Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

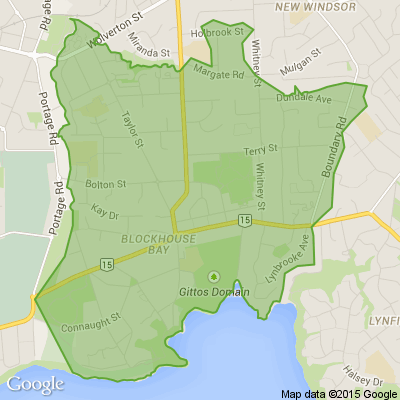

Nearby

Green Bay, Lynfield, Mount Roskill, Laingholm, Kelston, Waterview, New Windsor, Glendene, Hillsborough, New Lynn, AvondaleGot a job going in your company or in your backyard?

Share it on Neighbourly to find someone local.

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

Brian from Mount Roskill

They wave, they wait, they get us where we need to go, rain or shine, early or late. Auckland’s bus drivers are everyday legends who keep our city moving, and now it’s our turn to say thanks.

To celebrate, we’ve spoken to nine incredible drivers about their favourite moments, what they love… View moreThey wave, they wait, they get us where we need to go, rain or shine, early or late. Auckland’s bus drivers are everyday legends who keep our city moving, and now it’s our turn to say thanks.

To celebrate, we’ve spoken to nine incredible drivers about their favourite moments, what they love about their job, and the community they serve.

You might even spot your regular driver!

=======================================================

Prachi from Blockhouse Bay

Set of wine glasses - 11 of them for $40.

Price: $40

The Team from Neighbourly.co.nz

🌿 Air New Zealand reckons the future of air travel lies in AI. To them, AI means boosting efficiency without bumping up prices.

But what do you think? 🤔

Can AI really make flying more personal?

Keen to find out more? 👉 Check out Grant Bradley's piece on the Post

18 replies (Members only)

Markus from Green Bay

Approximate Dimensions are: Height: 45 cm, Width: 19 cm. Pickup in Green Bay (we live opposite Green Bay High School), or if you are outside Auckland then maybe a friend of yours in Auckland can do the pickup.

Price: $29

Hey neighbours!

If you’re running an Airbnb (or thinking about it), here’s a little secret: your bed can truly make or break your guest experience. A cozy, clean, thoughtfully chosen bed can turn an ordinary stay into a “Wow, I’m definitely coming back!” moment.

Whether you're … View moreHey neighbours!

If you’re running an Airbnb (or thinking about it), here’s a little secret: your bed can truly make or break your guest experience. A cozy, clean, thoughtfully chosen bed can turn an ordinary stay into a “Wow, I’m definitely coming back!” moment.

Whether you're hosting families, weekend adventurers, or friends on a quick getaway, the right bed sets the tone — comfort, style, and that warm “you’re welcome here” feeling guests instantly appreciate.

Not sure where to begin? We’ve put together a super helpful guide on choosing the perfect Airbnb beds — from comfort tips to design inspiration and those small touches that guests absolutely love.

Give it a read here: beds4u.co.nz...

If you want your Airbnb to stand out (and score those glowing 5-star reviews!), this guide is a must-read.

Happy hosting, neighbours!

Brian from Mount Roskill

You’re often entitled to a refund and can claim back other costs if it’s the airline’s fault.

Find out your international flight rights and how to claim, depending on where you’re flying from and to.

International flight rights

=====================

My international flight has been … View moreYou’re often entitled to a refund and can claim back other costs if it’s the airline’s fault.

Find out your international flight rights and how to claim, depending on where you’re flying from and to.

International flight rights

=====================

My international flight has been cancelled. What are my rights?

For international flights, your rights differ depending on where you are, where you’re heading and where the airline is based.

Assuming the airline is at fault, you should be entitled to reimbursement of your airfare and other costs under the Montreal Convention (up to a limit).

It will apply if you’re flying between two signatory countries (countries that have signed the Convention agreement), such as Australia and New Zealand.

However, airlines won’t be liable under the Convention if they can prove they took “all measures that could reasonably be required to avoid the damage [incurred by the cancellation or delay].”

You can claim compensation up to a limit of around $15,800.

If you’re flying through the EU and the UK, different rules apply.

EU and UK passenger flight rights

============================

The EU’s Denied Boarding Regulation provides clear-cut consumer protection.

You can claim compensation if your airline is responsible for cancelling or delaying your flight. You must be flying from the UK or EU or flying into an EU or UK airport on an airline based in the EU or UK to be covered.

