Review your home loan TODAY!!!

Next few months, it will be crucial to keep close eye on your mortgage. It is expected that significant number of fixed rate mortgages are due to expire.

Homeowners in New Zealand would be looking at fixing at higher interest rates once their existing fixed term expires.

We are here to help; as mortgage adviser, can assist with:

✅ paying off mortgage faster to save interest cost

✅ review your fixed term option

✅ discuss about preferred mortgage repayment to keep you going whilst meeting your day-to-day outgoings.

✅ mortgage restructuring

With high inflation, sky rocketing cost to maintain household expenses, you could focus on sustainable mortgage repayments to keep you and your family in secured financial situation.

Consult with us to learn more:

📲 0210749825

💻info@skfg.co.nz

Poll: Are our Kiwi summer holidays helping us recharge, or holding the economy back? ☀️🥝

There’s growing debate about whether New Zealand’s extended Christmas break (and the slowdown that comes with it) affects productivity.

Tracy Watkins has weighed in ... now it’s your turn. What’s your take? 🤔

-

72.8% We work hard, we deserve a break!

-

16.1% Hmm, maybe?

-

11.1% Yes!

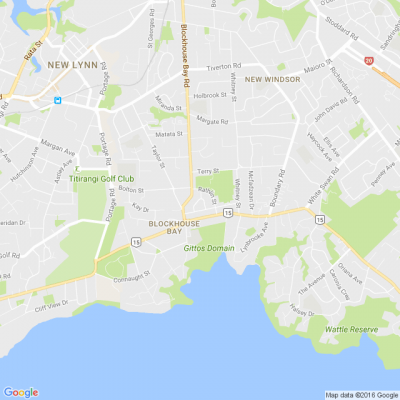

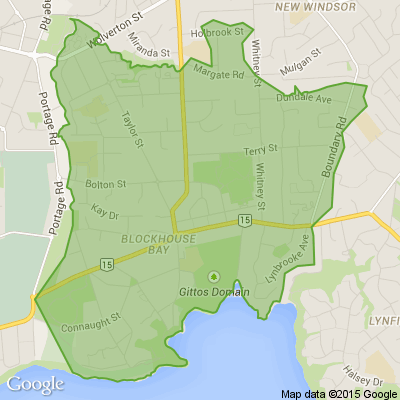

Aucklanders, we want to know: How are you feeling about the current property market?

New Zealand homeowners are now more likely to sell at a loss than at any time since 2013, and if you’re in Auckland or Wellington, the odds are even higher.

But there is a silver lining: buyers are still in a strong position when it comes to negotiating prices.

So we’re curious…

How are you feeling about the current property market?

If you’re keen to dive into the details, Deborah Morris breaks down all the latest insights.

Loading…

Loading…