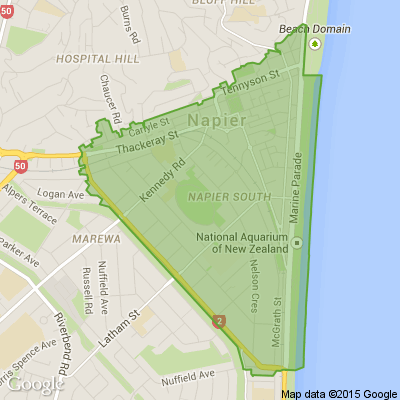

Napier Market Review: Low Inventory & Low Interest Rates

Napier Market Review - Cox Partners Estate Agents

During September, Hawke’s Bay property sales recovered from their 4-year low point last month. There were 105 sales in Napier and 87 in Hastings.

The average number of days to sell a property in Hawke’s Bay fluctuates from month to month but tends to sit at between 4 and 5 weeks. If a property is taking longer than six weeks to sell, it may mean that buyers are distracted by some perceived undesirability in the location or features of the property, or maybe the sellers price expectations are higher than those of the most active buyers.

According to CoreLogic’s latest House Price Index, values in Napier tracked sideways over the month of September and average property values are down – 0.9% over the last three months. However, prices are still up 8.2% over the last year.

Interestingly, Hastings experienced almost twice the rate of growth (15.3%) as Napier in the past year.

This has taken the average value in Hastings to $535,219 – less than $18,000 short of that in Napier ($553,128). This is a slim margin compared to recent history.

Consistently low mortgage interest rates continue to assist potential buyers. The official cash rate (OCR) remained at 1.0% this month, but there are indications that there may be a further drop in the OCR during November. If this happens, this will help ensure mortgage interest rates continue to stay attractive.

Listings remain low, which is contributing to price pressure, especially in the lower and median quartile price ranges. This will particularly appeal to first home buyers and investors.

Both low inventory levels and low mortgage interest rates are supporting the Hawke’s Bay property market. Prices are expected to continue to rise, but at much slower rates than we’ve seen in recent years.

While the outlook remains reasonably positive, uncertainty in business confidence, and doubts about the overall economy is expected to affect people’s willingness to take on more debt.

For an up-to-date report on the local real estate market please call us on (06) 835-4321 anytime.

Lest we forget...

On this ANZAC Day, let's take a moment to remember and honor the brave men and women who have served and continue to serve our country.

Tell us who are you honouring today. Whether it's a story from the battlefield or a memory of a family member who fought in the war, we'd love you to share your stories below.

Poll: Does the building consent process need to change?

We definitely need homes that are fit to live in but there are often frustrations when it comes to getting consent to modify your own home.

Do you think changes need made to the current process for building consent? Share your thoughts below.

Type 'Not For Print' if you wish your comments to be excluded from the Conversations column of your local paper.

-

91.5% Yes

-

8.2% No

-

0.4% Other - I'll share below!

Food and product recalls

These items have been recalled during the last month. If you have any of these items at home, click on the title to see the details:

Product recalls

Avanti, Malvern Star & Raleigh bicycles

Yoto Kids Speaker

Anko Kids Pyjamas

Battery drill chainsaw attachment

Industrial pedestal misting fan

Yamaha adaptor

Zero Tower safety harness

Naturacoco moisturising cream

Thule child bike seat

Food recalls:

Maketū pies mussel pie

The Catering Studio cottage pie

Matakana Smokehouse gravlax/salmon

Our Fruit Box fruit juices

ProLife Foods value packs - nuts, raisins.

YY Dumplings & Fu Yuan ready-to-eat meat products

Waiheke Herbs italian herb spread

We hope this message was helpful in keeping your household safe.

Loading…

Loading…