Setting and achieving your financials goals.

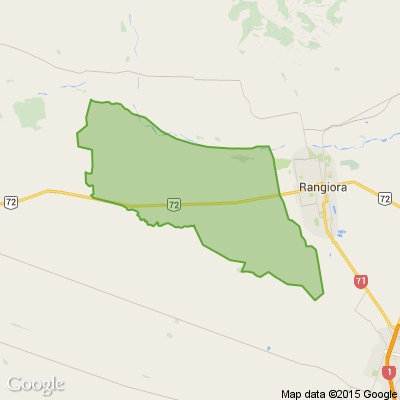

In August 1979, almost 46 years ago, our service was established in Rangiora.

Since then our service has been at the heart of the communities of the Waimakariri and Hurunui. Our free service is available to all New Zealanders.

Our passion is in advising and mentoring individuals, and their families, in creating and maintaining a sustainable budget.

Our wraparound support agencies are just a phone call away. We often refer clients to local support agencies who are better placed to deal with depression, addictions, housing needs, transport issues etc.

However, we’re very good at just listening and holding your hand….especially when you’re having a wobbly moment.

Not knowing where your money is going to and not being able to manage or service your debt (big or small) can be very stressful. Without judgement, our trained, professional Financial Mentors will help and guide you through the process.

Would you like some assistance with any of the following?

•Create a sustainable budget, set realistic and achievable goals. Turning dreams into reality?

•WOFF – Warrant of Financial Fitness – a review of your budget and general advice.

Maybe there are simple ways you could trim your spending or increase your income. Two pairs of eyes are better than one. A huge “well done” if you’re totally on top of it all!

•Compiling a Debts Schedule and a Cashflow will give you a better understanding of your payments and commitments. Knowing (who and what you owe) is better than wondering and stressing because you can’t remember it all.

•A free Credit Check will be another tool we’ll explain to you.

•Learning about Buy Now, Pay Later schemes - the good and the bad. Can you make it work for you?

•Advocacy is an area in which we excel. If you’re having challenging times communicating with various agencies, we will provide the necessary guidance and support. We’ll accompany you to any of the local agencies e.g. W&I.

In any instance, if a deadlock is reached, we will, with your permission, approach the relevant authority or Ombudsman for their assistance.

oMSD/Work & Income

oBanks

oCreditors etc. etc. etc.

oKiwisaver Hardship Withdrawals, Good Shepherd Loans, No Asset Procedures, Debt Repayment Orders, Bankruptcy – After completing a budget worksheet and debt schedule, and, if there are no other options suitable for your situation, we will help you to complete the application.

If you need help with insolvency documents or want to understand your consumer rights, our team of Financial Mentors have the expertise to help you improve your situation.

Sharon Grant, Service Manager of BSNC says: “It’s a real privilege to be able to support families to improve their financial wellbeing. We have received wonderful feedback from people delighted to finally repay long-term debts and who are now able to save for the first time in their lives. Talk to us about your situation, we’d be glad to help you to budget better.”

Phone or email to talk about your situation:

03 315 3505 or email: servicemanager@bsnc.org.nz

We’re on Facebook and www.bsnc.org.nz...

Our office is in the War Memorial Hall, 1 Albert Street, Rangiora.

Poll: Should we be giving the green light to new mining projects? 💰🌲

The Environmental Protection Authority announced this week that a proposed mine in Central Otago (near Cromwell) is about to enter its fast-track assessment process. A final decision could come within six months, and if it’s approved, construction might start as early as mid-2026.

We want to know: Should mining projects like this move ahead?

Keen to dig deeper? Mike White has the scoop.

-

53.2% Yes

-

46.8% No

Family Friendly Service and Discussion

Family-friendly monthly service - Sunday, 7 December - at the Ashley Community Church. The gathering will start at 3.30 pm with a shared afternoon tea. Remember to bring something to share!

Remember to go before you come as there is no toilet on site.

Enquiries to Paul or Lesley, Ph 021 140 2074

39 Canterbury St, Ashley.

‘Tis the season to not get scammed ...

As Christmas gift shopping moves increasingly online, scammers are ramping up their activity across the country.

Dunedin’s Investigation Support Unit is seeing more and more people fall victim to scams and other fraudulent activity, particularly on Facebook Marketplace.

There are a few ways to avoid the scams and keep yourself safe doing online trades this holiday season, says Southern District Service Delivery Manager Senior Sergeant Dalton.

🔒 “A good first step when looking to purchase something on Marketplace is to check when the seller’s Facebook profile was created. If it’s very recent, there is a higher risk that they have just created this account for a one-off fake item.”

🔒 Another important step is to make sure the seller’s profile name and bank account name match up. “We’re seeing a lot of scammers claiming their bank account name is different because it belongs to their partner or family member - that’s a huge red flag."

🔒 “When you’re selling, never trust a screenshot anyone sends you showing that payment has been made. Check your own bank account to make sure a payment has gone through."

🔒 “Quite frankly, it’s best for all parties to agree to pay, or be paid, for items in cash and in-person. Ideally in a public place with CCTV coverage."

🔒 "If you’re buying a car, check Carjam.co.nz to see if it’s stolen or if there’s money owed on it.”

A reminder: Suspicious activity can be reported on 105

Loading…

Loading…