Neighbourly Premium Business

Talkmoney Ltd

Hi Neighbours, I can offer 25% cashback on your first year's insurance premium for life, income protection and trauma policies.

Message me via Neighbourly to claim this offer.

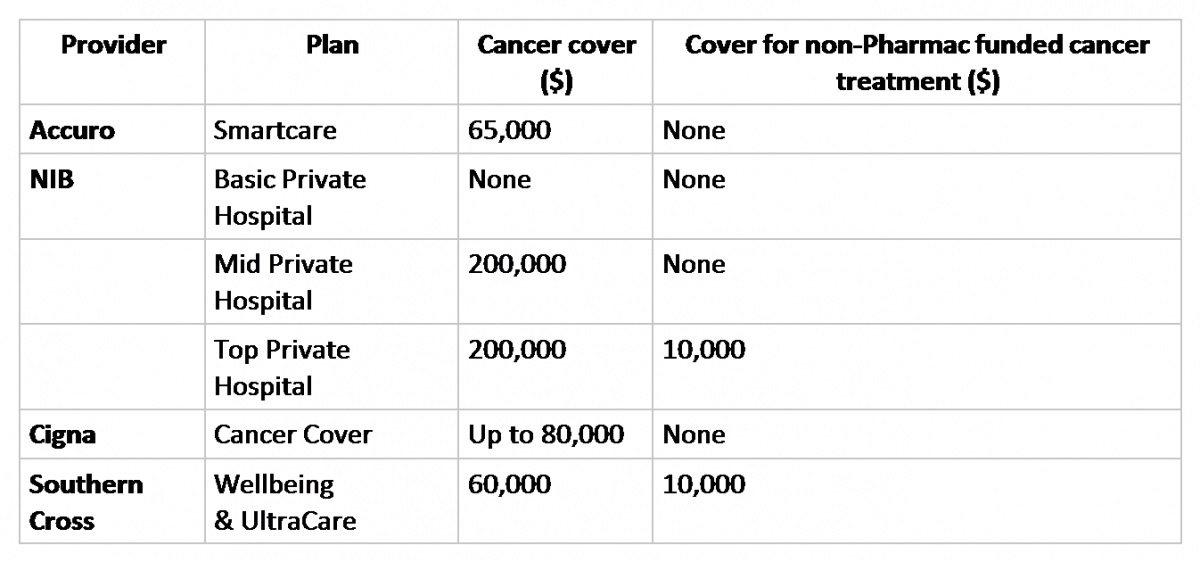

We search the market for you to find the best value, most suitable cover options from NZ's biggest and best insurers, then help you choose.

No cost. No pressure. Simple process.

We are real believers in the benefits of insurance. Unfortunately, bad things do happen to good people and even a little insurance can stop a sad and difficult time becoming a financial meltdown for your family.

Visit our website for more information www.talkmoney.co.nz

Message me via Neighbourly to claim this offer.

We search the market for you to find the best value, most suitable cover options from NZ's biggest and best insurers, then help you choose.

No cost. No pressure. Simple process.

We are real believers in the benefits of insurance. Unfortunately, bad things do happen to good people and even a little insurance can stop a sad and difficult time becoming a financial meltdown for your family.

Visit our website for more information www.talkmoney.co.nz

Insurance Agents / Brokers

Loading…

Loading…