Auckland's filthiest restaurants revealed by council

In Auckland Council's latest list of D grade food outlets, from last September to January this year, 41 shops received a D grade while two were forced to close temporarily after being issued E grades.

Breaches included poor cleaning and food safety preparation, hygiene and storage, deficient temperature controls, poor maintenance of equipment and facilities, and pests.

According to the council, a food grade certificate gives customers assurance that food they buy is safe and suitable to eat, and that the outlet meets quality and hygiene requirements under the Food Act.

An A, B or C grade means an outlet provides a level of confidence that the food it sells is safe.

D and E grades require enforcement by food inspectors, meaning a wide range of issues need to be rectified.

E ratings are given for critical risks, such as an out-of-control pest infestation or an absolutely filthy kitchen.

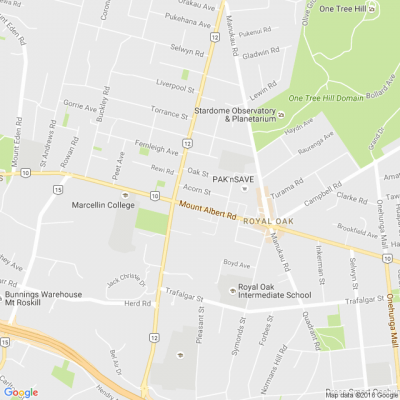

Central Auckland recorded the most D grade restaurants in the region with 13 shops identified with breaches, while south Auckland had 12.

Seven food shops in East Auckland were marked D grades, with five in the west, and four in the north.

Glen Innes Bakery and Cafe, Vanilla Plant Based Kitchen in Howick, Ak's Bakery in Mt Wellington, Dedwood Deli in Ponsonby, Manna Kitchen Onehunga, The Meat Hut in Massey, Gangnam Style Korean BBQ in Takapuna, Glen Eden Takeaways, 932 Mt Albert BBQ Noodle House, Mt Albert BBQ Noodle House and Hot and Spicy Pot East Tamaki all had pests.

Of the 41 shops that were issued with a D grade, 35 were reissued with A grades after rectifying breaches.

E grades were issued to United Coffee Nation on Victoria St West in Auckland Central, and Songket Malaysian Cafe at Kilham Ave, Northcote.

Both food outlets have been issued a D grade since, and allowed to operate.

South Auckland councillor Alf Filipina said customers deserved better, and eating at places that were clean was the bare minimum.

"The good thing about these inspections is that it's catching them out and taking them to task for not complying," Filipaina said.

"Once cockroaches or pests are identified, they're shut down and told to fumigate and prove that they can reopen again."

He said it was a shame that some owners have let their shops go.

"This is where people go to buy their food, and eat. The ones that are being shut down for cockroaches and pests, those are the ones that need to be highlighted.

"It's not just about the food, it's about cleanliness of the premises they walk into, customers expect that and its shop owners responsibility to make sure the cooking area is clean and around their shops too."

Food safety breaches don't incur fines, but the council recovers costs with reinspection revisits to monitor or confirm compliance.

The average compliance cost for an E grade reinspection was $1400, while it was up to $771 for a D grade.

