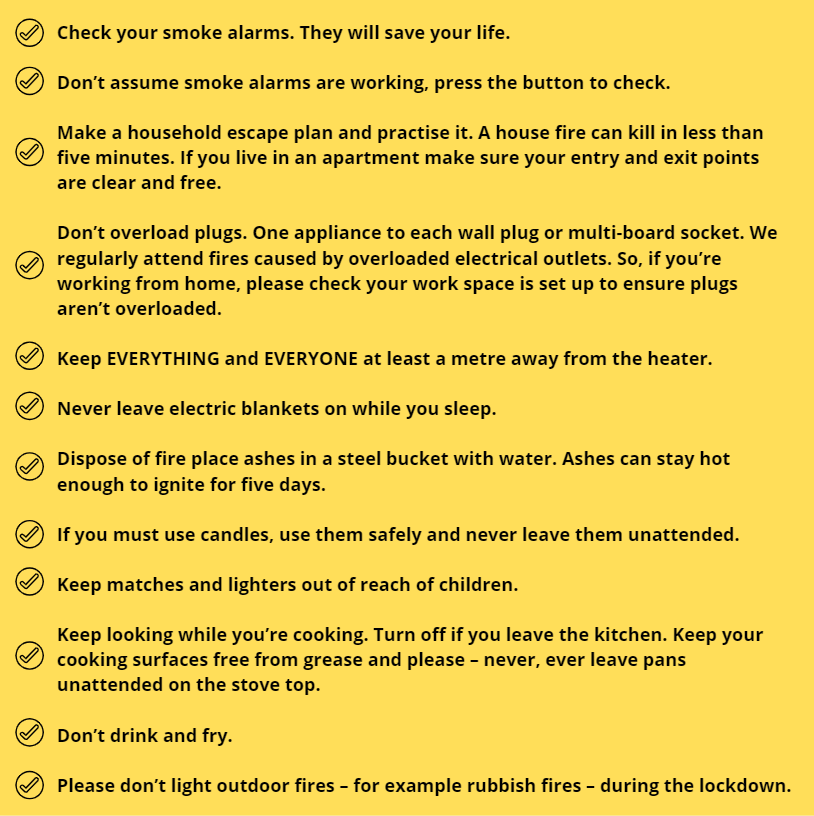

At-Home Fire Safety Checklist

With everyone staying home, it’s now more important than ever for everyone to be fire-safe. People can find information on our website - fireandemergency.nz...

We’re heading into winter, and with households self-isolating together, there’ll be more cooking at home, and more use of open fires, heaters, and dryers - all things which can increase fire risk.

New Zealanders can be confident that Fire and Emergency is well-prepared and ready to respond to emergencies as usual during the nationwide self- isolation period.

Please call 111 if you have a fire, we will ask you whether anyone at the address is self-isolating or has a confirmed case of COVID-19. Where this is the case, we already have necessary measures in place to ensure everyone’s safety including protective clothing, gloves, masks, safety glasses and mask.

Scam Alert: Fake information regarding December Bonuses from MSD

The Ministry of Social Development is reporting that fake information is circulating about new ‘December bonuses’ or ‘benefit increases’

If you get suspicious communication, please contact Netsafe.

Today’s Mind-Bender is the Last of the Year! Can You Guess It Before Everyone Else? 🌟🎁🌲

I dance in the sky with green and gold, a spectacle few are lucky to behold; I’m best seen in the south, a celestial sight—what am I, lighting up the New Zealand night?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Loading…

Loading…