Cost of living increases: Who is being hit hardest now?

Beneficiaries and people on NZ Super are experiencing faster increases in the cost of living, while the biggest spenders are getting some relief, new data shows.

Stats NZ has released data for the September quarter, which shows the average New Zealand household experienced a cost-of-living increase of 2.4 percent over the previous 12 months.

That is less than the 3 percent rate of inflation, because it includes a 15.4 percent drop in mortgage interest payments.

Mortgage interest payments were the main contributor to highest-spending households recording the lowest annual inflation, Stats NZ said.

Their annual inflation rate was 0.8 percent, compared with 3.9 percent for superannuitants, who are less likely to be paying mortgage interest. Beneficiaries had costs increasing 3.4 percent and the lowest-spending households had an increase in costs of 4 percent.

Rents increased 2.6 percent over the year to September. Rent makes up 29.5 percent of beneficiary household expenditure. This compares with 13.1 percent for the average household, and 5.1 percent for highest-spending households.

Council of Trade Unions policy director Craig Renney, a former adviser to then-Finance Minister Grant Robertson, said it had historically been the case that people on the lowest incomes had the highest rates of cost-of-living increases.

That had changed after Covid when home loan rates increased sharply but now the situation had reversed. He said it was likely that the impact would continue to be felt in this way.

Council of Trade Unions (NZCTU) policy director and economist Craig Renney.Craig Renney. Photo: Stuff / ROBERT KITCHIN

"Much of the challenges are in administered costs, rates, electricity, going to see the GP, which are rising faster than general inflation."

But Satish Ranchhod, a senior economist at Westpac, said it was important to note that some of the lower-income people who were experiencing higher rates of inflation would be young people in the earlier stages of their careers, who had not yet reached a point where they could buy a house.

"It's misleading to say they're getting hit, they're just at a different place in the lifecycle."

But he said times were still tough for many households, including many lower-income earners.

He said people who had mortgages had experienced large increases in recent years and a much bigger squeeze on their incomes.

The relief they were experiencing was likely to continue as the impact of falling interest rates filtered through to more people, he said.

Other significant increases were an 11.3 percent increase in electricity on average and an 8.8 percent increase in rates.

How are cost increases felt?

========================

Inflation experienced in the 12 months to the September 2025 quarter:

all households 2.4 percent

beneficiaries 3.4 percent

Māori 2.4 percent

superannuitants 3.9 percent

highest-expenditure household group 0.8 percent

lowest-expenditure household group 4 percent.

===================================================

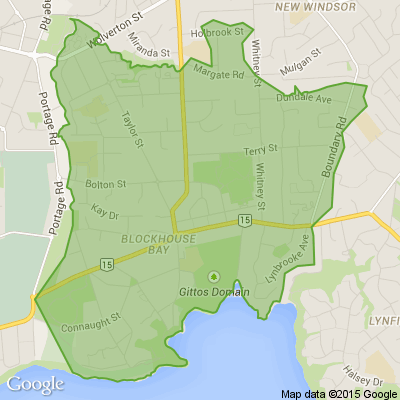

Neighbourhood Challenge: Who Can Crack This One? ⛓️💥❔

What has a head but no brain?

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

Want to stop seeing these in your newsfeed?

Head here and hover on the Following button on the top right of the page (and it will show Unfollow) and then click it. If it is giving you the option to Follow, then you've successfully unfollowed the Riddles page.

Some Choice News!

Many New Zealand gardens aren’t seeing as many monarch butterflies fluttering around their swan plants and flower beds these days — the hungry Asian paper wasp has been taking its toll.

Thanks to people like Alan Baldick, who’s made it his mission to protect the monarch, his neighbours still get to enjoy these beautiful butterflies in their own backyards.

Thinking about planting something to invite more butterflies, bees, and birds into your garden?

Thanks for your mahi, Alan! We hope this brings a smile!

Loading…

Loading…