How to match first-home buyers with everyday investors

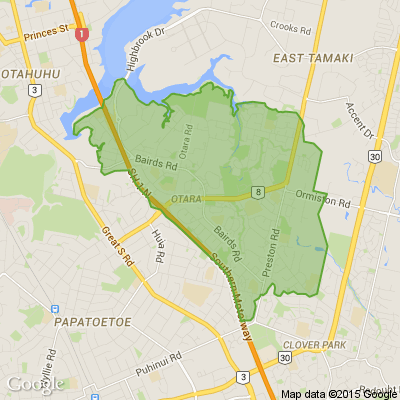

What do you think of the new online NZ platform Levridge aiming to match first-home buyers with everyday investors? Those with money to invest, put up a 20 percent deposit and those who have an income, but don't have enough to pay a deposit, take on the mortgage and live in the house.

After five years, the house can be sold and the two parties split the capital gains 50/50. Amy Wilkes is director of online house-buying platform Levridge.

What it costs To buy or invest

FOR BUYERS

In summary, a first home buyer is likely to have upfront fees of approx. $3,000-$4,000.

FOR INVESTORS

In summary, as an investor you will need to have sufficient capital to invest 20% of the value of the property, plus upfront fees of approx. $10,000.

Full description is detailed on their website.

Today’s Mind-Bender is the Last of the Year! Can You Guess It Before Everyone Else? 🌟🎁🌲

I dance in the sky with green and gold, a spectacle few are lucky to behold; I’m best seen in the south, a celestial sight—what am I, lighting up the New Zealand night?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

No gift? No stress

Let the Christmas elves at Mags4gifts.co.nz handle your last-minute shopping. For a limited time, gift a subscription with up to 40% off best-sellers like TV Guide, NZ House & Garden, and NZ Gardener. It’s the perfect Christmas present, sorted in minutes (and no one needs to know it was a last-minute surprise)!

Loading…

Loading…