Great job, good salary, no chance of a house? Kiwis fleeing to Australia in for a shock

Million-dollar homes now the norm across the ditch - even in “affordable” Adelaide and Brisbane.

- Kiwis moving to Australia for higher wages face expensive housing, especially in major cities like Brisbane and Sydney.

- Queensland is a popular destination, but affordable housing is scarce, with prices rising significantly.

- Despite higher wages, the cost of living, particularly housing, challenges Kiwis seeking a new life in Australia.

Kiwis heading across the ditch for higher wages and better jobs won’t find cheaper houses, Australian real estate agents have warned.

There were 70,000 migrant departures in the year to the end of March, with the latest Stats NZ figures highlighting that nearly 60% departing Kiwi citizens went to Australia.

Analysis of last year’s migration figures by Australian and New Zealand real estate agency Ray White found that Queensland was the favoured location for expats, closely followed by Victoria. Less than a fifth of migrants headed to NSW, down from a peak of 27%, while the number moving to Perth has grown by 14%.

And while jobs are easier to come by and offer better pay in Australia, property experts told that affordable housing in the state capitals was hard to find.

A news report in The Guardian Australia recently asked if Australia’s “bloated property market” was “destroying the middle class”, and highlighted the real estate plight of professionals with good jobs and a good education. Property prices in Australia, it said, were increasing at a faster pace than families can save for a deposit.

According to the latest figures from property analysis firm Cotality, one in three Australian homes has a value of A$1 million or more, with the nationwide median now A$838,00, up 41% in five years.

Brisbane, perceived by some Kiwis as more affordable than Auckland, is now Australia’s second-most expensive capital city after Sydney. Its median house value has jumped 76% since 2020 to just over A$1m.

Adelaide, another city that has attracted buyers on the hunt for cheaper homes, has seen house prices soar post-Covid. The South Australian capital’s median property value is hurtling towards the A$1m mark, with the average Adelaide house now costing nine times the median household income (New Zealand homes, by comparison, cost 7.3 times the median household income, the lowest level since 2019).

Cotality Australia head of research Eliza Owen told that housing in Australia was generally expensive, for both buyers and renters. Australia’s median rent had risen by 40.3% in the last five years to A$665 per week, whereas the growth rate has been much slower in New Zealand at 29%.

Rising house prices in Australia and flat or falling prices in New Zealand made it harder for Kiwis looking to start a new life across the ditch.

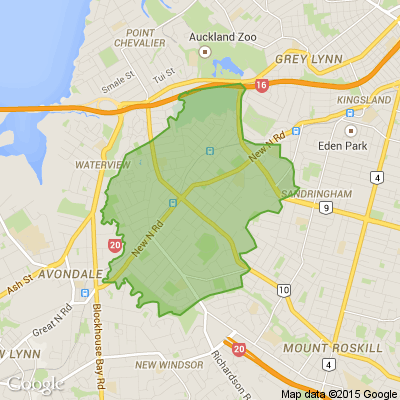

Ray White’s examination of what homeowners in New Zealand’s five biggest cities – Auckland, Christchurch, Wellington, Hamilton and Tauranga – could buy in Australia illustrates the challenges Kiwis face.

Senior data analyst Atom Go Tian looked at what the median sale price in each of the major Kiwi metros could get across the ditch. Unsurprisingly, Auckland money provides buyers with the most choice, with Go Tian identifying 54 districts in Australia’s state capitals and lower-tier towns and cities with a lower median value than Auckland’s.

However, homes in just three Sydney districts are cheaper than the cost of a typical Auckland home, and they are on the far-flung fringes. House prices in Sydney’s popular Eastern Suburbs and North Shore are more than double those in Auckland. Also out of reach would be houses on the Gold Coast and Sunshine Coast.

Go Tian found that Tauranga and Wellington house prices were cheaper than 37 and 36 Australian districts respectively, including the outer suburbs of Perth, Brisbane and Melbourne, while Hamilton and Christchurch money wouldn’t be enough to get into Australia’s big cities.

Go Tian said the data suggested Kiwis might have to bypass Australia’s state capitals in favour of the more affordable regional centres like Bendigo, Ballarat, Cairns and Townsville.

Ray White AKG business owner Avi Khan, whose patch covers Queensland’s biggest markets, told that Kiwis expecting to land a property bargain on the Gold Coast or in Brisbane would be disappointed. “There’s a common misconception that it’s cheaper to buy houses in Australia,” he said.

“It’s harder to get into the Gold Coast market. The jobs are based around Brisbane, so most people end up buying in Brisbane.”

He said that a four-bedroom, two-bathroom house on 500sqm and about 35-40 minutes from Brisbane CBD could be picked up for between A$800,00 and A$900,000. The same property would have been about A$200,000 cheaper two years ago, he said.

“I think a lot of Kiwis heading over here are surprised at how expensive it is, relative to 24 months ago.”

However, they were still arriving, moving to Brisbane for job prospects. Some bought homes near friends and family, as well as close to the beach as they could afford.

