Will prices fall in Hawkes Bay?

An interesting aspect of the debate about the housing market this recession compared to the 2008 – 09 Global Financial Crisis is that generally, massive price falls are not predicted. More people are losing their jobs than then, but there are other factors which appear to be supporting house prices and limiting the number of forced sales.

Reserve bank governor Adrian Orr is predicting unemployment will reach around 9% and house prices on average to fall by around 9% (coincidentally). Other forecasters, like economist Tony Alexander, are predicting lower levels of depreciation of between 5% and 10% across the country.

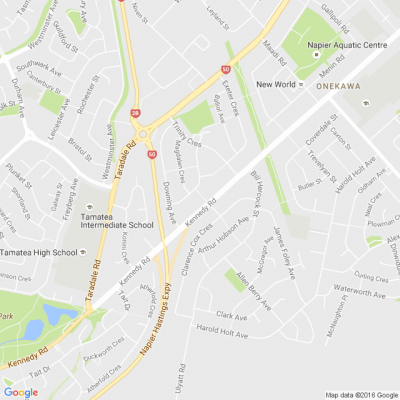

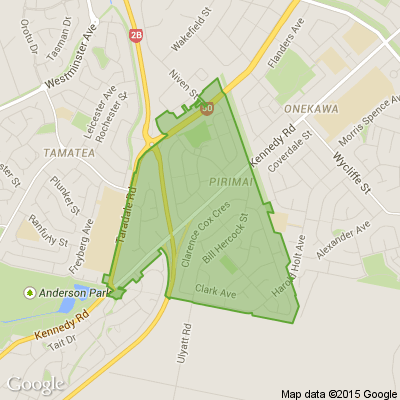

However, wide variations are expected between regions. For example, big falls are expected in tourism towns like Queenstown and Rotorua. But economist Cameron Bagrie believes real estate markets in Hawkes Bay, Gisborne and Southland will continue to show strength while other regions have moderated.

We also expect differences across various price segments. In Hawkes Bay over 70% of properties sell between $400,000 and $800,000, with an average of around $575,000. The number of homes available for sale below $600,000 is significantly less than the level of demand (by over 15%).

In this price range strong prices are being sustained by demand pressures, often pushed upward by multiple offers. On the other hand, the supply of homes for sale above $800,000 is almost double what the local market usually turns over. In the higher price ranges, sellers are now attracting offers at less than pre-covid19 levels.

Tony Alexander has identified some of the factors he expects to support the real estate market in the months ahead. Follows is an abridged summary of some:

1. Record low interest rates have just gone lower and may continue to fall. Two-year fixed rates are now only 2.69%.

2. Removal of LVRs could make a purchase possible for those who do not have enough deposit to make a 20% deposit (or 30% in the case of an investor).

3. The application of LVRs since 2013, means there are few people with high levels of debt and low equity in their properties.

4. Because average house prices have risen by up to 30% in the last 4 – 5 years most buyers have built up good equity in their current property.

5. Many of those being made redundant do not own a home and would not have qualified for a mortgage given their income circumstances.

6. The loss of migrant workers is likely to affect rents rather than property owners.

7. As New Zealanders return from overseas, after decades of losses there may be a shift to a net migration gain.

8. Commercial property investors may switch their focus back to residential property as business reduce office space.

If you’re looking for help selling a property in Hawkes Bay talk with one of the Cox Partners team first.

Poll: Does the building consent process need to change?

We definitely need homes that are fit to live in but there are often frustrations when it comes to getting consent to modify your own home.

Do you think changes need made to the current process for building consent? Share your thoughts below.

Type 'Not For Print' if you wish your comments to be excluded from the Conversations column of your local paper.

-

91.4% Yes

-

8.1% No

-

0.5% Other - I'll share below!

🐕 Please ph number below if you see the little lost dog

Jolene-Ann Erasmus Hi guys, our tiny minature pincher has gotten out of our new home in Hinton rd, Taradale while we were at work. Please let me know if you may have seen her, she is my baby! She is wearing a thick black citronella spray collar to prevent her from barking. She is a very nervous little girl so she may be hiding in someone’s garden 😢 please call me on 0273419450 😢😢

Lest we forget...

On this ANZAC Day, let's take a moment to remember and honor the brave men and women who have served and continue to serve our country.

Tell us who are you honouring today. Whether it's a story from the battlefield or a memory of a family member who fought in the war, we'd love you to share your stories below.

Loading…

Loading…