Banks have introduced new fraud protections as Kiwis lose millions to scammers

Banks must reimburse fraud victims up to $500,000 and introduce new scam prevention measures.

The changes include technology to identify risky transactions and the ability to freeze suspect accounts.

Compensation applies if banks fail to meet prevention commitments, with the new rules effective from November.

=====================================================

Banks will be required to reimburse fraud victims up to $500,000 and introduce new rules to crack down on scammers in a suite of measures unveiled today.

The changes include new technology to identify risky or unusual transactions based on a customer’s banking history and the ability to freeze payments and suspect accounts.

The moves are in response to Government demands to improve customer protections or be regulated in the face of Kiwi victims losing hundreds of millions of dollars to scammers each year.

The Herald has been campaigning for new safeguards to protect victims, highlighting dozens of cases in which Kiwis were tricked into losing their life savings through elaborate investment scams – many involving local “money mule” accounts.

Advocates have repeatedly warned that New Zealand was lagging behind other jurisdictions in terms of consumer safeguards. Today’s announcements aim to bring us into line with the likes of the UK.

The New Zealand Banking Association says it is rolling out a package of new protections in line with international best practice, which will be in place by November.

They include:

===========

A confirmation of payee service for customers to check that the name of the person they are paying matches the account number. Rollout of this has already commenced.

Pre-transaction warnings to consumers based on the payment purpose, for instance, higher-risk investments.

Identification of high-risk transactions or unusual account transaction activity, and the ability to block or delay payments.

A 24/7 reporting channel for customers who think they’ve been scammed.

Sharing scammer or “mule” account information with other banks to help prevent criminal activity, and freezing funds where appropriate.

New fraud reimbursement rules would also see victims who were tricked into authorising payments to fraudsters reimbursed up to $500,000, provided they met certain criteria.

The compensation would not apply to international money transfers, third-party payment services or purchases on social media.

Compensation would only apply if a bank failed to meet the new scam prevention commitments outlined above.

A decision on whether victims were compensated would also depend on whether they had taken “reasonable care” when making payments.

In the UK, the test is a much higher bar of “gross negligence”.

Association chief executive Roger Beaumont said scam prevention was the best way to protect consumers from scam losses. The new measures were a huge step up in the fight against online fraud.

“Banks already do a lot to identify and help prevent scams, and these new measures will enhance tech solutions to help protect customers from increasingly sophisticated scams.”

The new rules and policies are being written into the Code of Banking Practice, which will go live on November 30.

This means the Banking Ombudsman will be able to hold banks to account against the new code and determine if compensation should be awarded to complainants.

‘Important win for bank customers’

============================

Commerce and Consumer Affairs Minister Scott Simpson said banks had responded to the Government’s expectation to better protect consumers by introducing stronger safeguards and a compensation scheme.

“New commitments from banks mean that if a bank fails to adequately warn and protect a consumer from a scam, they will reimburse the victim up to $500,000.

“This is an important win for bank customers, who have been advocating for some time for better recognition from banks of the role they play as the final gate between a consumer and a scammer.”

The Government wrote to banks last year demanding improvements to protect customers, threatening regulation if the sector did not bring in voluntary measures.

Simpson said scams caused immense harm to the economy as consumers lost confidence in transacting online.

“While people still need to remain vigilant and take responsibility for their own online safety, these changes will enable consumers to check a payment is legitimate before transferring money.

“I have been clear with banks that the journey doesn’t stop here. I expect banks to continue to prioritise security and adapt to the ever-evolving scams environment.”

‘Emotional and financial cost of scams’

================================

Banking Ombudsman Nicola Sladden said her office had been calling for stronger consumer protections. While the new measures were welcome, the “devil is often in the detail”.

“We see firsthand the emotional and financial cost of scams. Beyond the monetary impact, victims endure the distress of being deceived, leading to a loss of confidence to operate online.

“Consumers are doing more and more online, making it increasingly vital they have a safe digital environment in which to make payments and transfer money.”

Confirmation of payee was an obvious way to fight back against scammers, Sladden said.

Other initiatives like greater sharing of intelligence, improved fraud detection systems and warnings for high-risk transactions would also help keep Kiwis safe.

Reimbursement scheme comes with caveats

====================================

Consumer NZ chief executive Jon Duffy has been a vocal critic of lax bank scam protections.

He said many of the measures announced today were already common overseas, which meant NZ banks had until now failed to respond adequately to increased scam activity.

The progress was welcome, but bank customers should note the new measures did not guarantee reimbursement if they were scammed, Duffy said.

“Banks will not be liable if they make reasonable efforts to alert a customer to risks. Customers will need to pay attention to warnings from their bank about risky transactions and be cautious if confirmation of payee checks return ‘no match’.

“Consumers should also note that protections do not apply to purchases made on social media or online marketplaces like Facebook Marketplace.”

=============================================================

WOOLWORTHS REWARDS CARD

To the lovely man who kindly let me use his Woolworths rewards card - I was buying brandy snaps etc can you please message me, thank you very much.

You made a comment you'll be asked why you are buying brandy snaps.

Estelle

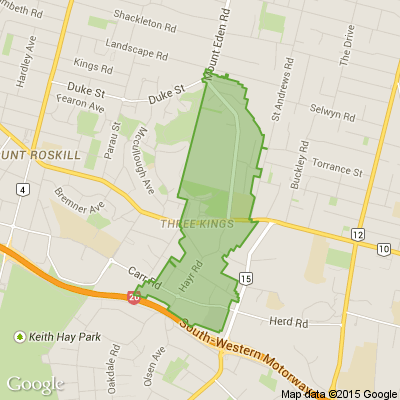

Poll: 🗑️ Would you be keen to switch to a fortnightly rubbish collection, or do you prefer things as they are?

Aucklanders, our weekly rubbish collections are staying after councillors voted to scrap a proposed trial of fortnightly pick-ups.

We want to hear from you: would you be keen to switch to a fortnightly rubbish collection, or do you prefer things as they are?

Keen for the details? Read up about the scrapped collection trial here.

-

85.1% Same!

-

14.9% Would have liked to try something different

Loading…

Loading…