For cancellations, you’re entitled to choose between re-routing to your final destination, a return flight home or a refund.

If you arrive at your final destination with a delay of 3 hours or more, you’ll also be entitled to assistance such as meals and free phone calls. If you're stranded overnight, you should also be able to claim for accommodation.

And you may be entitled to compensation proportionate to the distance you’re travelling – up to €600 (around NZ$1,200) for flights further than 3500km.

The EU has a tool that can tell you what your rights are depending on your situation.

US passenger flight rights

=====================

In the US, if an airline cancels your flight for any reason, or there is a significant schedule change, and you choose not to travel, it must provide you with a refund.

However, airlines are not required to give compensation.

If you’re bumped from your flight due to over-booking, the Department of Transportation requires airlines to compensate you in some circumstances.

Compensation is based on:

======================

the length of the delay

whether you were voluntarily or involuntarily bumped.

If it’s the latter, you can get up to 400% of your one-way fare, capped at US$2,150 (about NZ$3,800).

I missed my onward connection because of delays to an international flight. Does the airline have to reimburse me for my extra expenses?

An airline must reimburse you for extra expenses after an international flight delay if the delay was within the airline’s control.

You’re entitled to claim compensation under the Montreal Convention (up to around $15,800). If you’re flying through the EU and the UK, you may have additional protections.

If the airline doesn’t pay, you can lodge a claim at the Disputes Tribunal. It’ll cost you $61 to file a claim if you’re asking for less than $2,000 (the fee rises for claims above this).

For delays beyond the airline’s control, such as weather events, check with your travel insurer (if you have one) and the terms and conditions of your ticket to see what you’re covered for.

My baggage has been lost in transit. What are my rights?

=============================================

On an international flight, your baggage is covered by the Montreal Convention. The convention sets out the maximum amount an airline has to pay if your baggage is lost, damaged or delayed. The sum is about $3,800.

If your baggage is delayed, the airline only has to cover the cost of essential items. Typically, airlines don’t accept liability for consequential losses.

To claim for damaged baggage, you must write to the airline within 7 days of getting your bags back.

For delayed luggage, you must claim within 21 days from the date the baggage should’ve been available to you.

======================================================

Andrew from Mount Roskill

Purchased approximately 7 years ago with an opportune find at a op-shop, these were previously upholstered in a lovely pale pink fabric.

At the time of purchase I reupholstered them with the sage green canvas material and sanded and restored the timber. I’ve always been unsure of the timber … View morePurchased approximately 7 years ago with an opportune find at a op-shop, these were previously upholstered in a lovely pale pink fabric.

At the time of purchase I reupholstered them with the sage green canvas material and sanded and restored the timber. I’ve always been unsure of the timber but did think it was teak for a while so used oil suitable for that.

Although three chairs is an odd number, these go well with other chairs, either around a similar era round or rectangular table.

One of the chairs had had a hasty repair job which has resulted in scratches (as pictured in the last photos). This is easily fixed with a new piece of timber and screws. This needs to happen before I’d deem it a useable chair.

Selling to make room, and we haven’t been using them. They’ve been in a dry basement for a year or so and have been cleaned recently with a damp cloth.

Dimensions

510w 500d 800h, 450h to seat

Price: $130

Brian from Mount Roskill

For those familiar with the furniture giant from overseas, the Auckland store will have the same walk-through format that has made IKEA a global staple, but with several home turf twists.

The 34,000m2 store will offer roughly 7500 products, from its popular flatpack furniture sets to smaller, … View moreFor those familiar with the furniture giant from overseas, the Auckland store will have the same walk-through format that has made IKEA a global staple, but with several home turf twists.

The 34,000m2 store will offer roughly 7500 products, from its popular flatpack furniture sets to smaller, everyday household necessities.

The building will span three floors - two levels of retail and a bottom-level car park, as well as a restaurant and bistro - and will be accessible from within the Sylvia Park shopping mall.

Inside, the store’s showroom will showcase fully styled spaces, from family-sized kitchens and children’s bedrooms to small apartments and outdoor setups. The market hall is set to feature everything from textiles and cookware to lighting, décor and home organisation systems.

It will also include a self-service warehouse, allowing shoppers to take home flat-packed furniture on the day or arrange delivery.

The New Zealand store will debut a world-first IKEA restaurant concept. A 400+ seat Swedish restaurant will serve IKEA’s classic meatballs, salmon dishes and plant-based meals, alongside several meals exclusive to New Zealand.

A bistro and Swedish food market located at the store’s exit will serve cinnamon scrolls and hotdogs, as well as frozen meatballs.

