IRD Compliance for Financial Year End 31 March 2018

Diary the Due Dates from 31 March - 7 July 2018

# 31 March Final date for ratio option provisional tax applications

# 31 March Student loan repayments due for overseas-based borrowers

# 7 April Do you have a bill to pay by 7 April?

# 30 April Received your tax credit claim form for donations?

# 7 May Provisional tax instalments, student loan interim payments, GST returns and payments due

# 28 May GST returns and payments due

# 28 June Provisional tax payments for ratio option customers and GST returns and payment due

# 7 July Due date for income tax returns

____________________________________________

The 7th July 2018 is an important one - if you are behind with the preparation of your accounts or require advice - then please call or contact us:

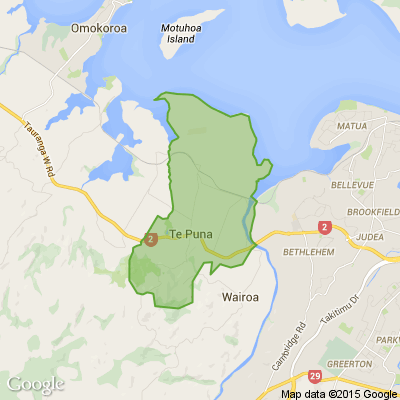

Pete at Accounting Payroll Solutions in Aongatete, today on 07 549 3593 or email: aps.accounts@xtra.co.nz for a no charge analysis of your present or starting out financial position prior to your End of Year 31st March 2018 filing of returns with the IRD.

We assure you of our careful attention.

Pete

Accounting Payroll Solutions

Neighbourhood Challenge: Who Can Crack This One? ⛓️💥❔

What has a head but no brain?

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

Want to stop seeing these in your newsfeed?

Head here and hover on the Following button on the top right of the page (and it will show Unfollow) and then click it. If it is giving you the option to Follow, then you've successfully unfollowed the Riddles page.

Possessions sold as one lot

Morning everyone 😊

I am wanting to sell our mother's possessions as one lot and not individually; ive heard there are people who do this. .

Does anyone know of someone or where I might start?

Loading…

Loading…