Food safety – tips for summer

1. Buy food that is safe

Check the ‘use by’ date to make sure food is fresh when you buy it. Avoid food with damaged packaging and buy fruit and vegetables that are slightly unripe or only just ripe – especially if you don't plan to eat them straight away.

2. Gathered food

Always wash food that you or others have gathered, such as pūha or watercress. If you gather kai moana or seafood, check that the place you are collecting from is clean and free of pollution.

3. Keep hands and surfaces clean

Wash your hands before and after you handle raw foods. Make sure benchtops, cooking tools and barbecues are clean before you use them. When you prepare the meal, use separate utensils, plates and other tools to handle raw and cooked foods. After the meal, clean your benchtops and cooking tools well.

4. Rinse all fruits and veg

Rinse all of your fruit and vegetables under cold running water and then dry them with a clean cloth to help remove dirt and bacteria.

5. Preparing chicken

Chicken is the main offender for spreading serious tummy bugs. It needs careful handling when it's raw. You might be great at remembering to wash your hands before and after touching raw chicken, but do you get carried away and wash the chicken before you prepare it? This common practice is a big no-no. Washing chicken in your kitchen sink can lead to contamination of your work surfaces, cloths and cooking utensils. Keep a special chopping board for preparing chicken and don't use that board for chopping up fruit and vegetables. Don't use the same knife to cut up chicken and other foods until it's been well washed.

6. Keep cold foods cold

Set your fridge temperature between 2°C and 4°C. Most harmful bacteria cannot grow at low temperatures.

Keep cold dishes like salads and puddings in the fridge until you’re ready to eat them. Store raw meats and seafood in the fridge until right before you cook them. Cover them and place them on the fridge’s bottom shelf so their juices can’t drip onto other food. Keep meat products away from ready-to-eat food such as fruit and vegetables. Other meat and seafood (kai moana) are sources of bacterial contamination, not just chicken.

If you’re eating outdoors, use an icepack or chilly bin to keep food cold.

7. Fully cook meats and seafood

Cook chicken, mince and sausages right through, and cook pork and poultry until the juices run clear. Use a meat thermometer to check that your meat has been cooked to a safe temperature – at least 75°C in the thickest part of the meat.

You can take a vacuum-packed cooked ham straight from the fridge to the table. But if you like to glaze your ham and serve it hot, cook it at 160°C for 20 minutes per kilogram. You want the inside to reach at least 60°C – use a meat thermometer to check the temperature.

Eating cold ham of any kind when you are pregnant can come with the risk of a serious infection called listeria, which is harmful to the baby. Instead, cook or reheat ham until it’s piping hot (over 70°C) and eat it straight away. Learn more about how to eat safely when you're pregnant(external link).

8. Cover all dishes

Cover any dishes that are sitting out on the benchtop or table to protect your food from flies, ants and other bugs. Don’t leave them out of the fridge for more than 2 hours. Or store them in the fridge while your guests enjoy their first serving, then bring them back out when it’s time for the next course. If you think that food has been left out of the fridge for 4 or more hours, it is better to throw it out than risk getting sick. If in doubt, don't eat it!

9. Store leftovers carefully

Refrigerate or freeze leftover food within 2 hours after it was cooked, sealed in a clean, airtight container. You can keep a cooked cured ham in the fridge for up to 2 weeks. Cover it with a clean damp tea towel and change the towel every day.

Reheat leftovers until they are steaming hot (over 75°C), stirring well so they heat all the way through.

10. Food safety in pregnancy

When you're pregnant (hapū) you have lower immunity which puts you at greater risk of food-related illnesses such as listeriosis and toxoplasmosis. These can be dangerous for you and your child. To be safe:

wash and dry your hands carefully before handling food

clean, cook and chill foods

store leftover food in the fridge and don't eat them after 2 days

avoid high-risk foods(external link).

11. Most importantly

If you've been unwell or have any symptoms of sickness, leave the food preparation and serving to others. Don't risk passing on your germs to your whānau.

