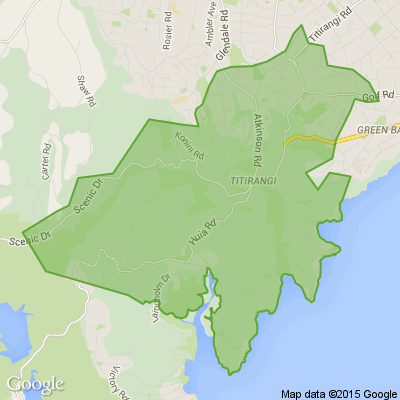

Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

See a link that looks suspicious? Don’t click it.

Verify the sender or website before opening. Say something: Let your community know about active scams.

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

Brian from New Lynn

What's gone live in 2019

====================

With the holiday season upon us here is a brief summary of the changes that have gone live this year.

Short-process rulings

==================

You can now apply for a short-process ruling. This is a new way to get a binding ruling on how a … View moreWhat's gone live in 2019

====================

With the holiday season upon us here is a brief summary of the changes that have gone live this year.

Short-process rulings

==================

You can now apply for a short-process ruling. This is a new way to get a binding ruling on how a tax law applies to a situation. It’s quicker and less expensive than private rulings, which means that more people can get certainty on how tax rules apply to them.

For more information, check out our website: ird.govt.nz/SPR

Ring-fencing rental losses

=====================

New rules apply from the start of the 2019-2020 income year. You will no longer be able to reduce your tax liability by offsetting residential rental property deductions against your other income, such as salary or wages, or business income.

For more information, check out our website: ird.govt.nz/ring-fencing

Investment income

================

Payers of investment income can opt into the new investment income reporting requirements. These will be mandatory from 1 April 2020.

For more information, check out our website: ird.govt.nz/investment-income

Research and Development Tax Incentive

==================================

The Research and Development Tax Incentive is available for the 2019-2020 income year and features a 15% tax credit on up to $120 million of eligible expenditure. You can enrol now. Use the eligibility tool and guidance on our website to find out if your R&D activities meet the incentive criteria.

For more information, check out our website: ird.govt.nz/rd-tax-incentive

KiwiSaver changes

================

There are two new KiwiSaver contribution rate options for members, who can now contribute 6% or 10%.

For more information, check out our website: ird.govt.nz/kiwisaver-individuals

Register for Inland Revenue's webinars

================================

In 2020 we’ll continue our series of tailored webinars to help you prepare for the upcoming tax changes. Our next session is on 22 January 2020 from 2:30pm – 3:30pm when we’ll share more information on:

Working for Families Tax Credit changes

Research & development tax incentive changes

Short-process rulings

Ring-fencing rental losses changes

Income equalisation

Moving on from cheques

======================================

To learn more about our future sessions or to view previous webinars on demand, visit our website: ird.govt.nz/webinars. You will also find questions and answers from previous webinars.

======================================

Research & Development Tax Incentive: preparing for your end of year returns

Businesses wishing to claim the Research & Development Tax Incentive (RDTI) must first enrol through myIR.

To claim for the 2019-2020 income year you will need to:

===============================================

complete an R&D supplementary return electronically

include the value of the tax credit you are claiming in your income tax return, which you will also need to file electronically

file your R&D supplementary return and income tax return by the required dates.

You can do this yourself or ask your tax agent to do it on your behalf.

====================================

The supplementary return is specific to the R&D Tax Incentive. It will be available to enrolled customers through their myIR account and will be visible after the end of their income year. ??To help you prepare, we’ve created a PDF showing the questions you’ll need to answer and the format. ?You can find this PDF on our website.

New Inland Revenue Tax Technical website coming in early 2020

=======================================

To help people find tax technical answers more quickly, we’re building a new Tax Technical website. The new site will be available on, but will operate separately from, the main Inland Revenue site.

==========================================

We’re improving the site in stages throughout 2020, with the first release planned for early 2020. This first release will make it easier to browse and search our tax technical publications, public consultations, and the Tax Information Bulletin (TIB).

==========================================

In the months that follow this first release, we will add more features, including:

The ability to browse for keywords e.g. motor vehicles, depreciation rates

Filters to narrow your results

Better linking between publications and to other websites

Better interlinking of TIB issues and their individual publications.

============================================

The development of a new and improved Tax Technical website follows on from our work to modernise the Inland Revenue website over the past year.

======================

No cheques from 1 March

======================

A friendly reminder that from 1 March 2020 we will stop accepting payment by cheque, including cheques dated after 1 March 2020.

There are several payment methods offered by us and the banks.

==============================================

Pay online through your bank

You can make payments to us through your bank’s online banking facilities. This can be fast, easy, secure and you can set your payment for a future date.

Pay online in myIR

=================

You can make payments to us in your myIR account with your credit or debit card. You can also set up a direct debit and select the date of the payment.

We recognise that online payments may not suit everyone. The following options are also available.

===================================

Automatic payment authority form (IR586)

You can set up an automatic payment from your bank account to us using our automatic payment authority form:

Complete the form and give it to your bank

Most suitable for fixed or regular payments, such as debt or arrears

Allows for two signatures

Available on our website, or we can post it to you on request.

Please speak to your bank about processing times for automatic payments.

Cash or Eftpos at Westpac

======================

You can make cash or Eftpos payments to us at a Westpac branch. Remember to bring your barcode to ensure the payment can be correctly allocated.

We encourage you to speak with your bank or a tax professional to help you find the best payment method for you.

For more information on these payment methods visit ird.govt.nz/cheques.

=================

Holiday office hours

=================

Our offices will close at 2pm on Tuesday 24 December and will reopen on Monday 6 January.

