Buying a house - what insurance do you need?

If you’ve recently bought your first home, or upgraded to a new home, your lender or mortgage adviser may have talked to you about life or mortgage insurance.

But do you know the difference between them? Here we take a look at these two types of cover, and how each can benefit you and your family.

MORTGAGE INSURANCE

Depending on the policy (some will cover you for mortgage repayments if you are off work ill or injured as well), you might find that this type of cover only pays off your mortgage in the event of your death.

The payment will go straight to the lender, rather than to any loved ones. This means that, at the very least, your family will have a freehold house they can live in – and possibly sell to downsize and free up some capital. Mortgage insurance, however, doesn’t usually give your loved ones any additional funds for other needs.

LIFE INSURANCE

Unlike mortgage insurance, life insurance is not linked to your mortgage. The money either gets paid out to the policy owner or into the insured’s estate – meaning it can be used for whatever the beneficiary (receiver of the money) decides they want to use it for.

Another feature of life insurance is that you can have as much cover as you can either afford or demonstrate you have the need for. This means that not only can you make provision for the mortgage to be paid off, you can also include some additional funds to cover funeral costs, other debts or childcare or education costs.

Scam Alert: Fake information regarding December Bonuses from MSD

The Ministry of Social Development is reporting that fake information is circulating about new ‘December bonuses’ or ‘benefit increases’

If you get suspicious communication, please contact Netsafe.

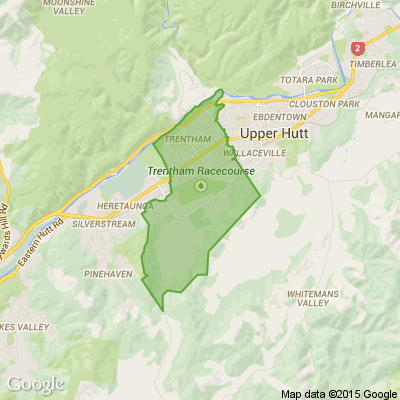

Advice please, declined house insurance cover

Looking for advice please. Has anyone had any issues reinsuring their homes. Our current house insurance went up by 11.5%, so I decided to get another quote. At the end of a very long phone with Tower, they declined to insurance us, saying our property is a landslide risk. I'm on Wyndham Road in Pinehaven. While the house is up off the street, the house itself and backyard are on the flat part of our section. Now - in the interest of full disclosure - I'm going to have to tell our current insurer too. I've rung the Council to see if they've updated their hazards mapping - and they said the only update has been to the Pinehaven Overflow. Have lived in this house since 2003, and insurance has never been an issue till now. TIA

Loading…

Loading…