📮Total BAN of life chaining of dogs request 📮

If you are animal lovers, please consider to support this request by Wed, March 15 🙏🏻

www.facebook.com...

Every email counts! Please help to end the most inhumane cruelty to the thousands of NZ dogs💔

youtu.be...

Dogs were born to be human's soulmates, but thousands of humans chain them 24/7. They are eating, sleeping, defecating, urinating, and walking in the same circle for years. Most of them have no shelter, starving, rotting alive and dying on the chain in unthinkable pain 💔

www.facebook.com...

Poll: Are our Kiwi summer holidays helping us recharge, or holding the economy back? ☀️🥝

There’s growing debate about whether New Zealand’s extended Christmas break (and the slowdown that comes with it) affects productivity.

Tracy Watkins has weighed in ... now it’s your turn. What’s your take? 🤔

-

72.7% We work hard, we deserve a break!

-

16.2% Hmm, maybe?

-

11.1% Yes!

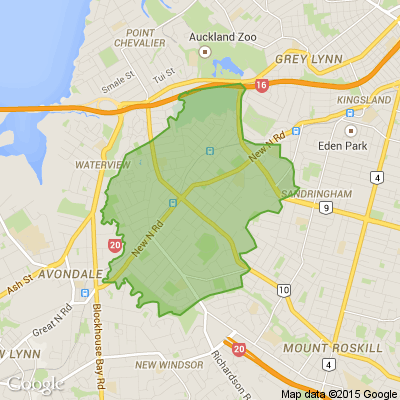

Aucklanders, we want to know: How are you feeling about the current property market?

New Zealand homeowners are now more likely to sell at a loss than at any time since 2013, and if you’re in Auckland or Wellington, the odds are even higher.

But there is a silver lining: buyers are still in a strong position when it comes to negotiating prices.

So we’re curious…

How are you feeling about the current property market?

If you’re keen to dive into the details, Deborah Morris breaks down all the latest insights.

7000 pensioners overcharged in another Inland Revenue error

Almost 7000 pensioners have been affected by another Inland Revenue error.

Last week, RNZ reported that 4500 people had overpaid tax after their imputation credits had been incorrectly recorded in their prep-populated tax returns.

Others got in touch and said they had also experienced a problem, this time with the way that NZ Super was recorded for ACC purposes.

One man said he had been charged $301.68 in ACC earner levy for $18,854.98 of gross income from NZ Super that should not have attracted a levy at all.

He said he was not able to control this when he completed his return and did not realise the error until the process was complete.

He said he did not think a lot more about it but when he saw RNZ's reporting of the other error, he realised that there had been at least two this year.

"This really starts to suggest a deficiency in change control of IRD systems."

Another couple said they wanted assurance that Inland Revenue had taken steps to stop it happening again.

======================================

Inland Revenue said 6778 people were affected.

======================================

"There was an issue identified earlier this year where we were not populating the 'earnings not liable' figure correctly for some customers. We fixed those returns for the customers in July 2025."

Chartered Accountants Australia New Zealand tax leader John Cuthbertson said ACC was not paid on NZ Super because it was not liable income.

"However, if you're working and receiving NZ Super, your earnings from that work do attract levies."

"The advancements in digitalisation and MyIR have been quite incredible, except when it goes wrong like this. You shouldn't need a Chartered Accountant to check prepopulated forms, but the average person might not know that super income does not attract ACC levies. We used to say 'google it' but many taxpayers are now using AI to do a basic check of their tax returns, asking simple questions like 'Should I pay 'x' levy on 'y' income?"

Angus Ogilvie, managing director of Generate Accounting Group, said it was concerning that issues seemed to be leading to erroneous data being prepopulated into Inland Revenue's system.

"The new software employed was a very costly and complex project. However, taxpayers should expect that there is a high level of diligence applied to get their tax obligations right. Let's hope that the department is devoting urgent resource to correct these issues".

======================================================

Loading…

Loading…