How to turn your home into an investment property

Not everyone chooses to sell their current home when they decide to move on. Sometimes, it’s not even an option. If you’re looking to hang on to your personal home and turn it into a rental, there are a few things to consider first.

1. Wear and tear

This is perhaps the biggest thing homeowners need to know. As a rental, your personal home will experience more wear and tear than it otherwise would if you lived in it. Your garden will probably not look as immaculate as it once did, and your walls and floors may acquire new scuff marks. So, if you can’t shake off your emotional attachment to the property, you may be better off selling it rather than renting it.

2. Location

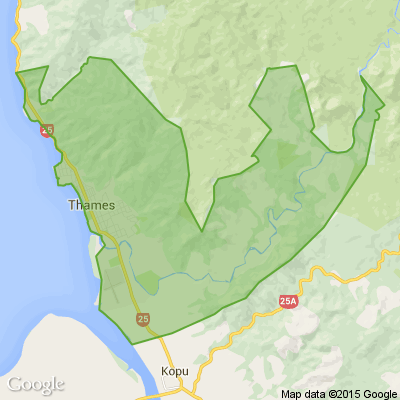

The location of your home can have a major impact on its rentability and how easy it is to find quality tenants. If you’re close to local amenities like schools, Waikato University, Waikato Hospital or public transport routes, you have a better chance of keeping your property tenanted.

3. Maintenance

If your home is high maintenance - perhaps it has a pool, a large garden, or old appliances - know that you’ll need to keep it maintained to a reasonable condition to meet your obligations as a landlord/owner. This may involve extra ongoing costs, or costs to remedy the amount of maintenance required.

4. Family homes do best

In Hamilton, family-sized homes do particularly well on the rental market. Four-bedroom houses in Hamilton fetch, on average, between $450 and $520 per week. As for the strongest performing suburbs, Hamilton East/University, Te Kowhai/St Andrews/Queenwood, Dinsdale South/Frankton, Dinsdale North/Nawton and Flagstaff/Rototuna have recently experienced the strongest rental growth for family-sized properties with three to five (or more) bedrooms.

5. Landlord responsibilities

When you turn your personal home into a rental, you will take on the mantle of landlord, which comes with its own set of responsibilities. This includes finding and screening tenants, conducting or arranging inspections, repairs and maintenance. It’s a lot to manage—especially if you’re no longer living in the region. It’s why so many investors hire professional property managers to take care of the day-to-day running of their properties. Moreover, their fees are tax deductible.

Important note: If you’re leaving the country for more than 21 days, you’ll need to either appoint someone as your landlord in your stead or hire a property manager.

6. Tax implications

If you turn your home into a residential investment, be aware that you may not be able to make tax claims against it. It always pays to talk to a professional accountant to make sure you set up your home-turned-rental properly to avoid issues with tax, ownership and debt allocation.

Lest we forget...

On this ANZAC Day, let's take a moment to remember and honor the brave men and women who have served and continue to serve our country.

Tell us who are you honouring today. Whether it's a story from the battlefield or a memory of a family member who fought in the war, we'd love you to share your stories below.

Poll: Does the building consent process need to change?

We definitely need homes that are fit to live in but there are often frustrations when it comes to getting consent to modify your own home.

Do you think changes need made to the current process for building consent? Share your thoughts below.

Type 'Not For Print' if you wish your comments to be excluded from the Conversations column of your local paper.

-

91.4% Yes

-

8.3% No

-

0.3% Other - I'll share below!

Food and product recalls

These items have been recalled during the last month. If you have any of these items at home, click on the title to see the details:

Product recalls

Avanti, Malvern Star & Raleigh bicycles

Yoto Kids Speaker

Anko Kids Pyjamas

Battery drill chainsaw attachment

Industrial pedestal misting fan

Yamaha adaptor

Zero Tower safety harness

Naturacoco moisturising cream

Thule child bike seat

Food recalls:

Maketū pies mussel pie

The Catering Studio cottage pie

Matakana Smokehouse gravlax/salmon

Our Fruit Box fruit juices

ProLife Foods value packs - nuts, raisins.

YY Dumplings & Fu Yuan ready-to-eat meat products

Waiheke Herbs italian herb spread

We hope this message was helpful in keeping your household safe.

Loading…

Loading…