List of D and E grade outlets from Sept 2023- Jan 2024

============================================

Glen Innes Bakery and Cafe

Howick Village Cafe

Barilla Dumpling, Milford

Chowfoo Restaurant, Albany

Bakar Malaysian Cuisine, Panmure

Huanoa Takeaways, Papatoetoe

Moore St Bake House, Howick

Happy Days Restaurant, Manukau

Love Punjab Restaurant and Bar, Manurewa

Vanilla Plant Based Kitchen, Howick

Yummy Dumpling House, Queen St

Razeens Fastfoods and Takeaway, Māngere

Bread N Butter Home Cookery, Onehunga

Esquires Manukau

Korean Foods, Papatoetoe

Polynesian Takeaway, Avondale

Bamboo Gardens Takeaway, New Lynn

Golden Rooster Chinese Resturant, Rosedale

Burrito House, Birkenhead

Top World Bakery & Cafe, Ōtāhuhu

Idly Sambar, Kingsland

Daaku Kebab & Cafe, Manurewa

Panda Noodle Express, Albany

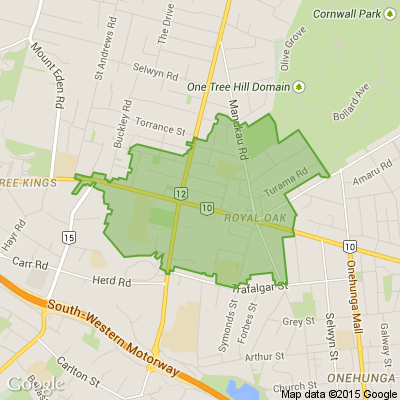

Happy Cafe, Royal Oak

Ak's Bakery, Mt Wellington

Dedwood Deli, Ponsonby

Daaku Kebab St George Street, Papatoetoe

Mount Eden Village Kebab

Al's Roast & Qiaos Chinese Takeaway, Snells Beach

Bombay Chinese Indian Restaurant, Queen St

Manna Kitchen Onehunga

Bawarchi Indian Food Takeaway, Sandringham

Beekeepers Wife, Riverhead

The Meat Hut, Massey

Chicking Takanini

Gangnam Style Korean BBQ Restaurant, Takapuna

United Coffee Nation, Victoria St West

Glen Eden Takeaways

932 Mt Albert BBQ Noodle House

Songket Malaysian Cafe

Mt Albert BBQ Noodle House

New Save Supermarket Newmarket

Hot and Spicy Pot East Tamaki

===================================

www.1news.co.nz...

===================================

Poll: Are our Kiwi summer holidays helping us recharge, or holding the economy back? ☀️🥝

There’s growing debate about whether New Zealand’s extended Christmas break (and the slowdown that comes with it) affects productivity.

Tracy Watkins has weighed in ... now it’s your turn. What’s your take? 🤔

-

73.1% We work hard, we deserve a break!

-

16.2% Hmm, maybe?

-

10.8% Yes!

Brain Teaser of the Day 🧠✨ Can You Solve It? 🤔💬

How many balls of string does it take to reach the moon?

(Peter from Carterton kindly provided this head-scratcher ... thanks, Peter!)

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Minimum wage to increase from April next year, Govt commits to bigger rise than last year

The Government will increase the minimum wage by 2% from April next year.

Workplace Relations Minister Brooke Van Velden announced the hourly wage would move from the current $23.50 to $23.95 in line with advice from the Ministry of Business, Innovation and Employment.

“Moderate” increases of the minimum wage formed part of NZ First’s coalition agreement with National.

Van Velden says the new rate, which would impact around 122,500 New Zealand workers, strikes a right balance between keeping up with the cost of living – the Reserve Bank expects inflation to fall to around 2% by mid-2026 – and no adding more pressure to the costs of running a business.

The starting out and training minimum wage would be move to $19.16 to remain at 80% of the adult minimum wage.

The minimum wage was last increased on April 1 this year. That 1.5% increased to $23.50, affecting between 80,000 and 145,000 workers, was not at the time in line with inflation which sat around 2.5% in March.

“I know those pressures have made it a tough time to do business, which is why we have taken this balanced approach. With responsible economic management, recovery and relief is coming,” Van Velden said.

“I am pleased to deliver this moderate increase to the minimum wage that reflects this Government’s commitment to growing the economy, boosting incomes and supporting Kiwis in jobs throughout New Zealand.”

Official documents from the Ministry of Business, Innovation and Employment (MBIE) show the department provided the Minister with seven options for the minimum wage, ranging from maintaining the current rate or increasing by 3% up to $24.20 per hour.

A 2% increase was recommended, the Ministry said, as this was ”considered to best balance the two limbs of the objective - protecting the real income of low-paid workers and minimising job losses."

“CPI inflation forecasts suggest annual inflation will ease to be within the 2–2.5% range in the first half of 2026 and remain relatively stable at around 2% from June 2026 through to 2028.

“These forecasts indicate that a 2% increase would largely maintain the real income of minimum wage workers relative to the level of the minimum wage when it last increased on 1 April 2025.”

Officials said a 2% increase wouldn’t have significant employment restraint effects.

But given recent economic data, including a Gross Domestic Product (GDP) contraction and elevated unemployment, MBIE said it favoured a “cautious approach”.

“A 2% increase to the adult minimum wage is expected to affect approximately 122,500 workers, including those currently earning at or below the minimum wage, or between the current rate and $23.95.”

The key groups that would be impacted include youth, part-time, female, and Māori workers, as well as sectors like tourism, horticulture, agriculture, cleaning, hospitality, and retail.

“While these workers would benefit from a wage increase, they may also be more exposed to employer responses to increased labour costs such as reduced hours or adjustments to non-wage benefits,” the ministry said

“The estimated fiscal cost to government from this increase is relatively modest, at $17.5 million annually, consistent with the small cost estimates across all rate options.”

=====================================================

Loading…

Loading…