Interest Rates: RBNZ OCR

2pm Wed 28 Feb, the RBNZ will unveil its eagerly awaited OCR decision, marking the first such announcement since 29 Nov 2023. What can we anticipate?

The RBNZ has adopted a hawkish stance, signaling potential rate hikes amidst concerns over domestic inflation - a sentiment echoed by ANZ's Chief Economist, NZ's largest bank.

Contrastingly, the majority of economists have taken a dovish position, cautioning against rate increases. They underscore the impacts of the successive rate hikes (+4.25%) over the past 2.5yrs and the softening underlying GDP, despite robust migration figures.

Adding to the complexity, our Prime Minister, Christopher Luxon, has characterized the nation's current state as "fragile."

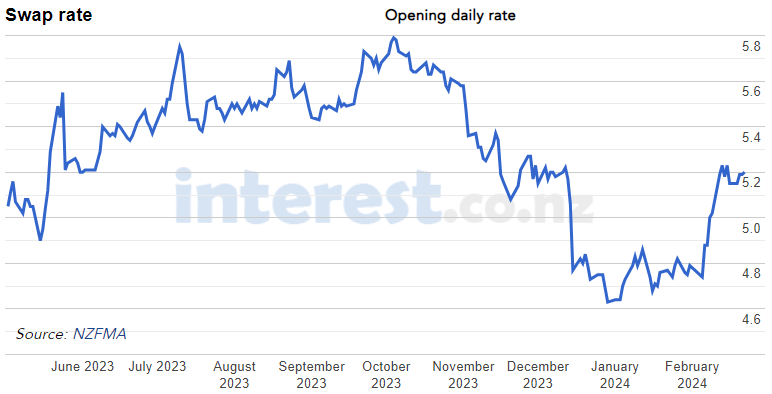

Market sentiment have been oscillating. Wholesale market funding rates experienced a -1.16% decline from 4 Oct to 29 Dec 2023, (refer to 2yr swap rate graphic). However, since then, they have rebounded, increasing +0.57%. Concurrently, retail mortgage rates have seen some reduction but not to the same extent.

Market dynamics are influenced by a plethora of factors, including local and international data releases like employment figures, inflation rates, and GDP growth. Moreover, commentary from influential figures - sometimes referred to as "jawboning" - can significantly sway market sentiment.

Ultimately, the RBNZ holds the reins, but it's far from a predetermined outcome.

If you are seeking independent guidance on your refix, restructuring, or refinancing options, reach out to adviceHQ today.

#advicehq #RBNZ #ocr #interestrates #mortgagerates

Secure your homes over summer

Police are reminding people to keep their homes secure during the summer months.

Inspector Glenda Barnaby, Christchurch Area Prevention manager, says daytime burglaries are just as common as nightime burglaries.

“Burglaries can be committed at any time of the day, and coming into warmer months there is more opportunity for thieves."

"Although a majority of burglaries involve forced entry through windows and doors, we are starting to see more incidents at insecure premises. Police deal with cases where burglaries are committed in broad daylight, sometimes even while the victim is at home. Good weather means open doors and windows, which makes homes more vulnerable to burglars.”

Inspector Barnaby says there’s a few things people can do to reduce their changes of a burglary being committed.

⚠️ If you’re going outside for gardening, relaxing in the sun, or working in the garage, take a moment to lock your doors and secure your windows first.

⚠️ Do the same at night when you go to bed - keep your doors and windows secure and close your curtains. Fitting window stays means you can get a breeze coming through, while keeping your windows secure.

⚠️ Get to know your neighbours - let them know if you’re going away and look out for one another.”

If you see any suspicious activity, people or vehicles in your neighbourhood, don't hesitate to contact Police.

If you witness or suspect any illegal activity, please call 111 if it is happening now, or make a report through 105 either online or over the phone, if it is after the fact.

Poll: Are our Kiwi summer holidays helping us recharge, or holding the economy back? ☀️🥝

There’s growing debate about whether New Zealand’s extended Christmas break (and the slowdown that comes with it) affects productivity.

Tracy Watkins has weighed in ... now it’s your turn. What’s your take? 🤔

-

72.5% We work hard, we deserve a break!

-

16.4% Hmm, maybe?

-

11.1% Yes!

Build Wealth Through Commercial Property

The First Light Property Fund Limited provides wholesale investors with exposure to six premium industrial and commercial assets located across Auckland and Hamilton.

As a tax efficient PIE-structured vehicle, the Fund is designed to deliver stable monthly returns and long-term capital appreciation. All of the commercial assets in the portfolio are NABERSNZ-accredited, enabling access to ESG-linked lending benefits.

This is an opportunity to invest in an established and high-performing commercial property Fund and participate in collective ownership alongside other experienced investors.

Loading…

Loading…