Why is our doctor, dentist and audiologist charging an extra 2% for credit card payments?

The Retail Payment System Act was passed in May 2022.

That legislation was particularly popular in Parliament, passing with the support of every party but Act.

Minister Clark said it was “unfair that retailers, especially small retailers, have been constantly stung with high fees for offering services they need to survive”.

Merchant service fees are the fees paid by retailers to accept credit cards and some debit card payments.

Many shops choose to pass this fee on to consumers for using credit cards or payWave, resulting in higher prices.

It is hoped that this practice will end, or the passed-on fees will be lower, thanks to the legislation.

The cap on credit interchange fees is set at 0.8 per cent, in line with fees charged in Australia.

The legislation also caps fees for online debit transactions at 0.6 per cent.

www.nzherald.co.nz....

Poll: Are our Kiwi summer holidays helping us recharge, or holding the economy back? ☀️🥝

There’s growing debate about whether New Zealand’s extended Christmas break (and the slowdown that comes with it) affects productivity.

Tracy Watkins has weighed in ... now it’s your turn. What’s your take? 🤔

-

72.9% We work hard, we deserve a break!

-

16.1% Hmm, maybe?

-

11% Yes!

Celebrate in Style: Craft Your Own Decor with Testpots

Create handcrafted celebrations using Resene testpots. Find out how to create your own with these easy step by step instructions.

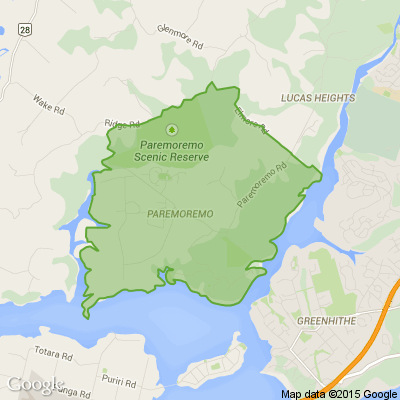

Aucklanders, we want to know: How are you feeling about the current property market?

New Zealand homeowners are now more likely to sell at a loss than at any time since 2013, and if you’re in Auckland or Wellington, the odds are even higher.

But there is a silver lining: buyers are still in a strong position when it comes to negotiating prices.

So we’re curious…

How are you feeling about the current property market?

If you’re keen to dive into the details, Deborah Morris breaks down all the latest insights.

Loading…

Loading…