Swap Rates Keep Sliding — And Now Banks Are Reacting.

As noted in my last post, falling wholesale funding costs were creating margin for banks to cut fixed rates. We’ve now seen the first moves:

👉 1-year fixed cut to 4.49%.

This follows the sharp drop in the 2yr swap rate (-0.2%), driven by weaker GDP data and markets reassessing the OCR terminal rate.

For borrowers, this shows how quickly sentiment shifts:

▪️ GDP weakness → markets price in lower OCR.

▪️ Swap rates fall → banks sharpen retail pricing.

adviceHQ provides independent financial advice to help clients position ahead of these shifts — capturing opportunities when markets move.

#adviceHQ #mortgagerates #OCR #independentfinancialadvice

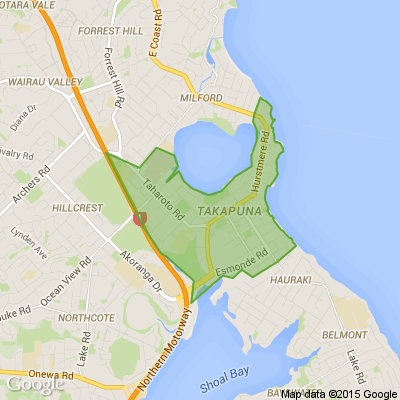

Poll: 🗑️ Would you be keen to switch to a fortnightly rubbish collection, or do you prefer things as they are?

Aucklanders, our weekly rubbish collections are staying after councillors voted to scrap a proposed trial of fortnightly pick-ups.

We want to hear from you: would you be keen to switch to a fortnightly rubbish collection, or do you prefer things as they are?

Keen for the details? Read up about the scrapped collection trial here.

-

85% Same!

-

15% Would have liked to try something different

Loading…

Loading…