Nationwide pick-up points

=====================

While Sylvia Park will be the country’s only physical place to shop, the full IKEA range will be available nationwide.

Online shopping will launch the same day as the store opening, with 29 pick-up points from Kaitaia to Invercargill, meaning Kiwis across the country will have the chance to get their hands on the much-loved Swedish furniture sets.

IKEA’s loyalty programme, IKEA Family, has already rolled out nationwide, offering members exclusive discounts and early updates ahead of opening day.

New Zealand Market Manager Johanna Cederlöf said the team had been “counting down the days” to opening, calling it a long-awaited milestone.

“It’s very exciting for us. For many shoppers, this will be their first time inside an IKEA store,” she said. “We are excited to see how Kiwis fall in love with us and how they interact with us.”

To better understand the New Zealand market, IKEA conducted more than 500 home visits across the country to get to know how locals live, including daily routines, storage habits and space use.

Cederlöf said the visits highlighted New Zealand’s “diverse ways of living” - with many households having a strong focus on sustainability and maximising storage space.

One unique Kiwi quirk different from anywhere else in the world was the role of the garage.

“We noticed there are more garages here than almost anywhere else in the world,” she said, with many Kiwi households using them as multipurpose areas for storage, laundry and work.

Opening-week rush expected

========================

More than 500 staff, known as ‘coworkers’ to reflect IKEA’s family ethos, are focused on final preparations ahead of the expected opening-week rush.

“It’s been a huge effort to get everything ready,” Cederlöf said. “The team have been working very hard to make this happen.”

Founded in Sweden in 1943, the retailer has grown into a global household name, known for its flatpack furniture, minimalist design and walk-through room displays.

Operating in 63 markets, the IKEA brand is operated by several companies with different owners. The New Zealand operation is run by Ingka Group, which represents about 90% of IKEA sales.

IKEA has not confirmed plans for any additional New Zealand stores, saying it will monitor how shoppers use the Sylvia Park store and online service before deciding on future expansion, but it noted the strong response ahead of the opening is a promising sign.

For now, all eyes are on opening day, where Kiwis will get their long-awaited first look at the experience that has made IKEA a global staple for more than eight decades.

=======================================================

IKEA opens on December 4 in Sylvia Park, Auckland, and online everywhere in New Zealand.

======================================================

Tharaa from New Windsor

Hi

We are looking for a plumber to fix a pipe outside our property in Marconi Place. The sooner the better.

Any recommendations are welcome.

Brian from Mount Roskill

Looking for some simple ways to help reduce your energy use and lower your bill? Read on for some ideas you can put into action right now.

In the kitchen

===========

Let food cool down before putting it in the fridge or freezer to keep these appliances running at their best (2°C - 5°C for your… View moreLooking for some simple ways to help reduce your energy use and lower your bill? Read on for some ideas you can put into action right now.

In the kitchen

===========

Let food cool down before putting it in the fridge or freezer to keep these appliances running at their best (2°C - 5°C for your fridge, and -18°C for your freezer).

Keep fridge and oven doors closed as much as possible.

Use cold water when filling the jug or rinsing dishes.

Run your dishwasher only when it’s full.

Heating your home

================

Stop cold air from coming in by closing your damper when you're not using your fire place. Also block gaps under windows and doors.

Put an extra blanket on your bed instead of using an electric blanket.

Try using a thermostat to control when your heaters come on.

Close your curtains just before dark to keep in the heat.

Use a dehumidifier to keep your house dry and make it easier to heat.

Bathroom & laundry

================

Use a short, cold wash cycle when washing clothes.

Have showers instead of baths and try to keep them less than five minutes.

Dry your washing on a clothesline as often as possible.

Open a window when you’re showering to avoid moisture build up.

If you haven’t got one, look at installing a hot water cylinder wrap.

Lighting your home

================

Replace traditional lightbulbs with LED bulbs.

Clean lights and lampshades to get maximum light.

Switch the lights off when you leave a room.

Forming energy efficient habits

==========================

Switch off appliances at the wall. Standby mode uses power too!

Turn phone and laptop chargers off when your batteries are full.

Replace old appliances with ones that have a high-energy star rating.

Switch off your hot water if you’re away for more than two weeks.

====================================================

Olga from Blockhouse Bay

Hello.

If you need baby clothes 3-9month and maturnaty clothes L size. Please let me know, I give it away for free.

