What happens after redundancy? NorthTec layoffs highlight jobseeker struggles

Tertiary Education Union organiser Jill Jones says redundancy can have a deep effect on a person’s sense of identity.

Jones has dealt with many redundancy proposals over the years, the latest being NorthTec.

The result of redundancy went far beyond the financial implications, especially if people were qualified in a niche area.

“It can make it incredibly difficult for them to find another job, especially if they have a commitment to a particular subject, and it becomes part of their identity in a sense,” Jones said.

“The narrower the field, the less likely it is you’re going to find employment.”

Jones said one man had told her he had still not told his adult children he had been made redundant, despite it happening months earlier.

“Because he felt embarrassed and ashamed.”

She pointed out that people who worked in roles with cultural or social impact sometimes experienced a loss of mana as well.

Redundancies are just one of the hardships faced by Northlanders.

Between September 2024 and 2025, the proportion of the working-age population receiving Jobseeker Support increased in most regions, according to Work and Income data.

By the end of September, Northland had the highest proportion receiving Jobseeker Support, at 11.4%.

That coincided with a surge in applications per job listing on Trade Me from July to September, where applications were up 11.8% quarter on quarter.

Though Work and Income had no data readily available to illustrate how many of those on Jobseeker Support had been made redundant, layoffs have undoubtedly played a part.

People Potential chief executive Bronwyn Ronayne recalled that one of the biggest redundancy bouts in Northland was when the Marsden Point oil refinery closed in 2022.

Many people were left with “niche” skills that they struggled to transfer.

There were now “really nice stories” starting to emerge of people who had started their own businesses and made opportunities out of the change, she said.

“There are so many people I can think of personally who are made redundant who are doing really cool stuff.”

Northland’s jobseeker levels came as no surprise to her.

“I think Northland’s always a bit slower to come out of whatever economic impact there is, a bit slower to recover from the knocks.”

Muriel Willem, director and lead careers practitioner at New Focus NZ, said the wellbeing and community-development company had noticed an increase in redundancies over the last six months.

That was particularly in trades associated with building projects that had stalled with the economic downturn, as well as hospitality after cafe closures.

She said clients who had been made redundant often worked through shock, disappointment, sadness and anger.

“The process can be an emotional rollercoaster, especially for those who haven’t needed to update a CV for years or previously found work through word of mouth.”

Willem said people over 60 struggled disproportionately with redundancy.

“Often they have CVs full of experience and knowledge, yet with retirement only a few years away and competition from younger applicants who may accept lower pay rates, they are often overlooked in the job market.”

However, she said mental health was often the greatest barrier for anyone returning to employment.

Trade Me data from July to September showed a 2% decrease in job listings in Northland, which head of Trade Me jobs Nicole Williams said was driven by major centres like Auckland and Wellington recording drops.

“We know job hunters are still finding it tough to land on their feet with the unemployment rate [nationally] at 5.2%,” Williams said.

Northland received the highest growth in applications per listing year-on-year.

Trades and services had the most listings started (approximately 22%), and this category saw 4.7% quarter-on-quarter growth and +14.1% year-on-year growth.

Other categories experiencing quarter-on-quarter growth in the region were transport and logistics (up 24.2%), retail (23.3%), healthcare (18.3%) and construction and roading (17.6%).

The average salary for Northland jobs listed during the July-September quarter was $73,858, a record high.

======================================================

Poll: 🗑️ Would you be keen to switch to a fortnightly rubbish collection, or do you prefer things as they are?

Aucklanders, our weekly rubbish collections are staying after councillors voted to scrap a proposed trial of fortnightly pick-ups.

We want to hear from you: would you be keen to switch to a fortnightly rubbish collection, or do you prefer things as they are?

Keen for the details? Read up about the scrapped collection trial here.

-

83.4% Same!

-

16.6% Would have liked to try something different

Why we need cash to stick around----Cash is king – Using notes and coins to pay for everyday goods and services is quickly becoming obsolete. When will cash disappear from our lives? And who'll miss out when it does?

Every March, the New Zealand Red Cross sends out teams of street volunteers across the country. With their white buckets and red vests, they're instantly recognisable. The idea, says philanthropy director Jasmine Edwards, is to raise awareness for Red Cross’ work and hopefully get some donations in the process. “It’s part of our largest fundraising event of the year,” she says.

But, over the past five years, the amount the street appeal brings in has been trending down. Edwards describes a combination of contributing factors: COVID, the ongoing cost-of-living crisis and a lack of cash. “We’ve seen a pretty steady decline in people carrying cash, and that’s had a big impact on our street appeals,” she says. “It’s really affected what we’re able to raise.” That, in turn, affects how much aid work the Red Cross can do.

Edwards and the teams she co-ordinates have pivoted to other fundraising methods. They’ve trialled EFTPOS, tap-and-go donation machines and even QR codes. Each has downsides, says Edwards. EFTPOS isn’t quick, and QR codes often rely on the person taking a photo and remembering to donate later. “The tap-and-go machines are quicker because you just pop your card on, but they’re quite costly. You could never afford to have one of those at every site.”

So far, the cashless options haven’t worked as well as people reaching into their pockets and grabbing a couple of notes or a handful of coins to throw into the Red Cross buckets. However, those days, it seems, are over. In 2023, Stats NZ reported just 7% of transactions were made in cash. Everyone is using alternative methods to pay for goods and services these days, from EFTPOS and apps like Afterpay to swiping their phones and watches loaded with their credit cards.

Edwards wonders how long Red Cross has got until it needs to make more changes to its street appeals. “Our volunteers have amazing conversations with people on the street,” she says. “It’s a real moment of human connection. You can’t quite replicate that with online donations.”

