Interest Rates: RBNZ OCR

2pm Wed 28 Feb, the RBNZ will unveil its eagerly awaited OCR decision, marking the first such announcement since 29 Nov 2023. What can we anticipate?

The RBNZ has adopted a hawkish stance, signaling potential rate hikes amidst concerns over domestic inflation - a sentiment echoed by ANZ's Chief Economist, NZ's largest bank.

Contrastingly, the majority of economists have taken a dovish position, cautioning against rate increases. They underscore the impacts of the successive rate hikes (+4.25%) over the past 2.5yrs and the softening underlying GDP, despite robust migration figures.

Adding to the complexity, our Prime Minister, Christopher Luxon, has characterized the nation's current state as "fragile."

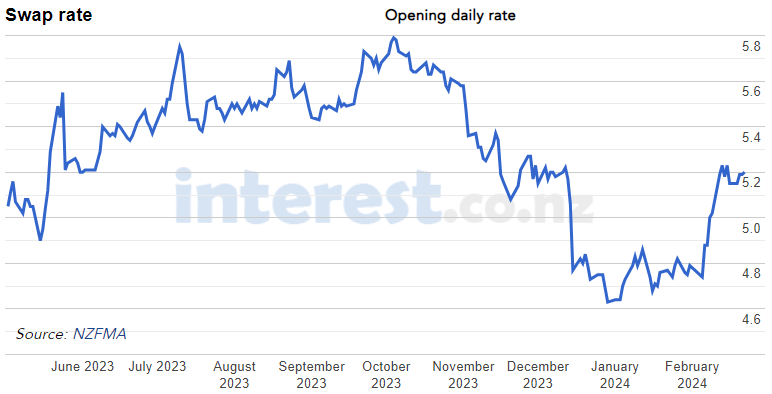

Market sentiment have been oscillating. Wholesale market funding rates experienced a -1.16% decline from 4 Oct to 29 Dec 2023, (refer to 2yr swap rate graphic). However, since then, they have rebounded, increasing +0.57%. Concurrently, retail mortgage rates have seen some reduction but not to the same extent.

Market dynamics are influenced by a plethora of factors, including local and international data releases like employment figures, inflation rates, and GDP growth. Moreover, commentary from influential figures - sometimes referred to as "jawboning" - can significantly sway market sentiment.

Ultimately, the RBNZ holds the reins, but it's far from a predetermined outcome.

If you are seeking independent guidance on your refix, restructuring, or refinancing options, reach out to adviceHQ today.

#advicehq #RBNZ #ocr #interestrates #mortgagerates

Poll: Are our Kiwi summer holidays helping us recharge, or holding the economy back? ☀️🥝

There’s growing debate about whether New Zealand’s extended Christmas break (and the slowdown that comes with it) affects productivity.

Tracy Watkins has weighed in ... now it’s your turn. What’s your take? 🤔

-

72.9% We work hard, we deserve a break!

-

16.1% Hmm, maybe?

-

11% Yes!

Celebrate in Style: Craft Your Own Decor with Testpots

Create handcrafted celebrations using Resene testpots. Find out how to create your own with these easy step by step instructions.

Aucklanders, we want to know: How are you feeling about the current property market?

New Zealand homeowners are now more likely to sell at a loss than at any time since 2013, and if you’re in Auckland or Wellington, the odds are even higher.

But there is a silver lining: buyers are still in a strong position when it comes to negotiating prices.

So we’re curious…

How are you feeling about the current property market?

If you’re keen to dive into the details, Deborah Morris breaks down all the latest insights.

Loading…

Loading…