Foreign buyers snap up 741 Auckland homes in last 3 months

The share of home transfers to overseas people fell from 3.3 per cent last quarter to 2.8 per cent this quarter, Stats NZ said. "Overseas people" includes people who are not New Zealand citizens or resident-visa holders. There were 39,627 property transfers involving a home in the June 2018 quarter, up 1.5 per cent on the year.

Some 8 per cent of those were to people who held a resident visa, meaning they were not New Zealand citizens but could live in New Zealand permanently. "These could be people who have lived in New Zealand for many decades and chosen not to get citizenship, or they could be people who have only held a resident visa for a very short time," property statistics manager Melissa McKenzie said. A further 11 per cent were to companies and other corporate entities. Information on the ownership of these corporates (by New Zealanders or overseas people) is not currently available. "We can say confidently that 2.8 per cent of home transfers were to overseas people in the June quarter. However, it is less clear how many corporate buyers might have had overseas owners.

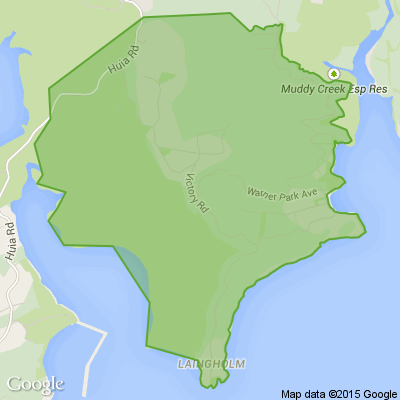

Auckland continued to top the list for home transfers involving non-NZ citizens or resident-visa holders with 741 property transfers, followed by Hamilton City, where there were 48 transfers and Queenstown-Lakes district, where there were 27. Stats NZ took over the task of publishing the home transfer statistics from Land Information New Zealand, which began publishing quarterly property transfers and tax residency reports to try and obtain a better picture of the housing market after growing concerns that foreign buyers were pushing up house prices.

According to the statistics agency, property transfer statistics are based mainly on land transfer tax statements and capture property transfers by New Zealanders and overseas people. This includes information on the citizenship, visa status, or tax residency of people and companies involved in property transfers. The new data includes a time series to make comparisons over time easier, detailed statistics about transfers involving homes and statistics for regions. In terms of home transfers by buyer tax residence, 19,122 were to buyers who were exempt from stating their tax residency, because they were NZ citizens or resident-visa holders and the transfer involved the main home, and 18,960 were to buyers who stated no overseas tax residence. A total of 552 were to tax residents of China only and 240 were to tax residents of Australia only (many of whom were NZ citizens).

==========================================================

The Summer Kiwi Quiz is back by popular demand

Grab a copy of your local Stuff newspaper between 1 Jan - 28 Jan and participate in the Summer Kiwi Quiz! Test your knowledge, answer the daily New Zealand based questions, and find out how well you know our beautiful country!

Each correct answer will get you one entry into the draw to WIN 1 of 5 Ooni Karu 2 Portable Pizza Oven bundles, valued at $1024! Each bundle includes: an Ooni Karu 2 Multi-Fuel Portable Pizza Oven, Ooni Karu 2 Carry Cover, Ooni 12" Perforated Peel, Ooni Digital Infrared Thermometer and an Ooni Cookbook: Cooking with Ooni. The more answers you enter correctly, the higher your chance of winning. For more information and to submit your answers, click here

The Team at Stuff

Scam Alert: Fake information regarding December Bonuses from MSD

The Ministry of Social Development is reporting that fake information is circulating about new ‘December bonuses’ or ‘benefit increases’

If you get suspicious communication, please contact Netsafe.

Loading…

Loading…