END OF YEAR CHECK LIST for EOY 31st March 2018

If not and you are behind with your accounts – then make contact with us for a No Obligation – No Charge assessment:

• Bank accounts AND credit card accounts should be reconciled EVERY month. At year-end, your bookkeeper or accountant is going to want, at a minimum, your reconciliation for the last month in your fiscal year AND the first month in your new year. (They use it for accounts receivable and payable cut offs).

• Your accounts payable subledger should be reconciled to vendor statements. If you haven't been doing this during the year or don't receive vendor statements, call your Customers today to request one.

• If you have a bank loan, you probably have been receiving loan statements. What have you been doing with them? Hopefully you have been comparing them to your bank loan balance on your balance sheet and making any adjusting entries necessary.

• Clean up those miscellaneous over and under balances on your accounts receivable and payable reports. Review accounts outstanding more than 90 days. Your bookkeeper or accountant will to want to know if you think they are collectable.

• If you have inventory, mark your calendar to take a physical count on the last day of the fiscal year. If you have a periodic inventory system,

• Reconcile your payroll account(s). Make sure they match what you have reported and remitted to IRD. IIf there are discrepancies, have an analysis that explains them.

• GST – If registered - are you up to date with your One or Two Month Returns. If there are discrepancies, have an analysis prepared explaining them.

• Take a look at how you handled any reimbursement of expenses. IRD requires they be recorded as income and NOT netted against the expense.

• All in all we can assist if you have a worry or two and somehow ended up behind due to pressure of work

---------------------------------------------------------------------------------------------

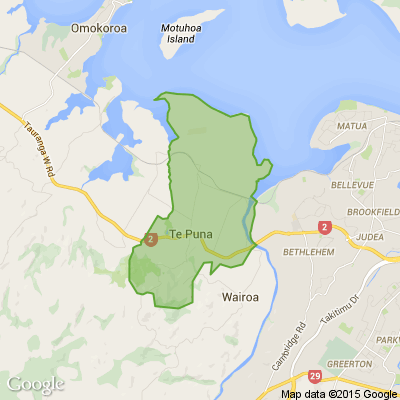

"assistance or advice" - then please call Pete at Accounting Payroll Solutions in Aongatete, today on 07 549 3593 or email: aps.accounts@xtra.co.nz for a no charge analysis of your present or starting out financial position prior to your End of Year 31st March 2018 filing of returns with the IRD.

Pete

Accounting Payroll Solutions

Today’s Mind-Bender is the Last of the Year! Can You Guess It Before Everyone Else? 🌟🎁🌲

I dance in the sky with green and gold, a spectacle few are lucky to behold; I’m best seen in the south, a celestial sight—what am I, lighting up the New Zealand night?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Scam Alert: Fake information regarding December Bonuses from MSD

The Ministry of Social Development is reporting that fake information is circulating about new ‘December bonuses’ or ‘benefit increases’

If you get suspicious communication, please contact Netsafe.

Loading…

Loading…