=====================================================

Poll: 🗑️ Would you be keen to switch to a fortnightly rubbish collection, or do you prefer things as they are?

Aucklanders, our weekly rubbish collections are staying after councillors voted to scrap a proposed trial of fortnightly pick-ups.

We want to hear from you: would you be keen to switch to a fortnightly rubbish collection, or do you prefer things as they are?

Keen for the details? Read up about the scrapped collection trial here.

-

83.4% Same!

-

16.6% Would have liked to try something different

Why we need cash to stick around----Cash is king – Using notes and coins to pay for everyday goods and services is quickly becoming obsolete. When will cash disappear from our lives? And who'll miss out when it does?

Every March, the New Zealand Red Cross sends out teams of street volunteers across the country. With their white buckets and red vests, they're instantly recognisable. The idea, says philanthropy director Jasmine Edwards, is to raise awareness for Red Cross’ work and hopefully get some donations in the process. “It’s part of our largest fundraising event of the year,” she says.

But, over the past five years, the amount the street appeal brings in has been trending down. Edwards describes a combination of contributing factors: COVID, the ongoing cost-of-living crisis and a lack of cash. “We’ve seen a pretty steady decline in people carrying cash, and that’s had a big impact on our street appeals,” she says. “It’s really affected what we’re able to raise.” That, in turn, affects how much aid work the Red Cross can do.

Edwards and the teams she co-ordinates have pivoted to other fundraising methods. They’ve trialled EFTPOS, tap-and-go donation machines and even QR codes. Each has downsides, says Edwards. EFTPOS isn’t quick, and QR codes often rely on the person taking a photo and remembering to donate later. “The tap-and-go machines are quicker because you just pop your card on, but they’re quite costly. You could never afford to have one of those at every site.”

So far, the cashless options haven’t worked as well as people reaching into their pockets and grabbing a couple of notes or a handful of coins to throw into the Red Cross buckets. However, those days, it seems, are over. In 2023, Stats NZ reported just 7% of transactions were made in cash. Everyone is using alternative methods to pay for goods and services these days, from EFTPOS and apps like Afterpay to swiping their phones and watches loaded with their credit cards.

Edwards wonders how long Red Cross has got until it needs to make more changes to its street appeals. “Our volunteers have amazing conversations with people on the street,” she says. “It’s a real moment of human connection. You can’t quite replicate that with online donations.”

Cash is king – until it’s not

=====================

Cash use is declining – rapidly. In its 2023 Cash Use Survey, the Reserve Bank of New Zealand found cash usage for everyday purchases had decreased from 95.8% in 2019 to 60.4% in 2021 and just 57.2% in 2023. The bank says 15% of New Zealanders prefer to use cash for everyday payments, but only 8% are regular or daily cash users.

Despite this decline, cash remains important, according to the Reserve Bank: it all depends on the situation. “Research establishes that New Zealanders place a high value on having access to cash,” a spokesperson told Consumer NZ. They cited short-lived personal emergencies, long-term complex personal challenges, community-level emergencies and digital payment outages as reasons for cash’s importance.

In December 2024, the Australian government announced it would mandate businesses selling essential goods and services in that country to accept cash from 2026. “For many Australians, cash is more than a payment method, it’s a lifeline,” officials said. Australians support this, with a survey by Australia’s consumer watchdog Choice showing 97% of respondents think stores shouldn’t be able to turn down cash for essentials.

But that’s not the case in New Zealand, where there are no rules to protect cash. If a business doesn’t want to accept cash, it just has to put up a sign saying so. The only rules limit how much a consumer can pay in coins. “The Reserve Bank is currently considering further changes to the law to support the cash system and ensure New Zealanders can access and use cash as desired,” the Reserve Bank spokesperson said.

How cash can help you spend less

=============================

Tom Hartmann, the personal finance lead at New Zealand’s independent money guide Sorted, says cash can be used as an important tool for some people to make better budgetary choices. He says credit cards or apps like Afterpay removes a buffer and encourage consumers to spend more. “You go up to the till; you get what you want; you pay, wave, swipe, whatever you do ...,” he says. “It’s all pleasure because you’re getting the thing, and any pain is sort of reserved for the future, when you get the bill.”

