Avoiding the Blues at 31st March

There are a couple strategies that can help avoid the 31st March End of Year (EOY) deadline

Don’t Avoid the Problem

I’ve had several bookkeeping clients who were putting all IRD correspondence aside in its own pile, sometimes waiting months before they worked up the nerve to open and read any of it.

But the longer you wait, the harder it will become. It is always better to deal with this kind of problem head-on, with honesty and transparency. Schedule time to review any correspondence, study the issue and prepare as best you can.

Understand your obligations

You need to start preparing your business accounts towards the end of the financial year so that they’re ready for tax filing and form submission. For many businesses, it can be a busy time finishing off those dry weather jobs! Contact us for a check list at 07 549 3593.

Your assets, liabilities and equities will give you an idea of how well your business performed this year. Use your accounting software to generate visual balance sheet and Profit & Loss reports. Then identify where your business did well, and where there's room for improvement next year. If there is a problem – we can assist

Check out your income statement to see your profitability

Your income statement will list each revenue-generating item, along with your tax-deductible expenses. It's a useful way to see your profit and loss for the year.

Arrange a meeting with your bookkeeper, accountant and/or financial advisor Each of these will have work to do for your business at year end. Talk to them, and make lists of tasks that they need to carry out. This will help them focus on your business at this busy time of year.

Did you achieve everything you intended to last year? If so then great, If not, try to find out why. Making goals for the coming year can help keep you motivated as your business grows. Review them regularly to stay on track.

These few steps will help you get prepared for the year end

If this is all too much and you are behind – then now is the time to contact us for a No Obligation Chat to find out where you are at and where we can assist

-------------------------------------------------------------------------------------------------------

"assistance or advice" - then please call Pete at Accounting Payroll Solutions in Aongatete, today on 07 549 3593 or email: aps.accounts@xtra.co.nz for a no charge analysis of your present or starting out financial position prior to your End of Year 31st March 2018 filing of returns with the IRD.

Pete

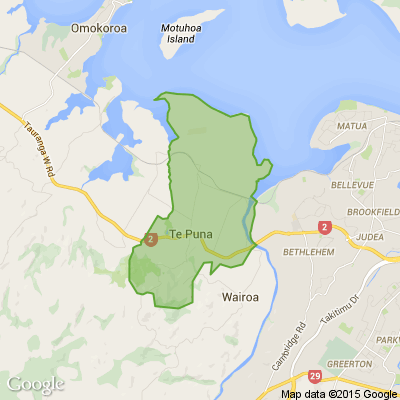

Accounting Payroll Solutions

Today’s Mind-Bender is the Last of the Year! Can You Guess It Before Everyone Else? 🌟🎁🌲

I dance in the sky with green and gold, a spectacle few are lucky to behold; I’m best seen in the south, a celestial sight—what am I, lighting up the New Zealand night?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Scam Alert: Fake information regarding December Bonuses from MSD

The Ministry of Social Development is reporting that fake information is circulating about new ‘December bonuses’ or ‘benefit increases’

If you get suspicious communication, please contact Netsafe.

Loading…

Loading…