Location: Lynfield, West Auckland

0224366095

The Team from Resene ColorShop New Lynn

Short on garden space? No worries. A tiered planter is ideal for small spaces and can be used for strawberries, herbs or salad greens. We finished ours in Resene Forest Green, Resene Green House, Resene Caper and Resene Red Berry. Find out how to create your own tiered planter with these easy step … View moreShort on garden space? No worries. A tiered planter is ideal for small spaces and can be used for strawberries, herbs or salad greens. We finished ours in Resene Forest Green, Resene Green House, Resene Caper and Resene Red Berry. Find out how to create your own tiered planter with these easy step by step instructions.

Premium care is just meters away from our village. Join our caring community, where passion thrives. Trust Terrace Kennedy House for exceptional care and meaningful connections. Find out more

The Team from New Zealand Police

Police are working to locate Paul Kyle Peekay Rehua, who has a warrant for his arrest and is wanted by Police.

Rehua, 42, is wanted in relation to escaping custody and is believed to be in the wider Waitematā area, though he known to frequent the greater Auckland and Waikato regions. It’s … View morePolice are working to locate Paul Kyle Peekay Rehua, who has a warrant for his arrest and is wanted by Police.

Rehua, 42, is wanted in relation to escaping custody and is believed to be in the wider Waitematā area, though he known to frequent the greater Auckland and Waikato regions. It’s believed he is actively avoiding Police.

If you have seen Rehua or have any information that may assist in locating him, please update us online now or call 105.

Please use the reference number 251107/5350.

Alternatively information can be provided anonymously to Crime Stoppers on 0800 555 111.

Brian from Mount Roskill

Fast food giant McDonald's is worried about losing lower-income customers, as data shows it can probably no longer be considered a "cheap" food option.

When McDonald's released its latest earnings report in the United States it said comparable sales were up but chief executive … View moreFast food giant McDonald's is worried about losing lower-income customers, as data shows it can probably no longer be considered a "cheap" food option.

When McDonald's released its latest earnings report in the United States it said comparable sales were up but chief executive Christopher Kempczinski said low-income customers were avoiding its restaurants.

CNBC reported that he noted "traffic from lower-income consumers declining nearly double-digits in the third quarter, a trend that's persisted for nearly two years.

"Traffic growth among higher-income consumers remains strong, increasing nearly double-digits in the quarter."

A spokesperson for McDonald's in New Zealand said this country did not report on total sales or business performance so he could not say whether the same trend was happening here.

On social media posts recently, customers have questioned the price of the new Big Arch burger, and complained that there had been price increases on the McDonald's app.

Another said it was like a Big Mac but more expensive while a third customer said it was due to wage rises.

On Uber Eats this week, a Bacon & Egg McMuffin was $9.30, a Big Mac was $11.80 and a cheeseburger $6.80. A Big Arch burger was $16.

Burger King had a Whopper with cheese for $14.80 and a Hawaiian BK Chicken for $17.60. Its triple cheeseburger was $13.90.

Gareth Kiernan, chief forecaster at Infometrics, said Stats NZ data showed takeaway food of all types had become a lot more expensive recently.

Between September 2005 and September 2025, the consumer price index had risen 66 percent, the food price index 84 percent, ready-to-eat food 103 percent and a Big Mac 93 percent.

Fish and chips had lifted 154 percent.

Kiernan said the fact the Big Mac had increased in price less than the 147 percent increase in the minimum wage over the period could be considered a good outcome.

He said takeaway food prices would have been driven up by both the wider increase in food prices and the cost of labour.

Bodo Lang, a marketing expert at Massey University, said it was often said that McDonald's had stopped being a cheap option but he was not convinced that weas the case.

"Despite offering high priced menu items, McDonalds still offers a range of choices for smaller appetites and smaller wallets. Classic items, such as the Big Mac or Quarter Pounder are still likely at the cheaper end when compared to others. For example, McDonald's prices are comparable with other international chains such as Burger King or KFC. Even when compared to local independent operators, McDonalds prices are still fairly comparable. At least for its classic items. Ordering anything via an app and have it delivered will obviously at much cost and little convenience, thus distorting consumers price impression."

Burger Fuel was charging $24.50 for a Bacon Backfire burger on Uber Eats this week.

"What McDonald's has done very well is to diversify its product portfolio to appeal to different tastes and wallet sizes. While its classics are still available at comparatively low prices, McDonald's luxe items, such as its Grilled Chicken Bacon Deluxe, are at the upper end of the price range and compete head on with the likes of local chains, such as Burger Fuel. So McDonald's has done an excellent job of trying to appeal to its classic customers, particularly through bundles and offers, while appealing to others with premium priced items," Lang said.

========================================================

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

© Neighbourly 2025