Rates capping digs ‘bigger borrowing hole’ – mayor

By local democracy reporter Jonathan Leask:

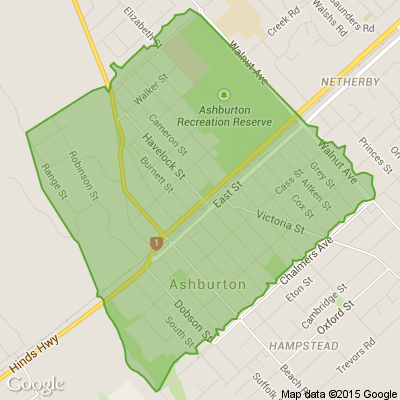

Ashburton mayor Neil Brown says rates capping isn’t the answer for the district after hearing cautionary tales from Australian councils.

The Government is exploring the option of rates capping to balance the long-term interests of ratepayers with the financial sustainability of councils.

It was discussed at the Local Government New Zealand (LGNZ) meeting in Wellington last month, which included a presentation on how rates capping worked in New South Wales and Victoria.

Brown said rising costs demand smarter solutions, but after hearing cautionary tales from Australian councils, rates capping would harm essential services and increase council debt.

The examples highlighted that if inflation was higher than the capped rate increases, then councils couldn’t deliver all its services, he said.

“They either had to cut services or borrow money, or both.

“They were just getting into a bigger borrowing hole.”

LGNZ president Sam Broughton said a rates cap would ultimately limit council investment.

He said there was a lot to learn from the Australian experiences of the immense challenges that came with rate capping.

Local Government NSW president, councillor Darriea Turley, urged caution around moves to introduce rate capping (or rate pegging).

“Local government’s capacity to fund existing levels of services and infrastructure is under increasing stress.

"There is a wealth of evidence that NSW councils and their communities have been damaged by rate pegging.

“In NSW, it has severely hampered councils’ ability to fund current, let alone future, levels of service.”

Broughton wants the Government to keep an open mind about rates capping, and to explore other alternatives that could achieve the same result.

“Ratepayers need to have confidence in council decisions and to trust that we’re focusing on delivering the infrastructure and services that communities expect.

“That’s why we are also looking into the approach taken by South Australia, who elected to improve their rates transparency instead of rates capping.”

In Ashburton, Brown said there will be some robust budget discussion in the new year with a forecast 10.1% rates increase next year, following an 11.8% increase this year.

The rate increase shouldn't be increasing as "no new projects are coming in because we have only just signed off the long-term plan six months ago.”

The increase is to cover three waters and roading work, and increasing costs to insurance and servicing debt.

The declining interest rate levels could have a big benefit.

“A 1% drop in interest rates is about a 2% rate decrease,” he said.

When announcing the plans to explore rate capping in August, Local Government Minister Simeon Brown said council rates increased by around 15% on average this year, which is more than four times the rate of inflation.

"This is unacceptable and councils must ensure they are doing everything they can to reduce pressure on ratepayers.

“Ratepayers expect local government to focus on delivering the basics, picking up rubbish, fixing water infrastructure, and filling in potholes. We have done our part, and Kiwis expect councils to do theirs," he said in a statement.

The Summer Kiwi Quiz is back by popular demand

Grab a copy of your local Stuff newspaper between 1 Jan - 28 Jan and participate in the Summer Kiwi Quiz! Test your knowledge, answer the daily New Zealand based questions, and find out how well you know our beautiful country!

Each correct answer will get you one entry into the draw to WIN 1 of 5 Ooni Karu 2 Portable Pizza Oven bundles, valued at $1024! Each bundle includes: an Ooni Karu 2 Multi-Fuel Portable Pizza Oven, Ooni Karu 2 Carry Cover, Ooni 12" Perforated Peel, Ooni Digital Infrared Thermometer and an Ooni Cookbook: Cooking with Ooni. The more answers you enter correctly, the higher your chance of winning. For more information and to submit your answers, click here

The Team at Stuff

Scam Alert: Fake information regarding December Bonuses from MSD

The Ministry of Social Development is reporting that fake information is circulating about new ‘December bonuses’ or ‘benefit increases’

If you get suspicious communication, please contact Netsafe.

Loading…

Loading…