Plan forcing developers to pay for affordable housing met with overwhelming opposition

From reporter Debbie Jamieson:

Queenstown and Wānaka developers have signalled overwhelming opposition to a plan which would force them to contribute to community housing.

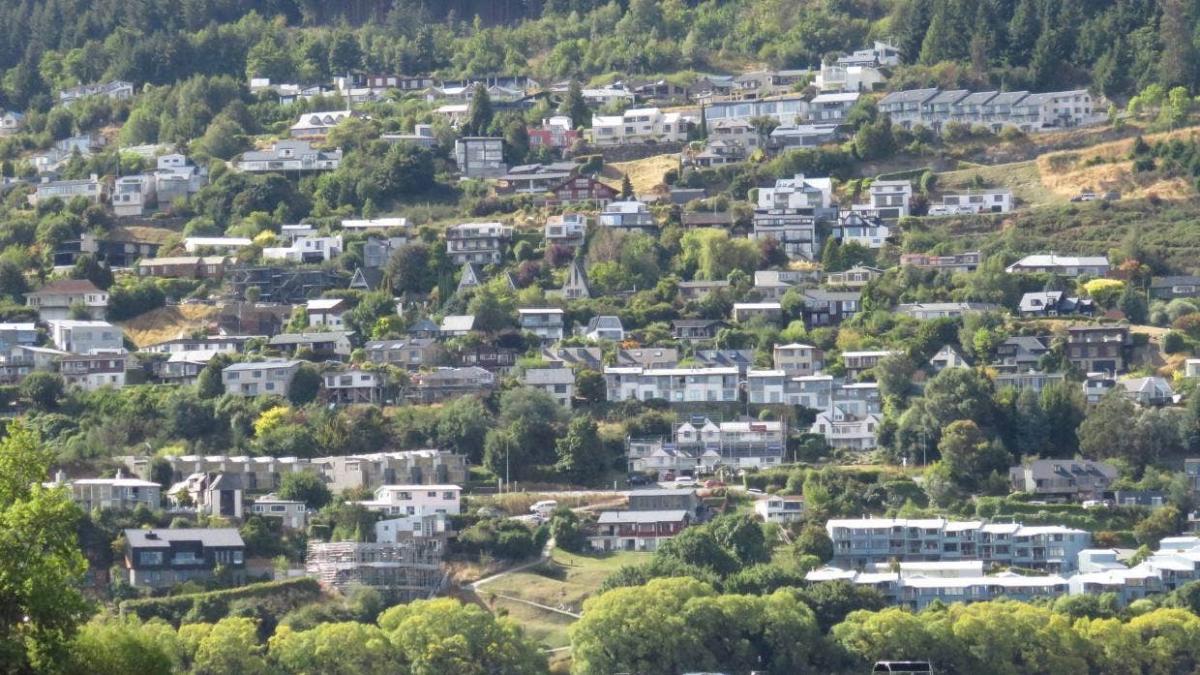

The Queenstown Lakes District is in the midst of a housing crisis with desperately-needed workers and families leaving town because they cannot find suitable accommodation.

To increase the supply of affordable housing the Queenstown Lakes District Council is proposing to require most new residential subdivisions and developments to pay a financial contribution of 5%.

It would be collected by the council and provided to Queenstown Lakes Community Housing Trust (QLCHT) or another community housing provider.

Known as “inclusionary zoning”, it has already been used on a voluntary basis by the council with developments such as Jacks Point and Shotover Country contributing.

Under the Housing Accords and Special Housing Areas Act developers were required to pay contributions of up to 12.5% in the district. The Act has since been repealed.

About half of the 181 submissions received on the district plan change proposal were from developers opposing the rules.

Many of the submissions are duplicates from law firms or planners, representing the likes of Wānaka developers Infinity Investment Group and film developers Silverlight Studios, Glendhu Station Properties Ltd, Henley Downs Land Holdings, and the Jacks Point developers.

They argue the plan is unlawful and unreasonable and will not increase affordability.

Centuria Property Holdco Ltd, the group behind the $1 billion fast-tracked Lakeview/Taumata development in central Queenstown, is also opposed.

Developers Winton want it to be rejected claiming the proposal is outside the scope of the council’s role under the Resource Management Act and that council evidence is flawed.

Many individuals stood alongside the developers, concerned the proposal would lead to the cost of land rising.

“We struggled to afford our current property and with the continuing cost of living crisis cannot afford an additional levy to now pay for someone else's property too,” Robert Haydon, of Wānaka, wrote.

Christoffel Beukman, of Wānaka, said the proposal would result in a downgrading of housing stock and value and lead to an increase in antisocial and criminal behaviour.

It would make the area attractive to people who would otherwise not be able to afford housing in the district, she said.

Many saw it as another tax, or disagreed on principle.

Queenstown man Tony Strain said it was the worst of all the “dumb ideas” the council had come up with.

“Why should landowners and developers subsidise the tourist industry which has been built on low wages and will benefit the most from cheap housing?” he said

Some were concerned that small landowners would have to contribute also.

However, the Queenstown Lakes Community Housing Trust has submitted that exemptions be put in place for already existing lots where only one residential unit was to be erected, or less than three lots created.

The trust had more than 800 households on the trust’s waiting list, in an area where the median house price in September was 15.6 times the median household income, compared to 8.1 times nationally.

Former mayor Jim Boult was among a handful of supporters for the plan.

He said Queenstown could be like other tourism towns around the world where most workers were commuters.

However, it was an inclusive community where the children of billionaires attended school alongside the children of supermarket workers, he said.

The inclusionary zoning tool was vital if the community was to make housing at least reasonably affordable for most, he said.

He acknowledged there was an offset to others buying property, but said it had not proven an inhibiting factor under HAASHA legislation.

The plan was supported by other housing trusts from around New Zealand.

Scam Alert: Fake information regarding December Bonuses from MSD

The Ministry of Social Development is reporting that fake information is circulating about new ‘December bonuses’ or ‘benefit increases’

If you get suspicious communication, please contact Netsafe.

Today’s Mind-Bender is the Last of the Year! Can You Guess It Before Everyone Else? 🌟🎁🌲

I dance in the sky with green and gold, a spectacle few are lucky to behold; I’m best seen in the south, a celestial sight—what am I, lighting up the New Zealand night?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Loading…

Loading…