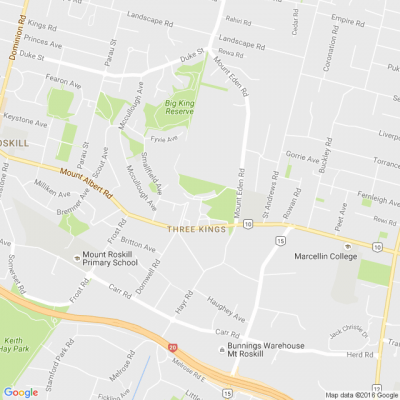

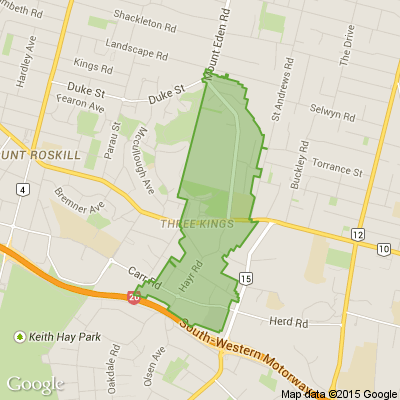

Find a Retirement Village in New Zealand

Ryman Healthcare offers the very best of retirement living and aged care with retirement villages throughout New Zealand. You'll find Ryman retirement villages near you, each with a unique personality and a range of living and care options. Gain a lifestyle you can thrive in and connect with like-minded people in a welcoming community.

In addition to independent and assisted living, Ryman villages offer a range of care options. Depending on the village, the levels of care we provide include rest home, hospital, specialist dementia care, and respite care. In some instances we may also be able to offer rest home care in an assisted-living apartment. This option enables you to remain in your own apartment but with a little extra support.

Click read more for the full article.

Neighbourhood Challenge: Who Can Crack This One? ⛓️💥❔

What has a head but no brain?

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

Want to stop seeing these in your newsfeed?

Head here and hover on the Following button on the top right of the page (and it will show Unfollow) and then click it. If it is giving you the option to Follow, then you've successfully unfollowed the Riddles page.

Some Choice News!

Many New Zealand gardens aren’t seeing as many monarch butterflies fluttering around their swan plants and flower beds these days — the hungry Asian paper wasp has been taking its toll.

Thanks to people like Alan Baldick, who’s made it his mission to protect the monarch, his neighbours still get to enjoy these beautiful butterflies in their own backyards.

Thinking about planting something to invite more butterflies, bees, and birds into your garden?

Thanks for your mahi, Alan! We hope this brings a smile!

Loading…

Loading…