Cash is king – until it’s not

=====================

Cash use is declining – rapidly. In its 2023 Cash Use Survey, the Reserve Bank of New Zealand found cash usage for everyday purchases had decreased from 95.8% in 2019 to 60.4% in 2021 and just 57.2% in 2023. The bank says 15% of New Zealanders prefer to use cash for everyday payments, but only 8% are regular or daily cash users.

Despite this decline, cash remains important, according to the Reserve Bank: it all depends on the situation. “Research establishes that New Zealanders place a high value on having access to cash,” a spokesperson told Consumer NZ. They cited short-lived personal emergencies, long-term complex personal challenges, community-level emergencies and digital payment outages as reasons for cash’s importance.

In December 2024, the Australian government announced it would mandate businesses selling essential goods and services in that country to accept cash from 2026. “For many Australians, cash is more than a payment method, it’s a lifeline,” officials said. Australians support this, with a survey by Australia’s consumer watchdog Choice showing 97% of respondents think stores shouldn’t be able to turn down cash for essentials.

But that’s not the case in New Zealand, where there are no rules to protect cash. If a business doesn’t want to accept cash, it just has to put up a sign saying so. The only rules limit how much a consumer can pay in coins. “The Reserve Bank is currently considering further changes to the law to support the cash system and ensure New Zealanders can access and use cash as desired,” the Reserve Bank spokesperson said.

How cash can help you spend less

=============================

Tom Hartmann, the personal finance lead at New Zealand’s independent money guide Sorted, says cash can be used as an important tool for some people to make better budgetary choices. He says credit cards or apps like Afterpay removes a buffer and encourage consumers to spend more. “You go up to the till; you get what you want; you pay, wave, swipe, whatever you do ...,” he says. “It’s all pleasure because you’re getting the thing, and any pain is sort of reserved for the future, when you get the bill.”

Cash, he says, helps those who may be struggling with their budgets get their spending under control. “With cash, it’s a different experience. You’re holding cash in one hand, and you receive the goods in the other. So, your brain is processing the trade-off right in that moment – is this worth the pain of letting go of this cash for what I’m getting?”

Carrying cash, he admits, is becoming an antiquated notion. It depends on your personality. When he’s got cash, he’s more likely to spend it faster. But Hartmann recalls a conversation he recently had with his 17-year-old son, who has an entirely different attitude. “He sold something on Trade Me recently, and he wanted to be paid in cash, because he holds on to [cash] better,” Hartmann says.

How small businesses are coping

===========================

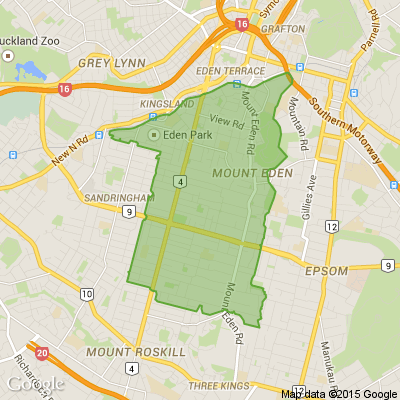

Every Sunday, Carol Gunn opens the Grey Lynn community centre early to let in stall-holders. By 8am, the markets are humming with customers grabbing freshly-baked pastries, recently picked vegetables, hot drinks, cheese, eggs and more. Gunn has noticed more stall-holders offering EFTPOS and credit card facilities, and fewer customers taking cash.

But she also recognises the issues, saying operating EFTPOS machines can be pricey for stall-holders, especially when they’re just getting going. “At this time of the year, we get lots of NCEA students trying out business ideas as part of their course assessments – they can only use cash,” she says. “We get community fundraisers who can only use cash. Getting rid of cash could disenfranchise the grass-roots activities in society.”

Frank Argent, the owner of Barefoot Gardens, a small produce farm in Kumeu, Auckland, agreed. While bagging up my potatoes and chillis recently, he told me about 40% of his customers paid in cash, which he encouraged. Why? “Every time you swipe your card, the bank takes a sizable chunk,” he said. “For a small business like ours, it adds up to a reasonable amount over a week.”

Other factors to consider in the death of cash

=====================================

There are still many elderly people who cannot use, or forget how to use, tech. Cash, therefore, remains very important to them for everyday items like groceries. “A cashless society makes things very difficult for older [generations],” one financial advisor told me.

Natural disasters or emergencies can affect internet networks, shutting down EFTPOS and credit capabilities. “Cash is often the only option at that time,” an advisor said. “Everyone should have a small amount of cash put aside.” How much is a personal decision, but the National Emergency Management Agency suggests it’s logical to have enough for three days’ worth of food and petrol. It also says small denominations, like $5 notes, are useful because some businesses may not be able to offer change.

Putting coins into a piggy bank is often a child’s first interaction with money. An advisor said the process can teach children important financial basics about saving money from an early age.

The king is dead; long live the king!

=============================

Claire Matthews, an associate professor at Massey University’s business school, says it’s too soon to say we’re on the brink of becoming a cashless society. “We have already moved a long way towards it, but I think cash transactions will be difficult to eliminate,” she says. “I think probably most of us are ready to move to a cashless society. But there are a few who aren’t and will likely find it very hard.”

But my own experiences suggest the shift could be happening faster than anyone thinks. While researching this piece, I found a sign at my local Pak’nSave declaring the store’s self-service check-outs would soon stop accepting cash. “Cashless,” warned a printed sign in red.

Then, at a recent Auckland Football Club match, I approached a cashier while balancing drinks and hot chips. When I handed her a $50 note, she turned it away, saying, presciently, “We don’t accept cash here”. I smiled and waved my phone over the terminal. That $50 will have to wait for another day.

====================================================

Loading…

Loading…