Our new rates bill. When will the Horizons one come?

I wonder if anyone else asked the question when the new valuations came out, if valuations had anything to do with increasinbg rates? My memory is that PNCC said. No.

Now we all know that the high revaluations, became nonsense figures within 12 months, with house selling between 50K to 100K below the Q.V. figures. So what our properties are worth to the market place, has nothing to do with Q.V. yet our rating system is based on that false figure.

Our section has a value that has no discount for the fact that we cannot use the area that the City stopbank, is on. Previously we had been allowed to overset that loss by being able to vegetable and orchard garden on adjoining reserve land which had no public access.

The decision that a 4 metre wide road would be along the riverside as a commuter way, and PNCC took away our ability to garden and have an orchard.

My next question is, as rates are clearly for a lot of retired fixed income people, going to be unsustainable, will well managed Councils soon be able to attract people of retirement age to the smaller centres instead? A google search was interesting, and a property search nation wide as well as looking at their rates guides, is proving very enlighting.

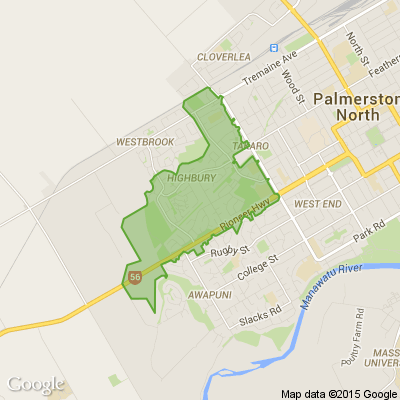

Palmerston North rates for a 1003 section, $4333. PNCC, Horizons yet to be recieved but expect it to be nearer $1k than $500.

Today’s Mind-Bender is the Last of the Year! Can You Guess It Before Everyone Else? 🌟🎁🌲

I dance in the sky with green and gold, a spectacle few are lucky to behold; I’m best seen in the south, a celestial sight—what am I, lighting up the New Zealand night?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Unwanted lawnmowers

Hi.i am looking for a petrol lawnmower going or not.steve.021665838.thankyou

Loading…

Loading…