National's ACTUAL tax proposal 31 Aug. (not the spin).

Quote: “A couple, without children, earning üp to $120k PA” (ie $119,999 PA jointly or $60k each) would get an extra $100 per fortnight”.

It's actually only $60.76 /fn !! That's a $1020 pa “HOLE”. (Here's the maths.)

Existing Thresholds

First $14,000 @ 10.5% =$1470

Then $34,000 (to $48,000) @ 17.5% =$5950

Then $12,000 (to $60,000) @ 30% = $3600

Total Tax paid each =$11,020

National's, proposal

First $15,600 @ 10.5% =$1638

Then $37,900 (to $53,500) @ 17.5% = $6632

Then $6500 (to $60,000) @ 30% = $1950

Total Tax paid each =$10,220

ACTUAL SAVINGS =$800PA (each $30.76/fortnight) or $61.53/fn for a couple - NOT $100

“A superannuant couple ($22,869ea X 2) up to $26 boost “ It's ACTUALLY only $8.61 /fn !! That's a $452 pa “HOLE” !

Existing Thresholds

First $14,000 @ 10.5% =$1470

Then $8869 @ 17.5% =$1552

Total Tax paid each =$3022

National's, proposal

First $15,600 @ 10.5% =$1638

Then $7269 @ 17.5% = $1272

Total Tax paid each =$2910

ACTUAL SAVINGS =$112 PA (each $4.30/fortnight) or $8.61/fn for a couple. NOT $26.

When you think about the cuts (austerity) that will be needed. It's actually pretty underwhelming and insulting.

Create a Stunning Stain Feature Wall with Resene Colorwood

Transform your living room into a work of art with Resene Colorwood wood stains. Find out how to create your own stain feature wall with these easy step by step instructions.

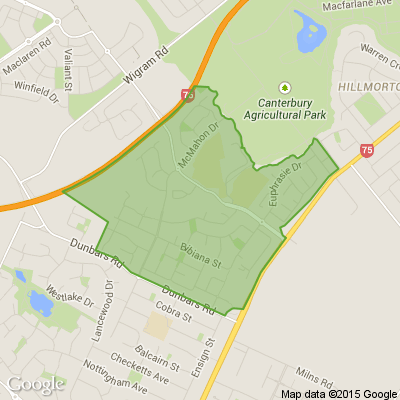

Poll: Are you starting to feel a lift in business confidence across the Canterbury region?

The Press reports that Canterbury is right in the middle of a construction boom, with activity forecast to peak around 2027 and major investment flowing into transport, water and energy infrastructure.

We want to know: Are you starting to feel a lift in business confidence across the Canterbury region?

-

40% Yes

-

60% No

Loading…

Loading…