Cautious optimism prevails

Last week the Reserve Bank reviewed the Office Cash Rate (OCR). In March the OCR was reduced to 0.25%, and it came as no surprise that it remained unchanged. The OCR is effectively the wholesale price for lending money in New Zealand, and it influences retail interest rates.

Home buyers have benefited from the decline in mortgage interest rates. For example, the average two-year fixed rates with major banks has fallen from 3.31% in March to 2.88% in May – that’s a 13% drop. The Reserve Bank governor referred to the economy currently doing better than expected, although downsides remain.

Following events of the past couple of weeks, many business people believe the biggest threat to the economy and business in general is a new community outbreak of Covid-19 forcing us back into lockdown. Effective border control is essential to maintaining public confidence.

People are also looking for indications that the pace of economic growth will accelerate into 2021. So far, the focus has been on carrying businesses and jobs through the weak June quarter and facilitating education and retraining for the unemployed. More is required to stimulate economic growth and investment.

As the election approaches, expect this to be debated thoroughly during the next couple of months. During this time the second round of the wage subsidy will expire, and the chances are reasonably high that when this happens many businesses using the subsidy will let go of some of their subsidised employees.

Recently there has been a significant increase in enquiry from first home buyers and, to a lesser extent, investors. Those looking for a bargain are likely to be disappointed given the continuing shortage of listings and absence of interest rate pressure on current owners.

The shortage of stock particularly in the lower quartile price range ($250,000 – $500,000) means that properties in this range are often receiving multiple offers and selling above price expectations. In April, while the Reserve Bank lifted LVR (loan to value) restrictions on mortgage lending, this benefit has not tended to have been passed on to borrowers as Banks have continued to impose tight lending criteria, amid concerns about the uncertain economic environment. Most borrows still require at least a 20% deposit.

In some instances, we have observed that mortgage applications have taken longer. And some lenders are

requiring detailed income projections and proof of income, especially in certain Covid-19 affected industries.

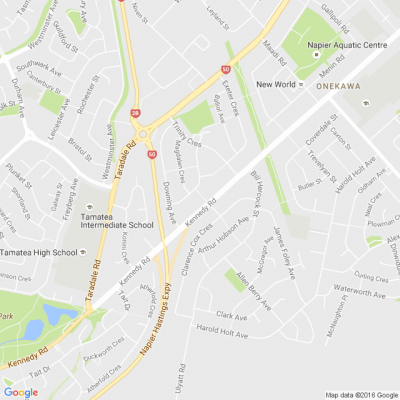

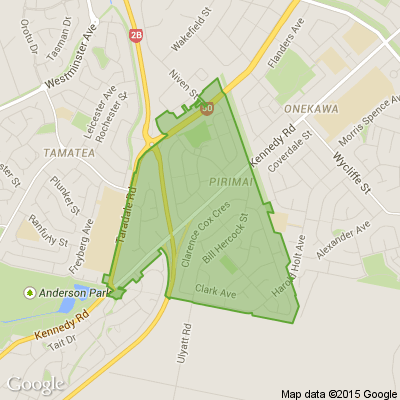

If you’re looking for help selling a property in Hawkes Bay talk with one of the Cox Partners team first. Call us anytime on (06) 835-4321.

Poll: Does the building consent process need to change?

We definitely need homes that are fit to live in but there are often frustrations when it comes to getting consent to modify your own home.

Do you think changes need made to the current process for building consent? Share your thoughts below.

Type 'Not For Print' if you wish your comments to be excluded from the Conversations column of your local paper.

-

91.4% Yes

-

8.2% No

-

0.4% Other - I'll share below!

Lest we forget...

On this ANZAC Day, let's take a moment to remember and honor the brave men and women who have served and continue to serve our country.

Tell us who are you honouring today. Whether it's a story from the battlefield or a memory of a family member who fought in the war, we'd love you to share your stories below.

Getting unfinished projects finished

This is an international project that completes projects left when someone dies. You pay postage to get it to a volunteer and for them to return it to you.

Loading…

Loading…