Khan said a housing shortage in Australia and Brisbane, in particular, was a challenge for those looking to buy or rent. “It takes a little bit longer to buy a house here because there’s so much competition.”

Harcourts WA chief executive Shane Kempton said competition for homes in his patch was similarly “fierce”, adding that stock levels in Perth had dropped to 4000 – about a third of where they usually sit.

Houses were often selling above asking price, he said, adding that vendors would typically receive multiple offers.

However, the job opportunities in Western Australia’s mining, energy and resource sectors were strong pull factors for Kiwis. “WA is short of skilled tradespeople, so work in these fields is plentiful. Perth lifestyle is relaxed with plenty of outdoor options with beaches, bush, islands and forests to explore.”

Kempton said he often met Kiwis at sporting events – especially rugby and netball games - and said they seemed to favour certain Perth suburbs, including East Rockingham, Midland, and Butler.

For Kiwis looking for more affordable areas to live in, Kempton suggested Two Rocks and Mandurah, about an hour outside of Perth. Prices in both were just under A$600,000.

Michael Pallier, managing director of Sydney Sotheby’s International Realty, said most of the Kiwis who were shifting to Australia’s largest city were renting, not buying.

“Sydney is one of the most expensive cities in the world. The wages are also much higher here. So, they can get a good job when they come here, and they can still find places to live – there’s accommodation available.”

Pallier had employed a hardworking Kiwi to work in his office at the start of the year and had come across many others who had also made the move.

However, Pallier said they quickly discovered that accommodation was much more expensive than they had expected, and they had to move almost an hour away from the city to be able to buy anything for A$1m or less.

“You are going to pay A$1m-plus for a house, even in Sydney’s Western suburbs. It doesn’t really get you a lot. Rent is A$600 plus a week for a two-bedroom apartment, A$1000-plus if it’s in the CBD.”

Kevin Chokshi, director of Ray White The Bayside Group, said Melbourne’s property market had only started to pick up in the last few months after a relatively flat two years.

His advice to Kiwis and Australians looking to buy in Melbourne was simple: act now. But he warned that competition was building, with auctions the favoured sales method.

Entry-level prices for standalone houses in the city were around A$900,000, while units sat between A$600,000 and A$700,000.

Prices dropped the further out buyers went, and those willing to travel about 40 minutes to an hour into the CBD might be able to snag a home in Frankston, Pakenham, Sunbury, Werribee or Epping for around A$700,000.

One Kiwi who has no complaints about her shift from Auckland to Brisbane is Clarissa Searle. She told OneRoof the move across the ditch was one of the best things she had done.

Friends had been encouraging her for years to make the move, and in September 2023, she finally listened.

Most of her mates had settled in Sydney, but Searle decided to make Brisbane her new home. “I just felt like I needed a change and more opportunities career-wise,” she told.

The 33-year-old, who works for a property development company, was lucky enough to secure a one-bedroom apartment for A$600 a week overlooking the Brisbane River before she arrived.

It was much better than the two-bedroom unit she rented in Auckland’s Mount Eden. “I get a lot more for my money here,” she said. “It’s like I’m living in a resort hotel. It’s gorgeous.”

She has noticed substantial increases in both rents and house prices since arriving in the city – her own rent lifted to A$635 a week and is set to rise again to A$700.

“Prices have gone up like crazy in the last year. There are just so many people looking for places to live at the moment. You turn up to rental inspections and there are like 50 or 60 people viewing it.”

Searle recently met with a mortgage broker to talk about buying her first home in the city. While Brisbane property prices were cheaper than prices in Auckland when she first arrived, this was changing, and she wanted to jump on the property ladder before prices were out of her reach.

But higher wages and cheaper grocery bills – especially healthy food – meant she still had more money left in her pocket than she had when she was in Auckland.

Not everything is cheaper – cars aren’t – but the overall cost of living probably was, she said. There are also extra incentives for Queenslanders, such as rebates on power and appliance bills and cheap public transport.

“I will not move back to NZ anytime soon. It’s such a better lifestyle here,” she said.

===================================================

Some Choice News!

Many New Zealand gardens aren’t seeing as many monarch butterflies fluttering around their swan plants and flower beds these days — the hungry Asian paper wasp has been taking its toll.

Thanks to people like Alan Baldick, who’s made it his mission to protect the monarch, his neighbours still get to enjoy these beautiful butterflies in their own backyards.

Thinking about planting something to invite more butterflies, bees, and birds into your garden?

Thanks for your mahi, Alan! We hope this brings a smile!

Scam Alert: Fake information regarding December Bonuses from MSD

The Ministry of Social Development is reporting that fake information is circulating about new ‘December bonuses’ or ‘benefit increases’

If you get suspicious communication, please contact Netsafe.

More than 120,000 disabled and older New Zealanders registered in the Total Mobility scheme will pay more for discounted taxi trips from next year as the Government announces a cut to trip subsidies.

Transport Minister Chris Bishop said subsidies would drop from 75% to 65% from July 1, 2026, blaming unsustainable rising costs.

