Thinking of living in a retirement village?

The Commission for Financial Capability (CFFC) is running a free seminar in Christchurch on Tuesday, April 2, about the financial implications of moving into a retirement village, with support from the Retirement Villages Association and experienced legal practitioners.

Speakers from the CFFC, Retirement Village Association and the legal profession (if available), will discuss types of retirement villages, the costs of moving into and living in them, and how they operate. The seminar will also explain some important residents' rights and where you can find out more information.

The seminar is 90 minutes long and will include question and answer time.

Tea, coffee and light refreshments are provided.

Places are limited and while attendance is free, registering is essential.

Please register by clicking on the link below:

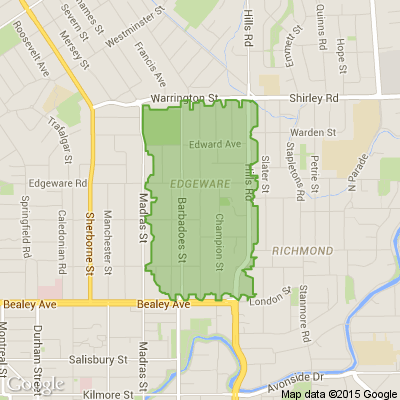

Neighbourhood Challenge: Who Can Crack This One? ⛓️💥❔

What has a head but no brain?

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

Want to stop seeing these in your newsfeed?

Head here and hover on the Following button on the top right of the page (and it will show Unfollow) and then click it. If it is giving you the option to Follow, then you've successfully unfollowed the Riddles page.

Some Choice News!

Many New Zealand gardens aren’t seeing as many monarch butterflies fluttering around their swan plants and flower beds these days — the hungry Asian paper wasp has been taking its toll.

Thanks to people like Alan Baldick, who’s made it his mission to protect the monarch, his neighbours still get to enjoy these beautiful butterflies in their own backyards.

Thinking about planting something to invite more butterflies, bees, and birds into your garden?

Thanks for your mahi, Alan! We hope this brings a smile!

Loading…

Loading…