Cash, he says, helps those who may be struggling with their budgets get their spending under control. “With cash, it’s a different experience. You’re holding cash in one hand, and you receive the goods in the other. So, your brain is processing the trade-off right in that moment – is this worth the pain of letting go of this cash for what I’m getting?”

Carrying cash, he admits, is becoming an antiquated notion. It depends on your personality. When he’s got cash, he’s more likely to spend it faster. But Hartmann recalls a conversation he recently had with his 17-year-old son, who has an entirely different attitude. “He sold something on Trade Me recently, and he wanted to be paid in cash, because he holds on to [cash] better,” Hartmann says.

How small businesses are coping

===========================

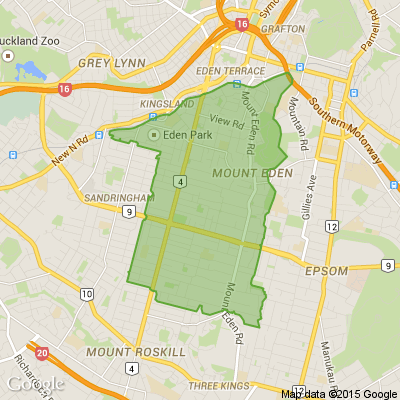

Every Sunday, Carol Gunn opens the Grey Lynn community centre early to let in stall-holders. By 8am, the markets are humming with customers grabbing freshly-baked pastries, recently picked vegetables, hot drinks, cheese, eggs and more. Gunn has noticed more stall-holders offering EFTPOS and credit card facilities, and fewer customers taking cash.

But she also recognises the issues, saying operating EFTPOS machines can be pricey for stall-holders, especially when they’re just getting going. “At this time of the year, we get lots of NCEA students trying out business ideas as part of their course assessments – they can only use cash,” she says. “We get community fundraisers who can only use cash. Getting rid of cash could disenfranchise the grass-roots activities in society.”

Frank Argent, the owner of Barefoot Gardens, a small produce farm in Kumeu, Auckland, agreed. While bagging up my potatoes and chillis recently, he told me about 40% of his customers paid in cash, which he encouraged. Why? “Every time you swipe your card, the bank takes a sizable chunk,” he said. “For a small business like ours, it adds up to a reasonable amount over a week.”

Other factors to consider in the death of cash

=====================================

There are still many elderly people who cannot use, or forget how to use, tech. Cash, therefore, remains very important to them for everyday items like groceries. “A cashless society makes things very difficult for older [generations],” one financial advisor told me.

Natural disasters or emergencies can affect internet networks, shutting down EFTPOS and credit capabilities. “Cash is often the only option at that time,” an advisor said. “Everyone should have a small amount of cash put aside.” How much is a personal decision, but the National Emergency Management Agency suggests it’s logical to have enough for three days’ worth of food and petrol. It also says small denominations, like $5 notes, are useful because some businesses may not be able to offer change.

Putting coins into a piggy bank is often a child’s first interaction with money. An advisor said the process can teach children important financial basics about saving money from an early age.

The king is dead; long live the king!

=============================

Claire Matthews, an associate professor at Massey University’s business school, says it’s too soon to say we’re on the brink of becoming a cashless society. “We have already moved a long way towards it, but I think cash transactions will be difficult to eliminate,” she says. “I think probably most of us are ready to move to a cashless society. But there are a few who aren’t and will likely find it very hard.”

But my own experiences suggest the shift could be happening faster than anyone thinks. While researching this piece, I found a sign at my local Pak’nSave declaring the store’s self-service check-outs would soon stop accepting cash. “Cashless,” warned a printed sign in red.

Then, at a recent Auckland Football Club match, I approached a cashier while balancing drinks and hot chips. When I handed her a $50 note, she turned it away, saying, presciently, “We don’t accept cash here”. I smiled and waved my phone over the terminal. That $50 will have to wait for another day.

====================================================

Loading…

Loading…