Thinking about a retirement village? 5 key questions to ask yourself first

1. Am I ready to part with my home and some of my things?

================================================

Moving into a retirement village usually involves downsizing. That could mean shifting from a three-bedroom home to a two-bedroom villa, or even an apartment. It can feel liberating to simplify, but the emotional attachment to a family home and a lifetime of belongings is real.

Ask yourself:

What will I need day to day, and what can I let go of?

Am I prepared to sell or donate furniture, keepsakes, or tools?

Would I need storage for things I want to keep but can’t take with me?

It helps to walk through a few village homes and visualise what daily life might look like. Could this space feel like home?

2. How do I feel about community living?

=================================

One of the biggest lifestyle shifts is moving into a more communal environment. Villages vary in size and each has its own unique culture.

Consider:

Do I enjoy meeting new people and joining in social activities?

Would I make use of the shared spaces, such as lounges and other facilities?

How do I feel about having neighbours close by?

All retirement villages let you choose how involved you want to be, but it’s worth thinking about whether a shared lifestyle suits your preferences.

3. Do I understand the costs and how they differ from buying a home?

========================================================

This is a big one. Retirement villages have a unique financial structure, and it’s important to go in with a clear understanding of how it works. Generally, you’ll encounter three main types of costs:

Upfront payment (capital sum):

This gives you the right to live in your chosen home and access the village facilities. You don’t technically own the home; instead, you are purchasing a ‘license to occupy’. Compare this initial capital sum to similar properties in the same area. It should be slightly lower, since you are unlikely to receive financial benefit from any resale gains.

Ongoing weekly fees:

=================

This fee covers the general running costs of the village, things like maintenance, rates, insurance, staff wages, and sometimes amenities or events.

Ask what’s included and how often the fees are reviewed.

Compare these to what you currently pay living independently (e.g. lawn care, house maintenance, rates, and water).

couple paperwork

Every village is different, so always review the Occupation Right Agreement and village disclosure statement closely.

Deferred management fee:

======================

This is charged when you leave and is usually a percentage of your initial capital sum (often capped at 20–30%). It contributes to long-term costs such as:

Refurbishment of your home prior to a new resident moving in

Maintenance of communal village areas, buildings, and facilities

Costs incurred during the resale process (e.g. marketing, admin, legal)

It’s not a cost you’d typically pay when selling a standalone home, so it’s worth understanding what’s included and how it may impact your estate.

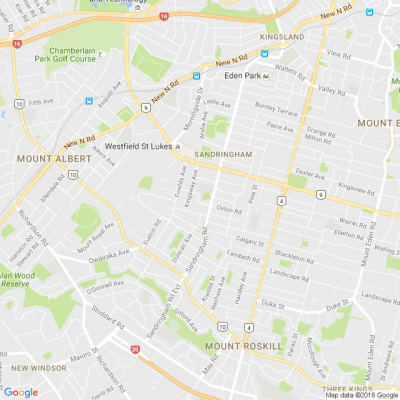

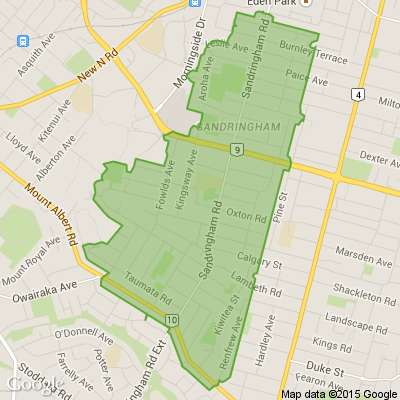

4. Will the location work for me long-term?

==================================

Moving to a retirement village could bring you closer to shops, cafés, or healthcare, but further from family, friends, or familiar surroundings.

Ask yourself:

Do I want to stay in my current area, or am I open to moving?

Will it be easy for friends and family to visit?

Are there transport options nearby if I stop driving?

Also think long term, what will matter most to you five or ten years from now?

5. What kind of support might I need later on, and does the village offer it?

==========================================================

Not all villages offer healthcare services or higher levels of care. Some provide support within your home (e.g. help with medication or personal care), while others have an onsite care facility.

Consider:

Does the village offer ‘continuum of care’ if your needs change?

Would you prefer to move once now or potentially again if your health changes?

What kind of support is important to you - nursing, transport to appointments, meal services?

Even if you’re in great health now, having a plan for the future gives you and your family peace of mind.

Don’t wait too long to start looking

=============================

Many people wait until a move feels urgent, but the best time to explore your options is when you have the time and energy to visit villages, talk to residents, and compare what’s out there.

Some people join waitlists years in advance - and that’s okay. Taking your time means you’re more likely to find a village that truly fits.

=====================================================

Scam Alert: Fake information regarding December Bonuses from MSD

The Ministry of Social Development is reporting that fake information is circulating about new ‘December bonuses’ or ‘benefit increases’

If you get suspicious communication, please contact Netsafe.

Some Choice News!

Many New Zealand gardens aren’t seeing as many monarch butterflies fluttering around their swan plants and flower beds these days — the hungry Asian paper wasp has been taking its toll.

Thanks to people like Alan Baldick, who’s made it his mission to protect the monarch, his neighbours still get to enjoy these beautiful butterflies in their own backyards.

Thinking about planting something to invite more butterflies, bees, and birds into your garden?

Thanks for your mahi, Alan! We hope this brings a smile!

Neighbourhood Challenge: Who Can Crack This One? ⛓️💥❔

What has a head but no brain?

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

Want to stop seeing these in your newsfeed?

Head here and hover on the Following button on the top right of the page (and it will show Unfollow) and then click it. If it is giving you the option to Follow, then you've successfully unfollowed the Riddles page.

Loading…

Loading…