only just ripe – especially if you don't plan to eat them straight away.

2. Gathered food

Always wash… View more1. Buy food that is safe

Check the ‘use by’ date to make sure food is fresh when you buy it. Avoid food with damaged packaging and buy fruit and vegetables that are slightly unripe or only just ripe – especially if you don't plan to eat them straight away.

2. Gathered food

Always wash food that you or others have gathered, such as pūha or watercress. If you gather kai moana or seafood, check that the place you are collecting from is clean and free of pollution.

3. Keep hands and surfaces clean

Wash your hands before and after you handle raw foods. Make sure benchtops, cooking tools and barbecues are clean before you use them. When you prepare the meal, use separate utensils, plates and other tools to handle raw and cooked foods. After the meal, clean your benchtops and cooking tools well.

4. Rinse all fruits and veg

Rinse all of your fruit and vegetables under cold running water and then dry them with a clean cloth to help remove dirt and bacteria.

5. Preparing chicken

Chicken is the main offender for spreading serious tummy bugs. It needs careful handling when it's raw. You might be great at remembering to wash your hands before and after touching raw chicken, but do you get carried away and wash the chicken before you prepare it? This common practice is a big no-no. Washing chicken in your kitchen sink can lead to contamination of your work surfaces, cloths and cooking utensils. Keep a special chopping board for preparing chicken and don't use that board for chopping up fruit and vegetables. Don't use the same knife to cut up chicken and other foods until it's been well washed.

6. Keep cold foods cold

Set your fridge temperature between 2°C and 4°C. Most harmful bacteria cannot grow at low temperatures.

Keep cold dishes like salads and puddings in the fridge until you’re ready to eat them. Store raw meats and seafood in the fridge until right before you cook them. Cover them and place them on the fridge’s bottom shelf so their juices can’t drip onto other food. Keep meat products away from ready-to-eat food such as fruit and vegetables. Other meat and seafood (kai moana) are sources of bacterial contamination, not just chicken.

If you’re eating outdoors, use an icepack or chilly bin to keep food cold.

7. Fully cook meats and seafood

Cook chicken, mince and sausages right through, and cook pork and poultry until the juices run clear. Use a meat thermometer to check that your meat has been cooked to a safe temperature – at least 75°C in the thickest part of the meat.

You can take a vacuum-packed cooked ham straight from the fridge to the table. But if you like to glaze your ham and serve it hot, cook it at 160°C for 20 minutes per kilogram. You want the inside to reach at least 60°C – use a meat thermometer to check the temperature.

Eating cold ham of any kind when you are pregnant can come with the risk of a serious infection called listeria, which is harmful to the baby. Instead, cook or reheat ham until it’s piping hot (over 70°C) and eat it straight away. Learn more about how to eat safely when you're pregnant(external link).

8. Cover all dishes

Cover any dishes that are sitting out on the benchtop or table to protect your food from flies, ants and other bugs. Don’t leave them out of the fridge for more than 2 hours. Or store them in the fridge while your guests enjoy their first serving, then bring them back out when it’s time for the next course. If you think that food has been left out of the fridge for 4 or more hours, it is better to throw it out than risk getting sick. If in doubt, don't eat it!

9. Store leftovers carefully

Refrigerate or freeze leftover food within 2 hours after it was cooked, sealed in a clean, airtight container. You can keep a cooked cured ham in the fridge for up to 2 weeks. Cover it with a clean damp tea towel and change the towel every day.

Reheat leftovers until they are steaming hot (over 75°C), stirring well so they heat all the way through.

10. Food safety in pregnancy

When you're pregnant (hapū) you have lower immunity which puts you at greater risk of food-related illnesses such as listeriosis and toxoplasmosis. These can be dangerous for you and your child. To be safe:

wash and dry your hands carefully before handling food

clean, cook and chill foods

store leftover food in the fridge and don't eat them after 2 days

avoid high-risk foods(external link).

11. Most importantly

If you've been unwell or have any symptoms of sickness, leave the food preparation and serving to others. Don't risk passing on your germs to your whānau.

=====================================================

Logan Campbell Retirement Village

We’ve pulled together a few clever Christmas hacks thanks to Ryman resident, Sullen - simple ideas to save time and stress so you can enjoy more of the festive fun.

A few favourites:

- Hang tree lights vertically for an even glow

- Use reusable gift bags for quick, eco-friendly wrapping

- … View moreWe’ve pulled together a few clever Christmas hacks thanks to Ryman resident, Sullen - simple ideas to save time and stress so you can enjoy more of the festive fun.

A few favourites:

- Hang tree lights vertically for an even glow

- Use reusable gift bags for quick, eco-friendly wrapping

- Prep food ahead to keep Christmas Day relaxed

Click read more for the full list of tips.

Brian from Mount Roskill

House prices are down, but rent rises have flattened.

In both markets, people looking for a home have the power.

So is it better, financially, to own or rent?

That's a question that ANZ economist Matt Galt has been pondering.

He said how the cost of renting compared to home ownership was a… View moreHouse prices are down, but rent rises have flattened.

In both markets, people looking for a home have the power.

So is it better, financially, to own or rent?

That's a question that ANZ economist Matt Galt has been pondering.

