Is it better to sell before you buy?

Selling your home first, then looking for a new one is less stressful and risky than buying and selling at the same time.

Selling first means you have freed up any equity and have a good idea of your budget for your next home. You’re also a cash buyer and will have an advantage over anyone who is making an offer conditional on selling their own property. If you can negotiate a long settlement period when you sell, you’ll have more time to find your next property without having to rent or move twice.

Renting or storing belongings between moving out of one home and into another will add to your costs. It may also be time consuming finding and moving to temporary accommodation and potentially disruptive, especially for children.

If you’ve already found your next home and need to sell your current home to finance it, you can make your offer to buy conditional on selling your home. If the seller accepts your offer with that condition, you’ll have time to sell your home within the time-frame set out in the condition. Sellers are likely to find unconditional offers more attractive, so consider this before deciding whether to sell your own home first.

You can talk to your bank or lender about bridging finance, which is a short-term home loan that can help you purchase a new property before your existing home is sold. There is a risk of more bridging finance debt than you planned if your sale takes longer than expected or if you get less than you hoped when you sell your house. If it takes longer to sell your existing home than expected, you may find yourself owning two properties for a while with the associated home loan, insurance and rates costs to pay.

Neighbourhood Challenge: Who Can Crack This One? ⛓️💥❔

What has a head but no brain?

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

Want to stop seeing these in your newsfeed?

Head here and hover on the Following button on the top right of the page (and it will show Unfollow) and then click it. If it is giving you the option to Follow, then you've successfully unfollowed the Riddles page.

Advice please, declined house insurance cover

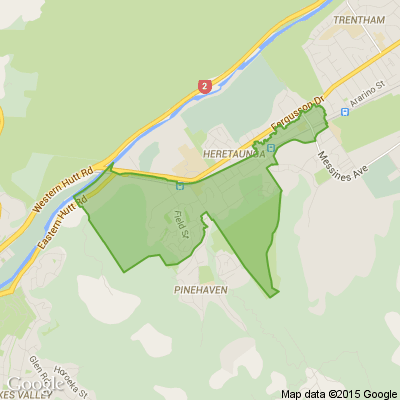

Looking for advice please. Has anyone had any issues reinsuring their homes. Our current house insurance went up by 11.5%, so I decided to get another quote. At the end of a very long phone with Tower, they declined to insurance us, saying our property is a landslide risk. I'm on Wyndham Road in Pinehaven. While the house is up off the street, the house itself and backyard are on the flat part of our section. Now - in the interest of full disclosure - I'm going to have to tell our current insurer too. I've rung the Council to see if they've updated their hazards mapping - and they said the only update has been to the Pinehaven Overflow. Have lived in this house since 2003, and insurance has never been an issue till now. TIA

Loading…

Loading…