==========================================================

Todd Niall Reporter from Auckland Stuff

Hi Neighbours, Are you in the city for New Year's Eve? Auckland is putting on it's biggest-ever downtown event, a forerunner of how it hopes to launch America's Cup year 2021. Does this sound like you ? Read the story below :

The Team from Auckland Council

If you see dumped rubbish call 0800 NO DUMP (0800 663 867).

Dumpers will be fined up to $30,000.

Your waste is your responsibility. For more information on how to dispose of unwanted items check out aucklandcouncil.govt.nz

Find out more

Dorothy from Glen Eden

Great Christmas Gifts, all hand made - Terrariums, Jewellery, herbs etc at G.A.S station- (next to McDonalds) Lincoln Road, Henderson. Prices on the photos.

Negotiable

New Zealand School of Food & Wine

Celia Hay & all of us at the New Zealand School of Food and Wine wish you a very merry Christmas and restful holiday season. Enjoy lots of delicious food at home.

At NumberWorks'nWords we will give your child the tools and strategies that work for them.

...and get back to summer.

This summer you can report anything or find advice online and it’s quick and easy to do.

Simply go to 105.police.govt.nz and get back to the barbeque.

Find out more

Pearly from Glen Eden

Hi,

Very good deal, 11 used bags, free for pickup, some are in excellent conditions, must pick up the whole lot please:)

Free

Brian from New Lynn

With just five days to go until Christmas, it is no surprise New Zealand's malls are flooded with people, with this week tipped to be the busiest of the year. Scentre Group, which operates St Lukes, Albany, Newmarket, Riccarton and Manukau Westfield shopping malls, says record numbers of … View moreWith just five days to go until Christmas, it is no surprise New Zealand's malls are flooded with people, with this week tipped to be the busiest of the year. Scentre Group, which operates St Lukes, Albany, Newmarket, Riccarton and Manukau Westfield shopping malls, says record numbers of shoppers have been through its centres this week, with foot traffic set to exceed forecasts. Westfield says "multiple tens of thousands" of people have already been through each of its centres, with the weekend expected to bring in further "record numbers". Paul Gardner, regional manager for Scentre Group, has visited each of the ASX-listed mall operator's New Zealand centres this week. He says all have been in similar states of crazy. "It certainly feels busier than ever," Gardner told. As Gardner puts it, there's only one place busier than Westfield Newmarket in Auckland right now, and in the month of December, and that's Auckland Airport. Carparks are scarce and the loading docks at Westfield Newmarket are humming, while supermarkets continue to restock their shelves. Westfield malls had been bustling with shoppers ever since Black Friday. In previous years there would often be a week of respite between the typically busy Black Friday week and the seven to 10 days before Christmas, but this was not the case this year, Gardner said. "We had a record Black Friday and it didn't stop in the week after, with Cyber Monday onwards. In previous years it went into a bit of a lull for a week or so, but that hasn't happened." Paymark figures show transactions in the month of December are up about 50 per cent, Gardner said that was inline with what the mall operator had experienced this month. "It feels busier in proportion with the number of transactions." Gardner expects Saturday to be the busiest trading day of year for Westfield, while Kiwi Property, which operates New Zealand's largest mall, Sylvia Park, expects Sunday at noon to be its busiest, based on shopper activity last year. Talking about Christmas shopping trends at Westfield St. Lukes. Westfield centres throughout the country have extended their hours or trade until 10pm this week and will be open until midnight on Saturday, Sunday and Monday, as has Auckland-based Sylvia Park. Gardner said the extended trading hours had been in response to activity in the centres in the lead up to Christmas last year. "Three consecutive midnights is the heaviest we've been." Retailers and malls have an extra day of Christmas trade this year, with Monday being the day before Christmas Eve and Christmas falling mid-week. "It is perfectly set up this year - this is probably the best possible scenario because it means you get the whole weekend [of trade] and the Monday and Tuesday as well. I think it will line up for a bumper year, partly because of Christmas landing in the middle of the week." With Black Friday proven to have been a record and foot traffic being un-relentless, the indicators implied the Christmas trading period would be a record, Gardner said.

He said shoppers seemed to be positive and happy, which often translated into more spending, he said.

Paymark figures show spending in the last seven days before Christmas rises to be 50 per cent more than the average week spread across the year. Spending at department stores, recreational goods and liquor stores and clothing outlets doubles in the lead-up to Christmas. Shoppers spent $6.4 billion in the first seven days of December, according to figures from Paymark, which processes 75 per cent of the country's electronic transactions. Jacquie Johnson, centre manager of Westfield St Lukes, told NZ Focus Live that gift cards seemed to be a popular choice for shoppers this Christmas. Johnson said it was "pandemonium" at St Lukes - just how the mall liked it at this time of the year. Drones had proven popular gifts this Christmas among parents, along with phones and electronics for teenagers. Skateboards and unicorns had proven popular gifts among children this year, as were books and Harry Potter-related merchandise, she said.

=========================================================

The Team from Blueberry Country Ltd.

How creative can you get with blueberries? From cakes, to smoothies, salads, glazes and more - Blueberry Country wants to know your favourite recipe!

Simply send us your recipe with an image of what you've made, and you'll go in the draw to win a $50 Briscoes voucher. Competition ends … View moreHow creative can you get with blueberries? From cakes, to smoothies, salads, glazes and more - Blueberry Country wants to know your favourite recipe!

Simply send us your recipe with an image of what you've made, and you'll go in the draw to win a $50 Briscoes voucher. Competition ends on the February 12, with winners announced on February 14. Go in the draw.

Enter now

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

© Neighbourly 2025