Breaking News: RBNZ Activates DTI Restrictions & Eases LVR Restrictions

From 1 July, the Reserve Bank of New Zealand (RBNZ) will be implementing the following changes:

DTI Restrictions Introduced

➖ 20% of new owner-occupier lending to borrowers with a DTI ratio over 6.

➖ 20% of new investor lending to borrowers with a DTI ratio over 7.

LVR Restrictions Easing

✔20% of owner-occupier lending to borrowers with an LVR greater than 80% (increased from 15%).

✔ 5% of investor lending to borrowers with an LVR greater than 70% (deposit requirement reduced to 30% from 35%).

If you are an investor or first home buyer with a low deposit, get in touch with adviceHQ to see how this helps you.

#adviceHQ #NZPropertyInvestor #FirstHomeBuyer #RBNZ #LVR #DTI

Poll: Are our Kiwi summer holidays helping us recharge, or holding the economy back? ☀️🥝

There’s growing debate about whether New Zealand’s extended Christmas break (and the slowdown that comes with it) affects productivity.

Tracy Watkins has weighed in ... now it’s your turn. What’s your take? 🤔

-

72.9% We work hard, we deserve a break!

-

16.1% Hmm, maybe?

-

11% Yes!

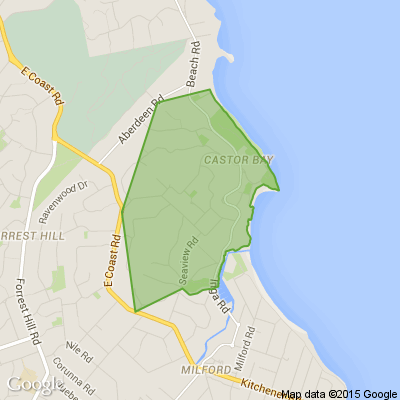

Aucklanders, we want to know: How are you feeling about the current property market?

New Zealand homeowners are now more likely to sell at a loss than at any time since 2013, and if you’re in Auckland or Wellington, the odds are even higher.

But there is a silver lining: buyers are still in a strong position when it comes to negotiating prices.

So we’re curious…

How are you feeling about the current property market?

If you’re keen to dive into the details, Deborah Morris breaks down all the latest insights.

Loading…

Loading…