Regional fare caps will also be lowered by around 10%.

Wide-ranging Ministry of Transport proposals for the scheme were released for consultation today. Suggested options included "strengthened" eligibility; periodic reassessments; caps on monthly trips; and the potential inclusion of ridesharing services.

"The Government is announcing decisions to stabilise the Total Mobility scheme so that the disability community is supported in a financially sustainable way, by all funding partners," Bishop said of the confirmed subsidy changes.

Disability Issues Minister Louise Upston said the new subsidy level would still be higher than what it was four years ago, when it was raised under the previous government.

"We appreciate these decisions will mean fares will increase for Total Mobility users.

"But they will still receive a higher subsidy level than prior to 2022. The changes also provide certainty that those who need the service will have continued access to it."

Demand for the scheme has soared since the subsidy rose from 50% in 2022. Registered users have jumped from 108,000 to 120,000, while trips have risen from 1.8 million in 2018 to three million.

Bishop said the 2022 increase had not accounted for higher demand over time.

"Increased demand now means the scheme is close to exceeding its Crown funding and is placing significant pressure on the contributions from local councils and NZTA," he said.

Costs are forecast to exceed funding by $236 million between 2025 and 2030 under current settings, according to the Government.

The Total Mobility scheme provided subsidised taxi fares for people who could not use public transport independently due to disability or age. The scheme was funded jointly by central government, NZTA's National Land Transport Fund and local councils.

The Government would also provide $10 million to NZTA to ease funding pressures on public transport authorities until the changes took effect.

Reacting to the subsidy changes, Disabled Persons Assembly chief executive Mojo Mathers told 1News that Total Mobility was an "essential service for us".

"This cut to Total Mobility on top of a cost-of-living crisis will only aggravate hardship in an already struggling population," she said in a statement.

"Total Mobility is an essential service for us. Not everyone can get on a bus or drive a car.

"Disabled people will face impossible choices when it comes to travel, when we know that over half don’t have enough to meet their everyday needs."

Labour has criticised the subsidy changes, saying the Government was "making life harder and more expensive for disabled New Zealanders".

Today's announcement came after a delayed year-long Transport Ministry review of the Total Mobility scheme, which included an earlier round of public consultation.

Further changes on the way, proposals in consultation

============================================

Alongside the subsidy cut, the Ministry of Transport has opened consultation on proposals including trip caps, stricter eligibility assessments, and expanding service providers beyond taxis to include ride-hail apps and on-demand public transport.

"Beyond ensuring the scheme’s financial viability, the Government is also taking the opportunity to consider changes to strengthen a system so that it works better for disabled people,” Upston said.

"The Ministry of Transport will be releasing a discussion document to consult on proposals to strengthen Total Mobility to ensure fairer, consistent and more sustainable access to services for people with the greatest need."

The wide-ranging proposals were not yet Government policy and were open for feedback until March 22, 2026. The 10% subsidy cut was not part of the consultation.

The proposals include trip caps, with two options. The first would give all users a flat monthly cap of 30 to 40 trips at 65% subsidy, with either no further subsidised trips or a reduced 50% subsidy once reached. The second would allocate 10 base trips, plus extras based on need – for example, for employment, health, or education.

The ministry proposed tighter eligibility requirements, including medical evidence from health practitioners, occupational therapists or psychologists when applying.

Currently, assessment standards varied, with no documentary evidence required.

Periodic reassessments would also be introduced under another proposal, requiring users to be re-evaluated after a set period to ensure they remained eligible.

The proposals also aimed to expand service providers beyond traditional taxis to include ride-hail apps, on-demand public transport services, and volunteer community transport providers. The ministry said this could increase availability and give users more options.

It was unclear whether ride-hailing apps would include popular ride-sharing apps such as Uber.

To improve wheelchair accessibility, the ministry also proposed more incentives for service providers, including higher funding for installing ramps and hoists in vehicles, and raising the $10 per wheelchair trip payment that has remained unchanged since 2005.

The ministry was also exploring a national public transport concession for people with disabilities – separate from Total Mobility and implemented through the National Ticketing Solution from 2027.

Labour critical of subsidy changes

============================

Labour disability issues spokesperson Priyanca Radhakrishnan said the Government was "making life harder and more expensive for disabled New Zealanders by slashing discounted transport fares during a cost-of-living crisis".

"Under Christopher Luxon, disabled Kiwis will now pay more just to get to work, attend health appointments, or see loved ones,” she said in a statement.

"Disability communities feel betrayed. First came the overnight cut to flexible funding; then restrictions on residential care with no warning.

"Then Whaikaha was gutted and disability support shifted to the Social Development Ministry. Now, the transport subsidy many rely on to live independently has been cut.

"For many disabled Kiwis, affordable transport isn’t a nice-to-have, it’s a lifeline. It means independence, dignity, and the ability to participate in everyday life and that’s why Labour increased the subsidy in government. This latest change is taking us backwards."

=========================================================

Loading…

Loading…