Budget 2025 Rates Rebate

New eligibility rules for the rates rebate will help nearly 66,000 more SuperGold Cardholders with their living costs.

Announced in the 2025 budget on 22 May, the income threshold for the maximum rates rebate for SuperGold Cardholders will be lifted from $31,510 to $45,000. The maximum rebate for the scheme will also increase to $805 from $790.

The new eligibility means every SuperGold cardholder earning only NZ Superannuation paying average council rates will be eligible for the full rebate. Cardholders with total income of more than $45,000 may also be entitled to a smaller rebate.

Ratepayers can apply for the new maximum rebate and thresholds after 1 July 2025. Application forms will be available from your local council or can be downloaded from the New Zealand Government website and then submitted to your local council from 1 July 2025.

====================================================

Age Well Kiwi

We are a new support group for seniors. We meet once a month to share our experience and discuss our challenges & concerns.

With the growth of our ageing population, and more seniors living alone, this group would explore and advocate/address the social, emotional and physical needs of our seniors, and promote positive and healthy ageing.

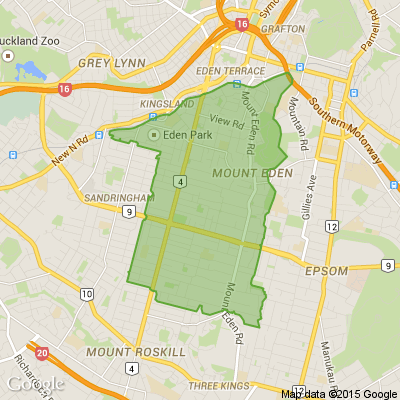

We meet on the first Saturday afternoon of the month in Mt. Roskill. Our next meeting will be 3 Jan 2026.

If you are interested in joining us and contribute your ideas, knowledge, experience, talents and resources, we would love to hear from you. Please contact us at agewellkiwi@gmail.com.

Today’s Mind-Bender is the Last of the Year! Can You Guess It Before Everyone Else? 🌟🎁🌲

I dance in the sky with green and gold, a spectacle few are lucky to behold; I’m best seen in the south, a celestial sight—what am I, lighting up the New Zealand night?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Loading…

Loading…