Financial Statements - End of Year Accounts - IRD - 31st March 2018

The end of financial year is nearly here!

Tax returns will be due by July 2018

Here are some reminders and tips to help you:

What if your pay spans 31 March? Your final pay for the year is determined by the Payment date. If this date is on or before 31 March, the pay falls into the current payroll year. If it's on or after 1 April, the pay falls into the new payroll year.

Do you have inventory?

Reconciling and reviewing your company file data is crucial at the end of the financial year - you want everything to balance! All the checking, comparing and looking for inconsistencies is done for you.

* Reconcile your Bank Accounts

* Depreciate your assets

* Journal your personal transactions

* Prepare Profit & Loss, Balance Sheet & Trial Balance

* Prepare and file your IRD Returns applicable to your business and personal incomes from rentals etc

___________________________________________________________________________________________________________

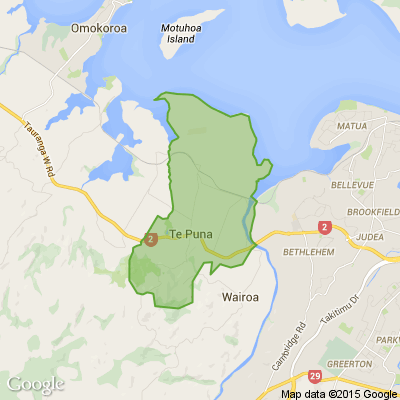

Do you require assistance or advice - then please call Pete at Accounting Payroll Solutions in Aongatete, today on 07 549 3593 or email: aps.accounts@xtra.co.nz for a no charge analysis of your present or starting out financial position prior to your End of Year 31st March 2018 filing of returns with the IRD.

Pete

Accounting Payroll Solutions

Today’s Mind-Bender is the Last of the Year! Can You Guess It Before Everyone Else? 🌟🎁🌲

I dance in the sky with green and gold, a spectacle few are lucky to behold; I’m best seen in the south, a celestial sight—what am I, lighting up the New Zealand night?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Scam Alert: Fake information regarding December Bonuses from MSD

The Ministry of Social Development is reporting that fake information is circulating about new ‘December bonuses’ or ‘benefit increases’

If you get suspicious communication, please contact Netsafe.

Loading…

Loading…