He said how the cost of renting compared to home ownership was a big driver of house prices.

"The balance between the running costs of owning a home over time - interest, council rates, insurance - and rents is one of the main anchors for house prices, to which they gravitate."

When the costs of owning a home are low compared to renting, both owner-occupiers and investors are more likely to buy, bidding up prices.

But when ownership costs are high relative to rents, house prices come under pressure.

To compare the cost of owning versus renting, he used the interest cost on a home loan with a 50 percent loan-to-value ratio at a five-year fixed rate, plus council rates, insurance, maintenance and a small buffer for other costs.

"What you often find is when you first buy a house, you have quite a big mortgage, like 80 percent loan-to-value for example, and when you have a big mortgage, the cost of owning a house will typically be quite a bit more than renting. But over the full time you own that house, hopefully you'll be able to repay principal and the LVR will come down and what we find is that the cost of renting and the cost of owning are about equal when the loan is 50 percent of the house value and that might be the experience over a number of years for some people."

In Auckland, the median rent is about $650 a week. Someone with a 20 percent deposit buying a house for $900,000 - the median price for first-home buyers in the city - would pay about $890 a week on a five-year fixed term.

But someone with a mortgage of $500,000 would be paying less than $620 as week.

He said between 2022 and 2024 high interest rates and other costs put downward pressure on house prices. At that point, it was a lot more expensive to own a house than to rent one.

But between 2019 and 2021, home ownership running costs were well below rents, which prompted some tenants to think they might as well buy if they could.

"I think a lot of people when they go to buy a house they'll look at what they might be paying in rent versus what they'll pay in mortgage and then they'll add on perhaps council rates or insurance and other costs as they learn more about the types of housing they are wanting to buy. If owning a house does look very cheap, like when interest rates were low in 2019 and 2020, it would really encourage people to jump into the market and they did in large numbers despite prices being very high at that time," Galt said.

"I think it does shape people's housing choices and particularly for investors as well, who will be quite carefully weighing up the rent income they receive versus the cost of owning a house."

Things are now back in balance compared to where they have generally been over history.

"Home ownership running costs have since eased as interest rates have fallen and overall are now more or less back in line with their historical relationship with rents.

"Interest is the dominant cost and also the main source of variation," he said. "The home ownership running costs proxy has dropped over the past month due to a sizeable fall in fixed mortgage rates over October."

But the story is nuanced.

"Changes in interest costs reflect not only changes in interest rates but also changes in house prices, as the proxy is for buying a house now. Over 2021, both were rising, which explains the particularly sharp increase in home ownership costs over that period."

Galt said several changes over the past year had brought ownership costs and rents back in balance.

"Home ownership costs have decreased as both house prices and interest rates have fallen, but this has been partly offset by increases in other ownership costs such as council rates and insurance. Rents have fallen a little, meaning home ownership costs have had to fall further to close the gap.

"The combination of falling rents and high council rates and insurance costs has been a significant drag on house prices in recent years, which has dampened the impact of falling interest rates," he said,

He said it was likely that five-year mortgage interest rates would rise a bit from where they are now through next year, but the comparison between renting and owning was not likely to change a lot.

"Our forecasts anticipate home ownership costs and rents staying in balance over the next couple of years, which points to broad stability in house prices, potentially with a modest increase in prices as the economy experiences a cyclical recovery next year.

"The current balance of these costs and benefits of home ownership certainly doesn't suggest that house prices are likely to race away.

"Overall, the market's looking quite well balanced at the moment. We are expecting the ongoing costs of home ownership and rents to stay roughly around balance over the next couple of years and that just reflects interest rates staying relatively low.

"We do have them ticking up in our forecasts towards the end of 2026 but that's very much a placeholder at this stage. The broad story is interest rates staying down for a while and house prices only increasing at a gradual rate next year as the economy recovers."

Council rates were likely to rise at a slower rate, he said.

"They increased 12 percent a couple of years ago, that's dropped to 9 percent and then we expect them to keep easing but still going up."

===================================================

At The Helier, retirement feels like a fresh beginning. Light-filled modern apartments, thoughtfully designed spaces and a warm, welcoming community create a place where you can live well and stay connected. Enjoy a lifestyle that feels easy, uplifting and entirely your own, right in the heart of … View moreAt The Helier, retirement feels like a fresh beginning. Light-filled modern apartments, thoughtfully designed spaces and a warm, welcoming community create a place where you can live well and stay connected. Enjoy a lifestyle that feels easy, uplifting and entirely your own, right in the heart of the Bays. Learn more

Make your house a home with TSB Living — proudly serving Auckland and all of New Zealand with affordable furniture, home décor, and lifestyle essentials. From comfy couches to stylish outdoor sets, we’ve got what you need to live beautifully for less. Join thousands of happy Kiwis who trust … View moreMake your house a home with TSB Living — proudly serving Auckland and all of New Zealand with affordable furniture, home décor, and lifestyle essentials. From comfy couches to stylish outdoor sets, we’ve got what you need to live beautifully for less. Join thousands of happy Kiwis who trust TSB Living for quality and value.

Discover something new for every room — delivered straight to your door!

Find out more

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

© Neighbourly 2025