Term 1 Classes at Epsom Community Centre

🌟 Dive into 2024 with Community Classes at Epsom Community Centre! 🌟

Join our Term 1 Programme starting in February 2024, offering a variety of classes for all skill levels.

🎨 Drawing for Beginners

Join Alba to master the basics of drawing, exploring various techniques and materials like pencil, charcoal, and pen. Perfect for both new artists and those brushing up their skills.

🖌️ Watercolour for Beginners

Discover the charm of watercolours with Alba. Learn essential techniques and color theory basics. Suitable for complete beginners.

💪 Pilates

Rose's Pilates classes offer a balanced approach to mind and body wellness, ideal for improving flexibility, posture, and strength.

🕺 Adult Jazz

Experience the joy of dance! Our Adult Jazz class offers a mix of lively sequences and music styles, welcoming dancers of all levels.

Exciting New Workshops:

🎨 Watercolour Techniques Workshop

Enhance your skills in this 3-hour workshop focusing on special watercolour techniques like color mixing and negative painting. Open to all levels.

🎨 Introduction to Watercolour Workshop

A beginner-friendly workshop introducing the fundamentals of watercolour painting. Also great for those looking to revisit the basics.

✨ Why Choose Epsom Community Centre?

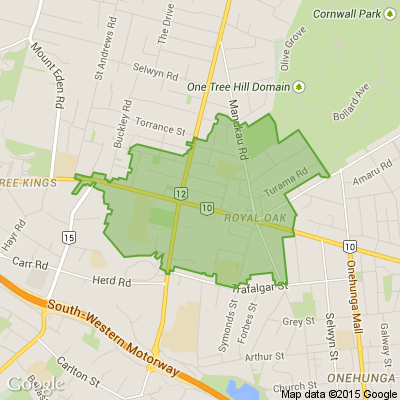

• Located at 202 Gillies Ave, Epsom.

• Friendly, welcoming environment.

• Iconic heritage building.

• Plenty of free parking.

🖱️ Enrol now: Epsom Community Centre - www.epsom-community-centre.org.nz...

📖 Learn more in our digital brochure: www.epsom-community-centre.org.nz...

Join us at Epsom Community Centre for a chance to learn, create, and connect. See you there! 🎉

Poll: Are our Kiwi summer holidays helping us recharge, or holding the economy back? ☀️🥝

There’s growing debate about whether New Zealand’s extended Christmas break (and the slowdown that comes with it) affects productivity.

Tracy Watkins has weighed in ... now it’s your turn. What’s your take? 🤔

-

73.1% We work hard, we deserve a break!

-

16.2% Hmm, maybe?

-

10.8% Yes!

Brain Teaser of the Day 🧠✨ Can You Solve It? 🤔💬

How many balls of string does it take to reach the moon?

(Peter from Carterton kindly provided this head-scratcher ... thanks, Peter!)

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Minimum wage to increase from April next year, Govt commits to bigger rise than last year

The Government will increase the minimum wage by 2% from April next year.

Workplace Relations Minister Brooke Van Velden announced the hourly wage would move from the current $23.50 to $23.95 in line with advice from the Ministry of Business, Innovation and Employment.

“Moderate” increases of the minimum wage formed part of NZ First’s coalition agreement with National.

Van Velden says the new rate, which would impact around 122,500 New Zealand workers, strikes a right balance between keeping up with the cost of living – the Reserve Bank expects inflation to fall to around 2% by mid-2026 – and no adding more pressure to the costs of running a business.

The starting out and training minimum wage would be move to $19.16 to remain at 80% of the adult minimum wage.

The minimum wage was last increased on April 1 this year. That 1.5% increased to $23.50, affecting between 80,000 and 145,000 workers, was not at the time in line with inflation which sat around 2.5% in March.

“I know those pressures have made it a tough time to do business, which is why we have taken this balanced approach. With responsible economic management, recovery and relief is coming,” Van Velden said.

“I am pleased to deliver this moderate increase to the minimum wage that reflects this Government’s commitment to growing the economy, boosting incomes and supporting Kiwis in jobs throughout New Zealand.”

Official documents from the Ministry of Business, Innovation and Employment (MBIE) show the department provided the Minister with seven options for the minimum wage, ranging from maintaining the current rate or increasing by 3% up to $24.20 per hour.

A 2% increase was recommended, the Ministry said, as this was ”considered to best balance the two limbs of the objective - protecting the real income of low-paid workers and minimising job losses."

“CPI inflation forecasts suggest annual inflation will ease to be within the 2–2.5% range in the first half of 2026 and remain relatively stable at around 2% from June 2026 through to 2028.

“These forecasts indicate that a 2% increase would largely maintain the real income of minimum wage workers relative to the level of the minimum wage when it last increased on 1 April 2025.”

Officials said a 2% increase wouldn’t have significant employment restraint effects.

But given recent economic data, including a Gross Domestic Product (GDP) contraction and elevated unemployment, MBIE said it favoured a “cautious approach”.

“A 2% increase to the adult minimum wage is expected to affect approximately 122,500 workers, including those currently earning at or below the minimum wage, or between the current rate and $23.95.”

The key groups that would be impacted include youth, part-time, female, and Māori workers, as well as sectors like tourism, horticulture, agriculture, cleaning, hospitality, and retail.

“While these workers would benefit from a wage increase, they may also be more exposed to employer responses to increased labour costs such as reduced hours or adjustments to non-wage benefits,” the ministry said

“The estimated fiscal cost to government from this increase is relatively modest, at $17.5 million annually, consistent with the small cost estimates across all rate options.”

=====================================================

Loading…

Loading…